Almost every investor is tempted by the idea of accelerating their returns.

On average, the S&P 500 returns about 9% every year with the dividends reinvested. That's enough to build substantial wealth over a long period of time, and it's a relatively low-risk way of doing it. However, for investors willing to take on more risk, there are ways to increase your potential returns by adding leverage. One of the most popular ways of doing this is trading on margin.

What is margin?

The simple definition of margin is investing with money borrowed from your broker.

There are two primary types of brokerage accounts. In a cash account, you invest your own money. In a margin account, you can borrow from the brokerage based on how much you have invested. When you invest with a margin account, you're able to purchase stocks according to your "buying power," which includes both your own cash and a loan against the money you have invested.

Margin Call

What is margin trading?

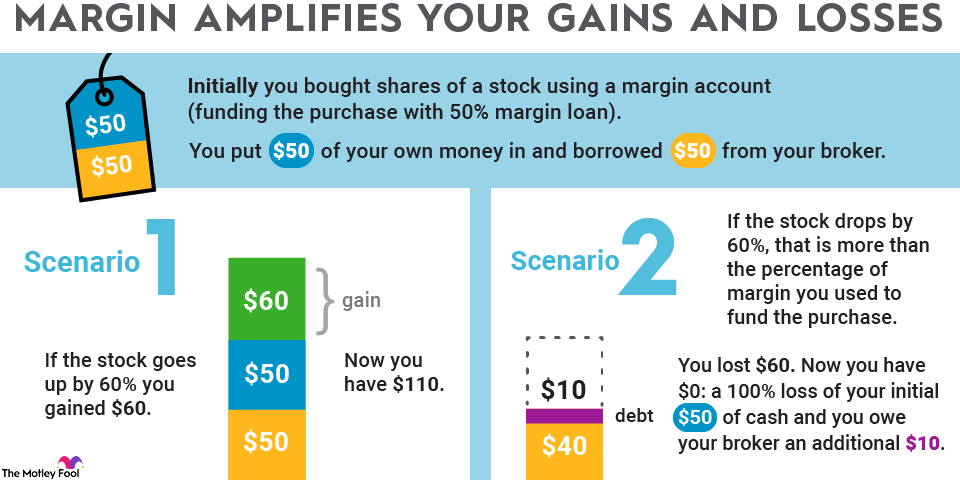

Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both for the good and the bad, and it's important for investors to understand the implications and potential consequences of using margin.

First, using margin means paying interest to your broker for the money you're borrowing. At Fidelity, for example, the interest rate you'll pay on margin balances up to $24,999 is 8.325%. When you compare that rate to the 9% to 10% potential annual return in stocks, you'll quickly recognize that you're taking the risk, but the broker is getting much of the rewards. Because of interest, when you use margin you have to worry about your net profit margin, or your profits after paying interest, which will be less than your investing gains.

Investors should also be aware that brokerage firms have initial margin requirements, or minimum margin requirements, requiring the investor to put a minimum amount in the account before they can borrow from the broker. At Fidelity, you must put in $2,000 to use margin. In order to buy an individual stock, the margin requirement is 50%, meaning if you want to buy $10,000 of a stock, you have to put in $5,000 in equity. There are also maintenance margin requirements of at least 25% equity, which would apply when account values fall, and that rate may be adjusted depending on how the account performs and broader market volatility.

Buying on margin example

Assume you have $1,000 in cash and want to buy $2,000 worth of a stock that trades at $10 a share. You can put up $1,000 of your own money, borrow $1,000 from your broker, buy 200 shares, and you'd own $2,000 worth of that stock. Your net account balance would still look like you have $1,000, but it would show up as $2,000 in stock and a $1,000 margin loan from your broker.

If the stock went up from $10 to $12, that's a 20% increase above your purchase price. At that point, your 200 shares would be worth $2,400, and your account balance would reflect a total value of $1,400 ($2,400 in stock, minus the $1,000 margin loan). That's a 40% increase to your account value on only a 20% increase in the stock price.

Of course, margin cuts both ways. Say that stock instead dropped 20%, from $10 to $8. At that point, your 200 shares would be worth $1,600, and your account balance would reflect a total value of $600 ($1,600 in stock, minus the $1,000 margin loan). That's a 40% decrease to your account value on only a 20% decrease in the stock price.

There's a bigger risk in margin trading than simply losing more money than you otherwise would have.

Related investing topics

What's the difference between margin trading and short selling?

There are some similarities between margin trading and short selling since both involve additional risks. However, the mechanics of short selling are much different from margin trading.

Short selling means borrowing shares from your brokerage with the intent of buying them back at a lower price. That strategy works when the share price falls, but it can easily backfire. If the stock goes up, you lose money, and, unlike owning a stock, your losses are theoretically unlimited.

In this sense, short selling is even riskier than margin trading because you can be on the hook for an unlimited amount of money. With margin trading, you're only at risk of losing what you've invested and borrowed. Like margin trading, short selling generally requires traders to put up collateral, and a short seller can also be subject to a margin call forcing them to close out their bet.

What margin trading does have in common with short selling is that it should only be considered by very experienced investors who fully recognize the risks. Even then, those investors who want to use them should carefully limit their total exposure so that, when the market moves against them, it doesn't jeopardize the rest of their financial position.

While margin trading can be advantageous at times, overall the risks of borrowing from your brokerage outweigh the benefits.