Learning how to invest in an IRA is a great way to build wealth and save for retirement. An IRA is a valuable retirement planning tool because it allows you to build a nest egg even if your job doesn't offer a retirement plan. You can also use an IRA to supplement the savings you have in a workplace plan.

In this article, we'll cover the basics of how to invest in an IRA. You'll learn about how IRAs work, the types of IRAs available, and where to open an IRA.

What is an IRA, and how does it work?

IRA stands for "individual retirement account." An IRA is a tax-advantaged investment account you open independently of an employer to save for retirement. (Note that there are types of workplace IRAs that you may encounter if you work for a small business, but most IRAs are designed for individual retirement savings.)

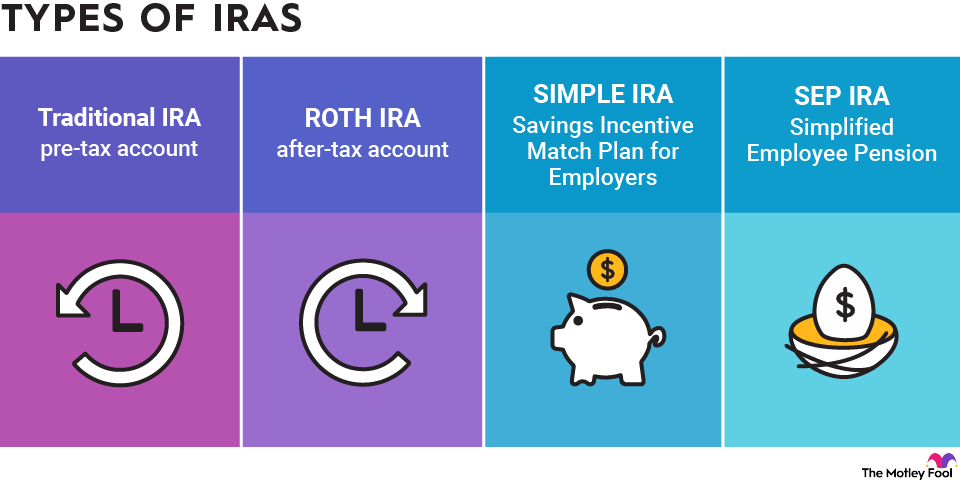

There are two basic types of IRAs: a traditional IRA and a Roth IRA.

Traditional IRA

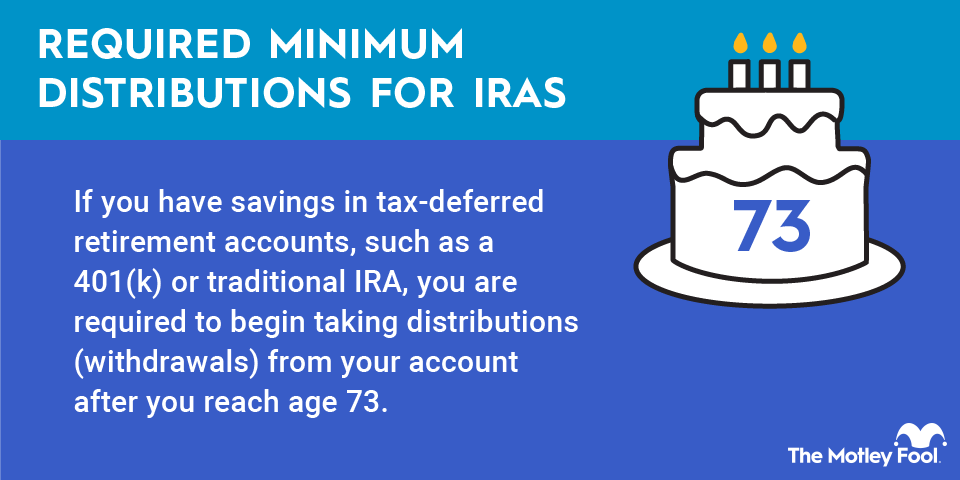

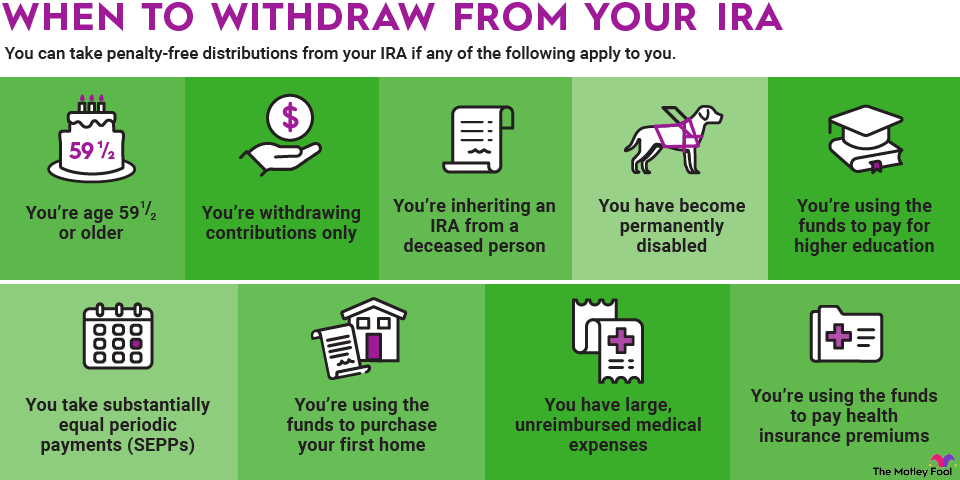

Traditional IRAs are funded with pre-tax money. Money grows on a tax-deferred basis, but withdrawals are taxable as regular income. Depending on your income and whether you or your spouse has a workplace retirement account, traditional IRA contributions could be tax-deductible. You'll generally owe a 10% early withdrawal penalty, plus income taxes, if you take money out of the account before age 59 1/2.

Roth IRA

Roth IRAs are funded with money you've already paid taxes on, so contributions are never tax-deductible. However, your money grows on a tax-deferred basis, and if you wait until age 59 1/2 and you've had the account for at least five years, your withdrawals will be tax-free and penalty-free.

You can also withdraw your contributions (but not the earnings) at any time, tax and penalty-free. But if an early withdrawal cuts into the earnings portion of the account, you'll owe taxes and a 10% penalty on the earnings.

To contribute directly, you can't earn more than the Roth IRA income limits for the year. However, some high-income people use what's called a backdoor Roth IRA strategy to get around this rule.

Other types of IRAs

There are a few other types of IRAs designed for specific situations, but they'll always be structured as a pre-tax account or a Roth account. Some examples include:

- Rollover IRAs are set up to hold money that you've rolled over from a 401(k) or a similar workplace retirement account to maintain its tax advantages and avoid penalties.

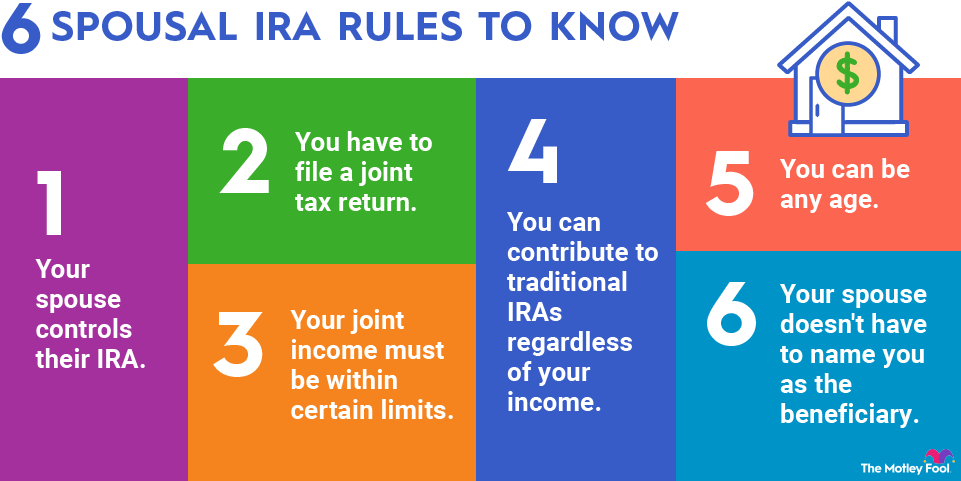

- Spousal IRAs are regular IRAs that are set up for a non-working spouse. To be eligible for a spousal IRA, couples must file a joint tax return.

- Inherited IRAs are used to hold inherited retirement accounts, like 401(k)s and IRAs, for a beneficiary.

- SIMPLE IRAs are IRAs for businesses with 100 or fewer employees. Employers typically must contribute either a flat 2% of each worker's pay or offer a 3% match.

- SEP IRAs are IRAs for self-employed people and those who own very small businesses. Owners must contribute the same percentage of each eligible worker's salary (including their own) to a SEP IRA. Only employers can contribute to SEP IRAs.

- Custodial IRAs are IRAs set up on behalf of a minor. An adult will need to manage the account until the child reaches the age of majority in their state.

What type of IRA is right for you?

For the purposes of this article, we'll focus on how to determine whether to invest in a traditional or Roth IRA. Often, the right type of IRA for you depends on whether you want to get a tax break upfront vs. tax-free income in retirement.

When you may want to save in a traditional IRA

A traditional IRA can make sense in the following circumstances:

- You want to deduct your contributions. Your traditional IRA contributions may be deductible, but eligibility for the deduction is based on your income and your access to a workplace retirement account. Note that even if you're not eligible to deduct your contributions, you can still fund a traditional IRA as long as you have earned income.

- You expect to be in a lower tax bracket in retirement. Predicting your future tax rate is difficult, but if you expect you'll be in a lower tax bracket in retirement, locking in the tax break upfront could be more valuable.

- You're not eligible to directly fund a Roth IRA. If you don't qualify to directly fund a Roth IRA because your income is too high, you can still contribute to a traditional IRA.

When you may want to save in a Roth IRA

On the other hand, a Roth IRA can be an especially lucrative savings vehicle in these circumstances:

- You want tax-free income in retirement. Again, predicting your future income is tough, but if you expect to be in a higher tax bracket in retirement (or simply want tax-free income in your golden years), consider a Roth IRA.

- You want the certainty of today's tax rates. If you're worried that overall tax rates will be higher by the time you retire, footing the tax bill now could be a smart move.

- You have investments with high potential growth. A Roth IRA is often a great choice for growth stocks since you won't pay taxes on withdrawals, including earnings, once you're 59 1/2 and the account is at least five years old.

- You want the flexibility to withdraw your contributions. You'll get the biggest benefits of a Roth IRA if you let the money grow until retirement, but the ability to withdraw your contributions without taxes or penalties can be a helpful fallback for an emergency or major expense.

You also don't need to choose between a Roth IRA and a traditional IRA. You could open both types of IRAs and split contributions between the two, but the total amount you invest can't exceed the annual IRA contribution limits.

What you need to open an IRA account and the best places to get started

If you're ready to start investing in an IRA, you'll need to choose a provider. Here are some things to look for when you select a provider:

- Fees. Many IRAs charge either a flat fee, e.g., $5 or $7 a month, or a percentage of assets under management (AUM), such as 0.25% of the total amount you have invested. Look for an account with low investment costs since the fees eat away at your returns over time. Be especially cautious about flat monthly fees if you're starting to invest with a small amount, as even a small flat fee could erase your returns.

- Investment choices. Many brokers allow you to invest in virtually whatever stocks, bonds, exchange-traded funds (ETFs), or mutual funds you choose, while others have far more limited investment options. Others are designed for passive investing and limit your options to a handful of pre-selected ETFs that are based on your goals. If you don't want to handpick investments, look for a provider that offers a robo-advisor.

- Minimum investment. Some providers don't have any minimum deposit requirements, while others require a starting deposit that can run as high as $500. Minimum deposits are also pretty common if you're using a provider's robo-advisor.

- User experience. Look for a platform that has an easy-to-use website and mobile app. You may also want to check out online customer reviews on sites like BBB and TrustPilot, but be aware that reviews for financial institutions tend to skew negative. However, if a provider has an unusually high number of complaints compared to its peers, you may want to stay away.

Some good IRAs for beginners include SoFi Active Investing (SOFI -1.73%), Fidelity, and Charles Schwab (SCHW +0.73%). You can check out our other options for top IRA providers.

Provided that you're at least 18, you can open an IRA in just a few minutes at an online broker by providing a few basic pieces of information:

- Full name.

- Date of birth.

- Social Security number.

- Employment information.

- Bank account info (for funding the account).

Brokerages also typically ask a few questions designed to gauge your risk tolerance. You'll then need to pick the type of IRA (Roth or traditional), fund the account, and select your investments.

Related investing topics

Pros and cons of an IRA

Some of the key IRA benefits include:

- You can invest for retirement even if you don't work for a company that offers a retirement plan as long as you earn money from working.

- They're a helpful tool for supplementing workplace retirement savings.

- You get to choose the provider and your investments.

- They offer tax advantages, such as a potential tax deduction (if you go with a traditional IRA) or tax-free retirement income (if you choose a Roth IRA).

- You control the account 100%, and you won't need to worry about rolling it over if you switch jobs.

However, there are a few disadvantages to investing in an IRA.

- The annual contribution limits are significantly lower than 401(k) contribution limits.

- You won't get an employer contribution (with the exception of a workplace IRA), though some brokers offer promotions where they match a small percentage of your contribution.

- There's a risk of losing money with any investments, including those you choose for your IRA.

- You'll often owe taxes and a penalty on early withdrawals.

- Unlike workplace plans, which often allow for 401(k) loans, you're prohibited from borrowing money from an IRA.

Overall, though, you'll probably find that the benefits of an IRA outweigh the negatives. Taking advantage of this flexible retirement savings will usually be a win for your later years, as long as you understand the rules and commit to long-term investing.