What is the production possibility frontier (PPF)?

What is the production possibility frontier (PPF)?

The PPF is a simple economic model (usually demonstrated as a graph) that helps explain the potential output in an economy given the available resources. As a conceptual model, it simplifies matters out of necessity. Still, its use can help economists and investors understand key concepts that help in planning and investment decisions.

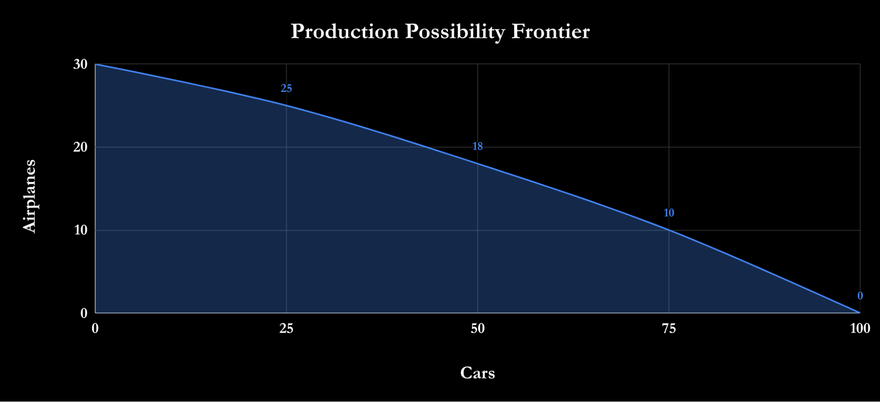

The simplest model assumes that only two products are made in an economy -- the following example uses cars and airplanes. It also assumes resources (labor, materials, etc.) and technology are constant. Finally, it also assumes a desire to produce at optimum efficiency.

Example

Production possibilities frontier example

The following chart shows an economy that only produces a combination of cars and airplanes from a fixed set of resources. For example, these resources can be used to make 100 cars and no airplanes, or at the other end, 30 airplanes and no cars. Similarly, any combination on the line or the area inside can be produced, such as 75 cars and 10 airplanes.

It’s important to note that the points on the line are always optimal. So, for example, an economy could produce, say, 50 cars and 10 airplanes, but that’s not as efficient a use of resources as making 75 cars and 10 airplanes.

While it might not make sense to produce the former (50 cars and 10 airplanes), there are plenty of scenarios where that could occur, such as political interference and labor disputes in the car industry. The critical point is that anywhere on the inside of the curve is not optimal production.

In a recession, the production of cars and airplanes will be somewhere inside the line. But when the economy is working at full capacity, production will be somewhere on the line.

Another critical consideration is the insight into the potential trade-off in shifting production; economists call this the opportunity cost. For example, say a decision is made to produce 75 cars instead of 50. The shift in production implies a reduction in airplane production from 18 airplanes to just 10 airplanes. In this way, economists can better understand the implications of changes in production.

How investors can use it

How investors can use the production possibility frontier

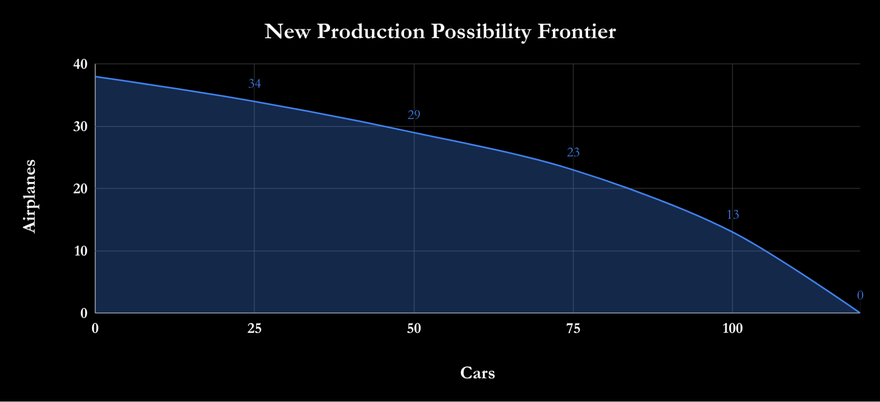

As noted above, the line represents the current production potential in an economy, but what if something happens to push the curve outward? In other words, the production potential in the economy improves by, say, an improvement in productivity through the development of new technology.

One real-life example of this coming in the production of cars and airplanes comes from the so-called fourth industrial revolution, whereby industrial companies increasingly incorporate digitally connected technologies (such as the industrial Internet of Things, or IoT) into their production processes. It’s a helpful example because it applies to cars and airplanes.

Wide-scale adoption of a new technology like robotics or the Internet of Things might push the production possibility frontier outward.

Why pushing out the production possibility frontier makes sense

Picking out a few data points helps illustrate this move. For example, the new economy can produce 75 cars and 23 airplanes.

This example is highly relevant because it illustrates the importance of implementing productivity-enhancing technologies. Moreover, it’s something that rings true even in an economic slowdown. For example, consider a downturn in an economy with the new production possibility frontier below. As discussed above, any point within the area indicates an economy not producing at full capacity, or a slowdown.

One such point is, say, 75 cars and 15 airplanes. However, that production level is still superior to the 75 cars and 10 airplanes in the original PPF line above. In other words, adopting the new technology means the economy can produce more in a slowdown than when the economy is firing on all cylinders in the previous example.

This illustrates that spending on productivity-enhancing technologies will likely persist even in a slowdown. As such, investing in technology stocks, such as IoT companies that can push out the PPF is likely to be a successful strategy, as adoption of their solutions will grow across many industries once it becomes clear that the PPF is being expanded.

Though it’s a conceptual model, the PPF helps investors understand the critical importance of enhancing economic productivity and the dangers of production being purposefully directed toward an end that results in a point inside the PPF line.