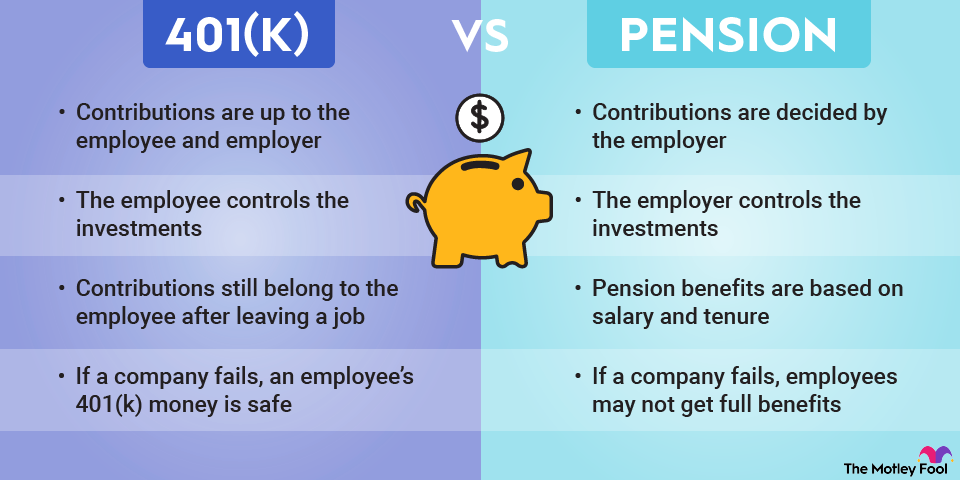

4. If the company fails, your money is safe in a 401(k)

Remember Enron? Its spectacular crash not only wiped out thousands of jobs but also destroyed the company's $2 billion in pension plans. And it wasn't just current employees who lost their retirement benefits; many former employees who'd already retired found themselves suddenly without their major source of income.

Even if your employer is in perfect financial health today, there's no predicting how it will be doing decades down the line. The Pension Benefit Guaranty Corporation insures private pensions and will step in if your pension fails, but the agency has only so much money to hand out. If your pension fails, there's a good chance you won't get your full benefits -- and, in some cases, you may not get a penny.

On the other hand, employers can't touch your 401(k) money. Those funds are in the hands of a 401(k) trustee precisely so that they'll be safe if something bad happens. Even if your employer is the next Enron, you may lose your job, but your 401(k) funds will be fine.

In theory, pensions are the ultimate retirement savings tool. In practice, they have many pitfalls -- and as a result, they pose a risk to anyone counting on them for retirement income. While 401(k)s also have their drawbacks in relation to pensions, they ultimately give you more control over your retirement savings.