Financial advisors help their clients manage money. Depending on the advisor's expertise and the client's needs, this can include educating, budgeting, planning, or investing.

This guide explains what financial advisors do, when you might need one, how to choose the right professional, and what alternatives exist if you’re not ready to hire an advisor.

What is a financial advisor?

A financial advisor is a professional who helps individuals manage money and make informed decisions about their finances.

Many advisors specialize in certain areas, as indicated by their job title or credentials. For example, stockbrokers make investment recommendations and manage portfolios, while certified public accountants (CPAs) help clients manage their tax liability. Other types of specialized financial advisors include financial planners, insurance agents, and estate planning attorneys.

Technically, “financial advisor” is a generic, unregulated term, meaning there are no formal qualifications required to use the title.

Fortunately, many advisors do hold credentials or designations that reflect their training, education, and experience.

Common financial advisor designations

Credentials can help signal an advisor’s training, ethical obligations, and areas of specialization, though no designation guarantees quality on its own. Four common financial advisor designations are defined below:

- Registered Investment Advisors (RIAs): Registered with the Securities and Exchange Commission. They provide investing advice and can directly manage client portfolios.

- Certified Financial Planners (CFPs): Meet certification requirements set by the CFP Board involving education, testing, experience, and ethics. CFPs often focus on comprehensive financial planning tied to long-term goals.

- Chartered Financial Consultants (ChFCs): Complete extensive coursework through the American College of Financial Services and adhere to ethics and continuing education requirements. Their training spans multiple financial disciplines.

- Personal Financial Specialists (PFSs): CPAs who specialize in financial planning and meet additional education and experience requirements.

When would you need a financial advisor?

A financial advisor may be a good fit if your finances feel complex, your goals feel unclear, or you’ve experienced a major life change that affects your money.

Financial goals that may warrant an advisor

You might consider working with an advisor if you want help with goals such as:

- Paying off debt more efficiently

- Investing for retirement

- Saving for a major purchase, like a home

- Planning for college costs

- Preparing for future healthcare expenses

- Creating an estate or legacy plan

An advisor can help you prioritize these goals and build a realistic plan to reach them.

Life changes that often trigger the need for advice

Major life events often require a new approach to managing money, including:

- Marriage or divorce

- Having a child

- Getting a new job or losing one

- Starting or closing a business

- Receiving an inheritance

In these situations, a trained advisor can help you reassess your finances and adjust your strategy accordingly.

How to hire a financial advisor

The right financial advisor should have expertise that matches your needs and strong communication skills. You’ll be discussing sensitive financial details, so trust and clarity matter.

Where to find financial advisors

Start by asking friends, family, or professional contacts for recommendations. You can also search for advisors in your area using reputable databases, such as:

- The Better Business Bureau

- FINRA’s BrokerCheck

- Investment Adviser Public Disclosure (IAPD)

- CFP Board’s advisor database

From these sources, create a shortlist of potential advisors.

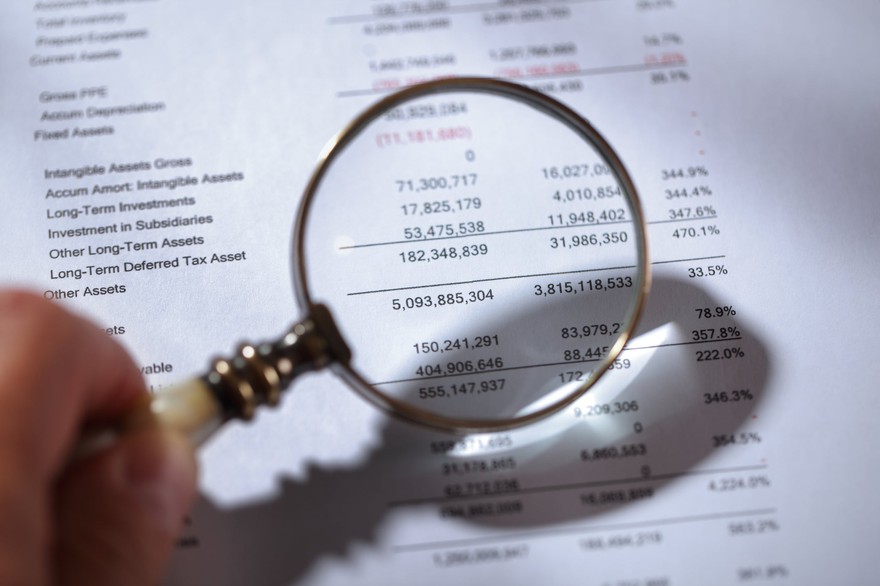

How to evaluate a financial advisor

From your shortlist, interview at least three advisors. The personal interview is your opportunity to assess the individual's professionalism and communication skills. You can also inquire about:

- References: Has the advisor worked with clients like you before, and what was the result?

- Credentials: What credentials does that advisor hold and what was required to secure those credentials?

- Expertise: What are the most common goals across the advisor's client base? What is the average net worth of the client roster?

- Fees: Does the advisor charge commission, flat fees, hourly rates, or a percentage applied to funds under management? Note that commission-based charges can encourage an advisor to promote heavy trading, which may not be in your best interest. If you’re unsure what these models typically cost, here’s a breakdown of how much a financial advisor costs.

Understanding standards of care

Financial advisors should follow either:

- The fiduciary standard of care, which requires them to act in your best interest across all financial advice, or

- The “best interest” standard under the SEC’s Regulation BI, which applies specifically to investment recommendations.

Both standards require advisors to prioritize your interests, but the fiduciary standard applies more broadly beyond investment recommendations.

Alternatives to hiring a financial advisor

You do have options if you need help managing your money but aren't ready to hire an advisor. The options include:

- Robo-advisors provide automated investing plans that suit common financial goals, such as saving for retirement.

- Investing advice services share promising stock picks. These are often tailored for more experienced investors.

- Online courses in personal finance can teach you basic money management skills, as well as more advanced investing tactics.

- Employers and 401(k) plans may offer free financial planning consultations.

- Financial apps can categorize your spending, support budgeting efforts, and project debt payoff timelines.

You can also engage an advisor temporarily to create a plan based on your situation and goals. Typically, you'd pay a flat fee for this service. You'd then implement the plan yourself. This approach can be a great way to try out an advisor. If you have a good experience with this professional, you can explore an ongoing relationship later as your needs evolve.