Image source: Getty Images.

The S&P 500 is up by just over 56% over the last decade, which means a $1,000 investment 10 years ago would be worth just over $1,560 today, not including dividends. While that's a decent 10-year return, plenty of individual stocks have vastly outperformed the index over this stretch of time.

Here's a closer look at three stocks that are up at least 500% over the last decade, and a few reasons why they all can continue to rise from here.

Align Technology: Up 512%

Malocclusion, or misaligned teeth, is a very common dental problem, affecting roughly 2 out of every 3 Americans. For years, orthodontists have used metal braces to straighten their patients' teeth, but many consumers are turned off by the prospect of wearing these braces and choose to forgo treatment. That fact has created a vast market opportunity for any company that can come up with a better solution, which is why Align Technology (ALGN +0.82%) has been growing like wildfire for years.

The company's Invisalign dental system has proven to be a popular alternative to braces. Patients around the world are attracted to the product's "invisible" design, which has helped Align to steadily win market share over the last few years. In turn, the company's revenue and profits have soared, allowing the company's stock to put up a market-beating performance.

Image source: Getty Images.

Despite its long history of growth, the company offers plenty of reasons for investors to believe that it is just getting started. Management estimates that its current addressable market is more than 5 million patients annually, which puts the orthodontic-device maker's market share at right about 7%. What's more, Align believes that continued innovation could eventually grow its addressable market up to 10 million patients, which is a massive opportunity that should allow the company to grow at double-digit rates for the foreseeable future.

Illumina: Up 679%

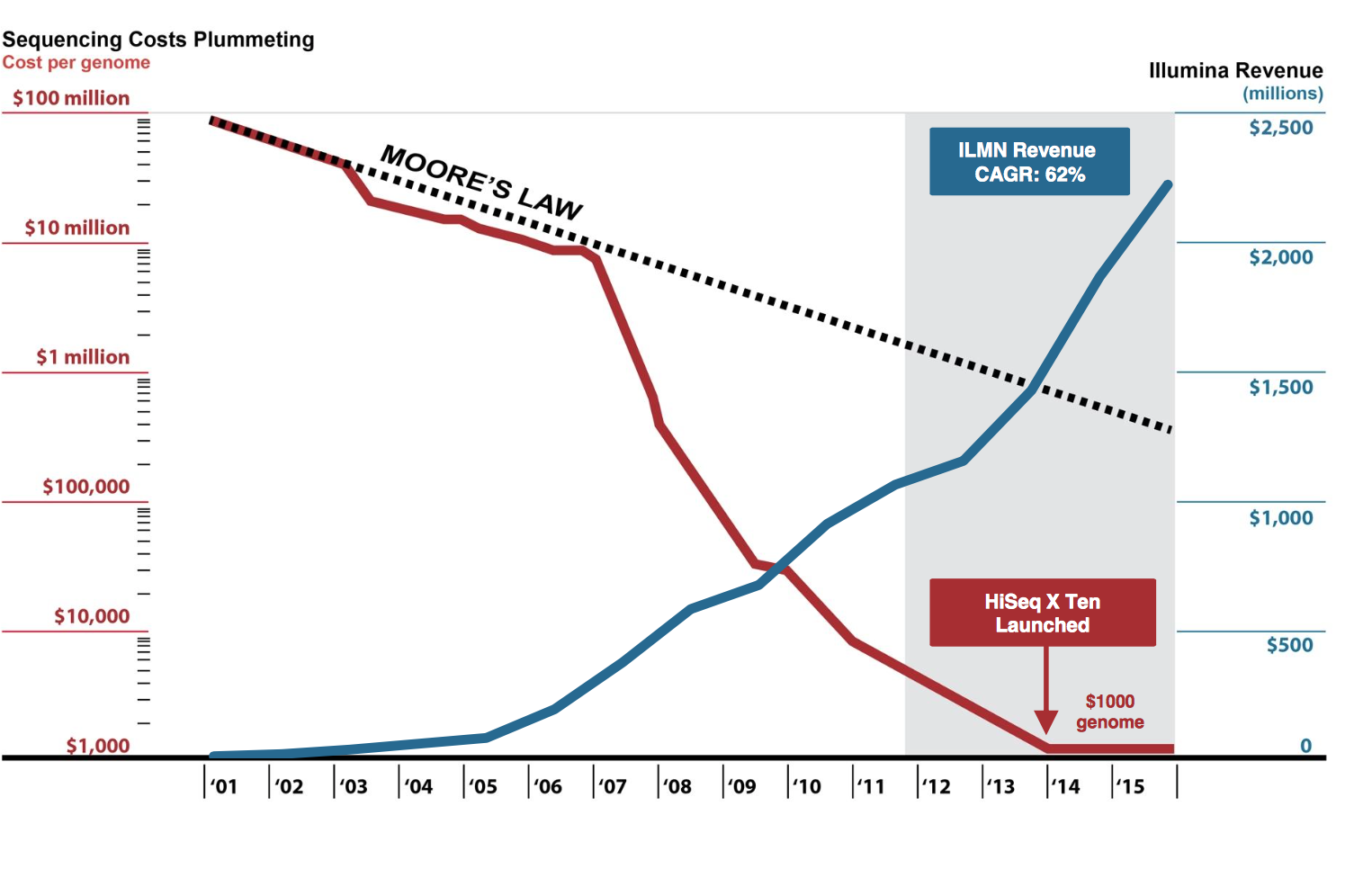

It took researchers on the Human Genome Project more than a decade and roughly $3 billion to decode the human genome for the first time. That monumental achievement gave rise to the genetic-testing industry, and ever since there has been an ongoing race to lower the cost of genetic testing to make it available to almost anyone.

Illumina (ILMN +0.87%) has long been the leader of this race, and its products can now sequence a human genome for as little as $1,000. That massive drop in cost has hugely increased the demand for the genetic-testing products, which in turn has allowed the company's revenue and profits to soar.

That huge growth has propelled Illumina's stock to new highs for years on end, turning the company into a growth investor's dream.

However, Illumina's stock was recently whacked after management stated that third-quarter results were going to come in below the company's gudiance range. If that wasn't bad enough, management projected that near-term growth would come to a halt, which is a big deal for a high-flying stock that is trading for more than 60 times earnings.

Nonetheless, it is highly likely that demand for genomic-sequencing machines will only continue to grow in the years ahead as costs continue to plunge and we find new and better uses for the data. That backdrop bodes well for the company's long-term growth prospects. If you agree, then today's discounted share price might prove to be an attractive entry point.

MasterCard: Up 1,320%

Americans have grown increasingly comfortable using plastic to make purchases, which has greatly benefited payment-processing giants like MasterCard (MA +0.83%). Since MasterCard earns a tiny commission on each transaction that occurs on its network, those incremental charges add up quickly. In turn, the company's top and bottom lines have grown by double digits for years.

It is tempting to believe that the company's days of fast growth are over since many consumers now carry multiple cards in their wallet. However, you might be surprised to learn that roughly 85% of global transactions are still based on either cash or check. As consumers and merchants alike warm up to the idea of card-based payments, that number should continue to slowly fall, which should ensure that MasterCard's growth remains robust for years to come.

Are any worth buying?

I'm a big fan of buying stocks that have a history of outperformance and still have huge growth opportunities ahead, so I think that all three of these companies are great buy-and-hold candidates. However, I must admit that MasterCard is my favorite stock on this list. I believe that the company stands an excellent chance at growing at above-average rates for decades to come, and the scalable nature of its business should ensure that profits continue to rise rapidly, too. Mix in a huge share-repurchase program and a fast-growing dividend, and I think this is the stock most deserving of investors' capital right now.