Beating Inflation: Credit Card Rewards and Points

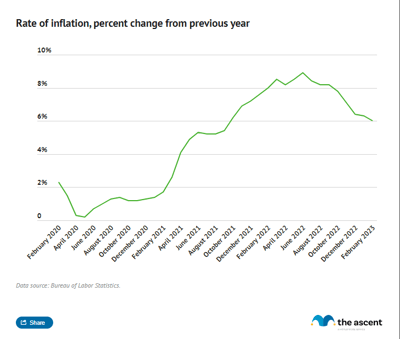

The United States is in the longest run of monthly price inflation over 5% since the 70s and 80s. Thankfully, many Americans have a tool in their wallet to help blunt rising costs -- credit cards.

Used responsibly, credit cards that earn rewards and points for spending in categories that have seen the highest rates of CPI inflation can offer users a boost in perks and even help recoup cash.

Most credit card points are rewarded on a per-dollar basis. That means aligning big spending categories with credit card rewards programs during consumer price inflation can net more points than might normally be earned -- essentially lowering the overall cost of inflation.

Which categories have experienced the highest rates of inflation and which credit cards can help beat inflation? Read on for a dive into the data.

Key findings

- Inflation has come in at over 5% from the previous year for 21 consecutive months, the longest stretch since the 1970s and 1980s.

- Gas, groceries, and airline fares are among the products with the highest average rate of year-over-year inflation in 2022.

- The purchasing power of the U.S. dollar was about 7% less at the end of 2022 than it was in 2021.

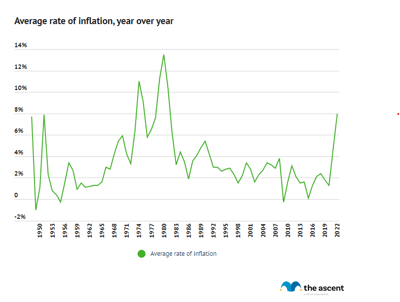

Inflation in 2022 compared to previous years

The U.S. is currently in the longest stretch of consecutive months of year-over-year inflation of over 5%. The streak started in June 2021 and has persisted through February 2023, although consumer price increases have begun to cool.

The most recent comparable stretch of inflation was from the mid-70s through early 80s, although the root causes and economic conditions then were entirely different from what they are now.

Which products have seen the highest inflation?

These are some of the products and categories that experienced the highest and lowest average year-over-year rate of inflation in 2022.

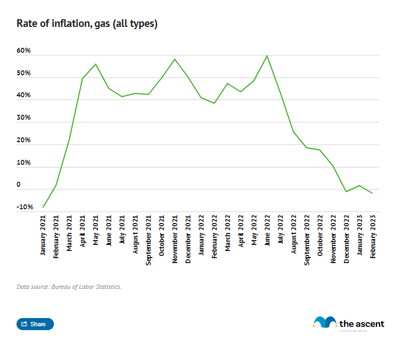

- Gas (all types): 32.7%

- Eggs: 32%

- Airline fares: 29.9%

- Energy: 25.4%

- Used cars and trucks: 14.5%

- Rice, pasta, and cornmeal: 12.8%

- Food at home (groceries): 11.4%

- New vehicles: 10.5%

- Pet food: 10.2%

- Food away from home (restaurants): 8.6%

- Shelter: 5.9%

- Apparel: 5%

- Medical care services: 4.3%

- Medical care commodities: 2.9%

Some of these products have seen relief since the start of 2023.

Gas prices were lower in February 2023 than they were in February 2022. The price of used cars and trucks, which had an average rate of inflation of 14.5% in 2022, dropped 13.6% in February 2023 compared to the previous February. New car prices are also down year over year albeit only by 1.6%.

Some food products, like bacon, beef, fruit, and pork have seen prices drop from February 2022 as well.

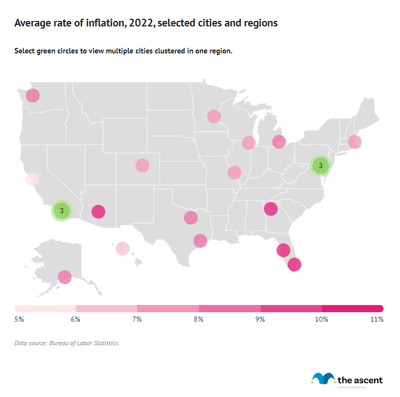

Which parts of the United States have seen the highest inflation?

Phoenix, Atlanta, Tampa Bay, and Miami experienced an average year-over-year inflation rate of over 10% in 2022.

The cities that saw the lowest average inflation in 2022 are Washington D.C., New York City, and San Francisco. The average year-over-year rate of inflation in those areas was 6%, 2% lower than the national average rate of inflation for all items.

| Area | 2022 average year over year rate of inflation |

|---|---|

| Phoenix-Mesa-Scottsdale, Arizona | 11.5% |

| Atlanta-Sandy Springs-Roswell, Georgia | 10.6% |

| Tampa-St. Petersburg-Clearwater, Florida | 10.2% |

| Miami-Fort Lauderdale-West Palm Beach, Florida | 10.1% |

| Baltimore-Columbia-Towson, Maryland | 9.0% |

| Seattle-Tacoma-Bellevue, Washington | 8.9% |

| Riverside-San Bernardino-Ontario, California | 8.6% |

| Dallas-Fort Worth-Arlington, Texas | 8.6% |

| Houston-The Woodlands-Sugar Land, Texas | 8.2% |

| Detroit-Warren-Dearborn, Michigan | 8.1% |

| Urban Alaska | 8.0% |

| Philadelphia-Camden-Wilmington, Pennsylvania-New Jersey-Delaware | 7.8% |

| Denver-Aurora-Lakewood, Colorado | 7.8% |

| St. Louis, Missouri-Illinois | 7.6% |

| San Diego-Carlsbad, California | 7.6% |

| Chicago-Naperville-Elgin, Illinois-Indiana-Wisconsin | 7.4% |

| Los Angeles-Long Beach-Anaheim, California | 7.3% |

| Minneapolis-St. Paul-Bloomington, Minnesota-Wisconsin | 7.2% |

| Boston-Cambridge-Newton, Massachusetts-New Hampshire | 7.1% |

| Urban Hawaii | 6.4% |

| Washington-Arlington-Alexandria, DC-Virginia-Maryland-West Virginia | 6.4% |

| New York-Newark-Jersey City, New York-New Jersey-Pennsylvania | 6.1% |

| San Francisco-Oakland-Hayward, California | 5.6% |

Cash back credit cards and inflation

Cash back credit cards are a straightforward way to limit the impact of rising consumer prices. These cards give you a percentage back on purchases, so if inflation is leading to higher spending, cash back credit cards can blunt that impact.

Inflation rose an average of 8% each month during 2022 across all items. The best cash back credit cards often net 1% to 2% on purchases, so they can help beat back inflation a bit.

Gas credit cards and inflation

On average, the price of gas throughout 2022 was 33% higher than it was in 2021. The best gas credit cards generally offer around 2% to 3% cash back at gas stations or can score two or three times the points normally earned on purchases.

Americans spent about $160 on gas per month in 2021 and likely spent much more in 2022 with gas prices shooting up for most of the year.

Given that gas isn't the largest expense for the average American, getting a credit card that provides solid rewards at gas stations could make sense for frequent drivers or those willing to manage an extra credit card just for spending at the gas station.

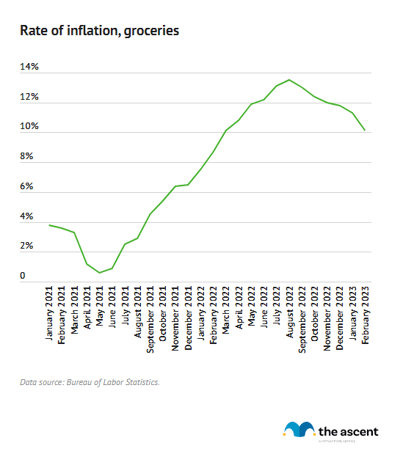

Grocery credit cards and inflation

Americans are spending more on groceries than in recent years. In 2021, the average American spent $438 on groceries each month. That amounts to $5,256 a year -- roughly 8% of the average American's spending.

Given that grocery prices were 11.4% more expensive in 2022 than in 2021, it's likely that groceries took up an even larger share of Americans' budgets.

Some of the best grocery credit cards can provide up to 6% cash back on purchases at supermarkets -- good for $270 based on average spending in 2021, and maybe more now.

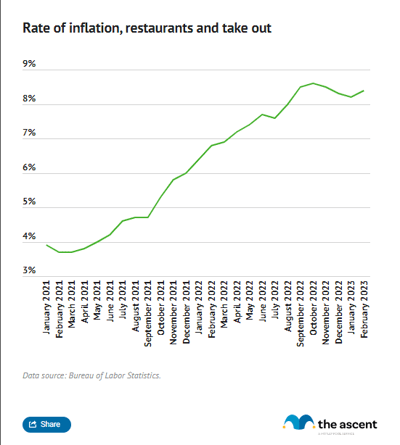

Dining and restaurant credit cards and inflation

The cost of dining at restaurants and ordering in 2022 rose by 7.7% in 2022.

While the average American spends less on eating out than they do on groceries, buying food from restaurants still accounted for 5% of the typical budget in 2021.

Given that the cost of groceries rose more than the cost of dining out, a credit card that offers solid rewards for purchases made at restaurants could be more attractive than usual.

The best dining and restaurant credit cards usually offer between 2% to 3% back.

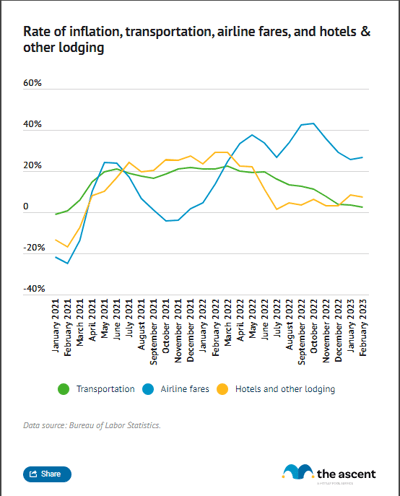

Travel rewards cards and inflation

The cost of transportation and airfare in particular skyrocketed in 2022. The average rate of inflation in 2022 for transportation was 15.7%, airline fares rose an average of 29.9% that year, and hotel prices and other lodging saw a 13.3% increase.

The best travel rewards credit cards not only provide cash back or points on travel spending or allow travel rewards to pay for airfare and hotels. Some also unlock access to airport lounges, provide free travel insurance, or open the possibility of upgrades on travel bookings.

How to beat inflation

Credit cards aren't a silver bullet to beating inflation, although they can reduce the cost of inflation if used strategically and, most importantly, responsibly.

Given that a dollar at the end of 2022 had 7.4% less purchasing power than it did at the end of 2021, an extra couple percentage points of cash back could make a meaningful difference.

Even with inflation cooling, the year-over-year change in the Consumer Price Index has remained stubbornly around 6% in January and February 2023. When inflation does cool, there's no guarantee that prices will decline to what they used to be. So thinking strategically about how to leverage credit cards could pay off now and in the long run.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.