A SEP IRA is a popular retirement investment vehicle for very small businesses and self-employed people. SEP means simplified employee pension, and IRA stands for individual retirement account.

Unlike 401(k) plans, which are funded by employee contributions that are often matched by employers, SEP IRAs can only be opened and funded by employers. Beyond that, SEP IRAs function much like regular IRAs in the sense that if your employer funds a SEP IRA for you, then you own the account and make the investment decisions. You choose the stocks, bonds, mutual funds, or exchange-traded funds (ETFs) in which to invest, and the brokerage holding the account on your behalf executes your trades.

SEP IRA requirements

Whether your business is a sole proprietorship, partnership, or corporation, you are permitted to establish a SEP IRA. If you are not a business owner or a self-employed person earning contract-based income, then you can't independently establish a SEP IRA or make contributions to one.

Business owners and self-employed people who establish SEP IRAs are making contributions as an employer, even if they are the only employee. An employer who offers a SEP IRA is required to contribute a uniform amount, on a percentage-of-salary basis, to both his or her own SEP IRA and the SEP IRAs of every eligible employee. Because of this rule, employers with many employees are less likely to offer SEP IRAs.

An employer who offers a SEP IRA is not obligated, on a dollar value basis, to contribute any annual minimum amount to the individual accounts. Provided that percentage-of-salary parity is maintained, employers tight on cash can choose not to fund any of the accounts. SEP IRA rules categorically prohibit employees from funding their own SEP IRAs, even when their employers choose not to do so.

If your employer offers a SEP IRA, they are required to:

- Give you a copy of IRS Form 5305-SEP or the prototype plan document, along with any other pertinent documents and disclosures.

- Notify you of any amendments to the SEP IRA or changes to the plan's requirements.

- Provide you with an annual statement detailing the contributions made to your account.

SEP IRA contribution rules

The SEP IRA maximum contribution limit is the lesser of:

- 25% of your salary

- $70,000 in 2025, or $72,000 in 2026

Unlike many retirement plans, SEP IRAs don't allow extra catch-up contributions for people 50 and older. No matter how old you are, you cannot exceed these contribution limits.

Contribution rules for employees vs. the self-employed

There's no vesting schedule for SEP IRAs, which means that any contribution your employer makes on your behalf immediately becomes 100% yours. As an employee, you're prohibited from directly contributing to your own SEP IRA.

If you are self-employed and receive contract income, you can establish an S corporation to pay yourself a salary as an employee. Since this turns you into an employer, you become eligible to establish a SEP IRA that you are the sole beneficiary of. Your maximum permissible contribution is 25% of your income as listed on your IRS W-2 form, up to the annual limits.

If you are self-employed but have not established an S corporation, meaning you do not pay yourself a W-2 salary, then you are still eligible to establish a SEP IRA. But calculating your salary in order to determine your maximum contribution limit is a bit more complicated.

Your maximum contribution limit is equal to 25% of your net self-employment income, which is the amount of your gross income that remains in a year after subtracting your direct costs of doing business, including self-employment taxes. Generally, the salaries of self-employed people are equal to just above 80% of their gross incomes.

SEP IRA eligibility rules

If you work for a company that offers a SEP IRA, your employer must make the same contribution, as a percentage of salary, to your SEP IRA and the SEP IRAs of every other eligible employee. You are eligible to receive SEP IRA contributions from your employer, provided you meet the following criteria:

- You're at least 21 years of age.

- You meet the 3-of-5 rule, which means you've worked for the company for any amount of time -- even just seasonally for a couple of months -- during at least three of the past five years.

If you do not meet these requirements, your employer can still choose to contribute to a SEP IRA on your behalf, provided that the employer's less-restrictive policies are applied equally to all employees and also to the employer.

Employers can contribute to SEP IRAs for employees younger than age 21, who do not satisfy the 3-of-5 rule, or who earn less than the threshold dollar amounts. The only requirement is that the same eligibility rules apply to everyone equally.

An employer cannot adopt eligibility rules that are more restrictive than the criteria above, even if the rules are applied equally to every person in the organization.

SEP IRA withdrawal and distribution rules

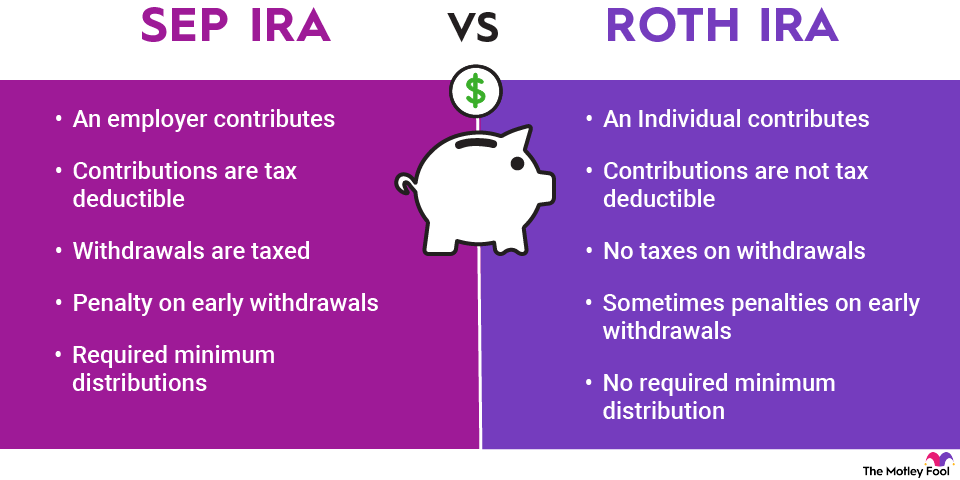

Most SEP IRAs are tax-deferred accounts, meaning that -- as with a traditional IRA -- contributions are made with pre-tax dollars and withdrawals are taxed as ordinary income. If you withdraw money from your SEP IRA before you reach age 59 1/2, you are likely obligated to pay a 10% penalty on the amount withdrawn.

If you leave your employer for any reason, you can roll your SEP IRA into another tax-advantaged retirement savings account, such as a traditional IRA, a 401(k), or a 403(b). While it's also possible to roll the money into a Roth IRA, moving the funds from a SEP IRA holding pre-tax dollars to one that accepts only post-tax contributions requires you to pay income tax on the transferred money in the year the rollover occurs.

However, it is worth noting that the SECURE Act 2.0, which was passed at the end of December 2022, created a Roth SEP IRA effective in 2023. A Roth SEP IRA allows you to contribute with after-tax dollars and defer your tax savings until retirement, just as a Roth 401(k) and Roth IRA offer.

Regardless of whether you have a traditional or Roth account, you cannot borrow money from your SEP IRA. And you must accept annual required minimum distributions (RMDs) once you reach age 73 unless you have a Roth account.

If you are eligible to contribute directly to a SEP IRA, which you can do only if you are the employer or are self-employed, then you can claim the contributions as tax deductions. If you're not the employer or self-employed, then you cannot deduct the contributions to your SEP IRA from your taxable income.

Having a SEP IRA doesn't affect your eligibility to fund a Roth IRA or a traditional IRA. Even if you are fortunate enough to have an employer-funded SEP IRA, it's still important to independently save for your own retirement. Owning both a SEP IRA and another account you fund on your own is a surefire strategy to maximize your retirement savings.