Your best strategy for IRAs is to leave them untouched during your working years to let them grow, only taking money out after you retire. Many retirees take that a step further, choosing not to take IRA distributions until they absolutely have to. But the IRS established rules that force you to withdraw money from your retirement accounts, and so knowing the ins and outs of the IRA distribution table will help you make sure you avoid some nasty penalties. Let's take a closer look.

1. When you must use the IRA distribution table

There are two situations in which you'll have to use the IRA distribution table to figure out your minimal withdrawal from your IRA. The most common is that if you will be age 70 1/2 by the end of the current year, you'll have to start taking required minimum distributions. That first year, you have until April 1 of the following year to take your RMD; after that, you must take distributions by December 31.

The other situation in which you'll have to use an IRA distribution table is if you inherit an IRA. Except for spouses, who are allowed to roll over inherited IRAs into a retirement account of their own, RMD rules apply to beneficiaries of all ages, and there's a different table that applies to inherited IRAs that you can find here on the IRS website.

2. What to do with the IRA distribution table

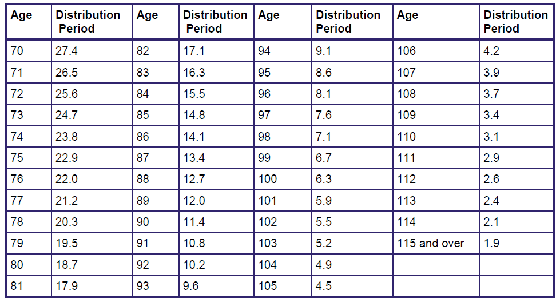

As you'll see in the full table at the bottom of this article, the IRA distribution table is a series of numbers that correspond to various ages. The numbers represent IRS life expectancy figures for people of given ages, and each year, you're required to take out a fraction of your IRA holdings based on that life expectancy. For instance, for those who are age 70, the IRA distribution table for retirees gives a figure of 27.4 years. That means you must take out 1 divided by 27.4, or roughly 3.65%, of your total IRA balance as of the beginning of the year as an RMD.

There are special rules that apply to minimum distributions for those who are married and have a spouse who is more than 10 years younger than they are. If that spouse is the only beneficiary of your IRA, then you're allowed to use a different set of tables that take into account your joint life expectancies. You'll find the tables that apply in this situation at the same link on the IRS website as the inherited IRA distribution table.

If you forget to take your distribution, there's a huge penalty that the IRS imposes. The penalty amount is 50% of what you should have withdrawn. That's typically a big enough incentive to get people to use the IRA distribution table and take their RMDs on time.

3. What the IRA distribution table means for your investment strategy

The figures on the IRA distribution table make it clear that as you get older, you're going to have to withdraw more of your IRA balances each year. Early in retirement, the percentages aren't so onerous as to require extraordinary measures.

Later on, though, the percentages get big enough that you're virtually required to start liquidating assets, as you won't be able to generate the 5% to 10% of income that you'll need when you reach your 80s and 90s. As a result, it's important to plan your investments according to make sure that selling those investments won't cause problems down the road.

Be smart about your IRA

Having to use the IRA distribution table might be intimidating, especially as the penalties are so high if you get it wrong. But by being smart about taking required minimum distributions, you can put yourself in the best position to make maximum use of your retirement accounts when you need them most.

IRA Distribution Table for Owners

Source: IRS.