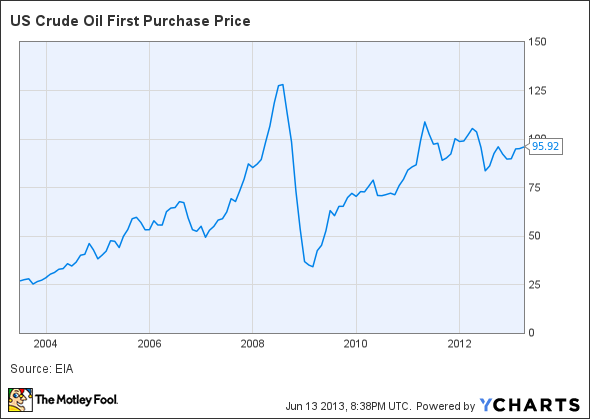

A quick look at a 10-year oil price chart reveals a clear trend: Oil prices are going up. Moreover, oil price increases are not a mere artifact of normal inflation. While the U.S. consumer price index has increased just 26.4% over the past 10 years, oil prices have gained a whopping 257%!

Oil Prices vs. Inflation, data by YCharts

The pace of price increases has been anything but steady, but if you exclude oil's rapid spike from mid-2007 to mid-2008 and the subsequent crash period from mid-2008 to mid-2009, you can see a clear uptrend.

US Crude Oil Price Chart, data by YCharts

Given this clear uptrend in oil prices, the conventional wisdom today is that oil prices are headed higher, both in real terms and in nominal terms. In fact, when my colleague Travis Hoium recently wrote that U.S. gas prices would never hit $5, dozens of people spoke out to disagree. Many said that they expect gas prices to rise well beyond $5 by the end of the decade.

However, this conventional wisdom is probably wrong. First, rising oil prices have significantly reduced long-term demand for oil, as users have implemented efficiency improvements and substituted cheaper fuels (including renewable energy and natural gas) when possible. Second, high oil prices have stimulated the development of new drilling technologies and a new round of crude oil discoveries. In fact, the International Energy Agency stated last month that the recent "positive crude and product 'supply shock' could prove as transformative for the oil industry as was the rise of Chinese demand during the last 15 years."

In short, the market has worked just as it should: The change in oil prices changed the behavior of consumers and producers. We now live in a world where there is ample excess oil supply -- the IEA recently estimated OPEC's "effective spare capacity" at more than 3.7 million barrels per day -- and supply will grow at least as quickly as demand for the foreseeable future. As a result, oil prices are likely to stagnate; in fact, expressed in real terms, oil prices are more likely to fall than to rise going forward.

A new environment

Not too long ago, many oil market-watchers were concerned about "peak oil": the idea that oil production was nearing a peak, after which declines at existing oil fields would outpace any new production. An article in the January 2012 issue of Nature magazine argued that oil had passed a "tipping point" where increases in demand could no longer be met by supply increases. The authors posited a global production "ceiling" of approximately 75 million barrels per day, beyond which increases in demand would lead to rapid price inflation because of the lack of additional supply.

The Nature article appears to be well researched, but it was ultimately untimely. While the authors concluded that oil supply -- and, to a lesser extent, oil demand -- had become inelastic, it now appears that the problem was just one of timing.

New extraction techniques such as hydraulic fracturing can be unprofitable when oil prices are below $80 (although that breakeven cost seems to be dropping), but the potential supply of oil grows significantly once prices rise beyond that level. However, the effect is not immediate; it takes time to develop new wells and build the necessary takeaway infrastructure, particularly pipelines. While oil prices spiked well above $80 in 2008, they remained above that level for less than a year. Oil prices have only remained consistently above this $80 "tipping point" since 2011.

Similarly, efficiency technologies such as hybrid car engines are more expensive than conventional internal-combustion engines. When oil prices spike, consumers don't all immediately run out to replace their gas-guzzling cars with more fuel-efficient models. However, over time, sustained high oil prices do change car-buying behavior, driving market-share gains for small cars, hybrids, and turbocharged engines.

Enter the U.S. supply boom

Now that oil prices have remained above $80 for a while, "tight oil" production has exploded in the United States. In the past four weeks, U.S. crude oil production has averaged 7.27 million barrels per day, according to the U.S. Energy Information Administration. That's up more than 1 million bpd from the comparable four-week period in 2012, and up approximately 1.6 million bpd compared with the production rate in June 2011.

Meanwhile, even as the U.S. economy has recovered (albeit very slowly) from the Great Recession, oil consumption has stagnated. People who changed their driving habits in 2008 (e.g., taking public transportation more often) haven't gone back to their old ways. According to the EIA, petroleum "product supplied" is down 1% over the past four weeks compared with the same period in 2012.

Efficiency gains

Moreover, U.S. vehicle fuel efficiency has grown by leaps and bounds. In 2012, Toyota Motor (TM +1.53%) made a big push to boost sales of its Prius model through the introduction of new varieties of the popular hybrid. The time was right, as gas prices remained high in much of the country throughout the year, and sales grew from 136,000 in 2011 to nearly 237,000 in 2012.

Even when car buyers have opted not to shell out the extra money for a hybrid, they have been choosing smaller cars. For example, General Motors (GM +1.45%) saw sales of its subcompact cars (Sonic, Aveo, and Spark) more than double in 2012 compared with 2011. Lastly, on a like-for-like basis, fuel efficiency in cars and trucks is improving, as high gas mileage is now a major selling point. As a result, the fuel efficiency of new vehicles sold in the U.S. improved by about 20% from 2007 to 2012.

Will it be enough?

Oil demand is thus stagnant in the U.S. -- and most other OECD countries -- as the effects of modest GDP growth are offset by efficiency improvements. Meanwhile, U.S. oil production is growing rapidly because of the shale revolution. The net result is that U.S. crude oil imports have dropped by 13% year to date, from an average of 8.84 million bpd in 2012 to an average of 7.68 million bpd in 2013.

Oil bulls generally argue that modest production increases and stagnant demand in the developed world will be easily offset by surging demand in the developing world, leading to higher prices. China is the most frequently cited example of a large, expanding economy with a rapidly growing need for oil. Indeed, in the past decade or so, China's oil demand has exploded, growing from around 5 million bpd in 2001 to more than 10 million bpd last year.

Yet the onset of high oil prices has provided a strong motivation for efficiency in China and other developing countries, not just in slow-growing OECD nations. China's oil consumption is expected to grow by just 4% -- 420,000 bpd -- this year. This growth will "soak up" less than half of the drop in U.S. imports. U.S. oil production in 2018 is expected to be approximately 3.9 million bpd higher than in 2012, meaning that there is plenty of room for declining U.S. oil imports to continue offsetting growth in China and elsewhere.

In short, stagnant demand and increasing supply in the OECD countries, particularly the U.S. and Canada, should be sufficient to offset demand growth in the developing world for at least five more years. Beyond that, the "shale revolution" will probably be exported to other countries that still rely on conventional drilling techniques today. While brief supply interruptions may cause price spikes now and again, oil prices will tend to be stagnant (or even trend lower) for the foreseeable future.

Foolish bottom line

When oil soared past $100 a barrel in 2008, global oil supplies were very tight. At the peak, in July 2008, the IEA assessed OPEC's effective spare capacity at just 1.5 million bpd. That figure has now risen to more than 3.7 million bpd, indicating a much more benign supply-demand balance.

The main reason for this shift is that we needed sustained high oil prices to change consumer behavior -- e.g., driving less often and preferring more fuel-efficient cars -- and to justify new (and more expensive) drilling techniques such as hydraulic fracturing. Now that oil prices have hovered near $100 for some time, supply growth has picked up again while demand is stagnant. Even demand growth in China has paled in comparison with U.S. supply increases.

I'll close with one more piece of corroborating evidence. While December 2013 Brent crude futures recently traded for approximately $103 a barrel, December 2019 Brent futures traded for less than $89. Conventional wisdom may say that oil prices will skyrocket sooner or later, but the market is telling us otherwise. Don't underestimate the power of efficiency gains and new drilling techniques to keep oil prices in check for many years to come.