The first indentured servants arose centuries ago out of necessity and desperation on both sides of the Atlantic. An unskilled laborer from pre-industrial England might need to save up multiple years' worth of wages to book passage to America. On the other side of the ocean, plantation owners and wealthy merchants had a tough time massing the labor they needed to expand their isolated enterprises.

The solution was indentured servitude. In exchange for the price of passage, poor European laborers signed contracts that bound them for years to the merchant who had paid their way. Since most indentured servants were under 21, their parents often handled the arrangement, hoping (at least we can imagine) to send their progeny off to a better life. For several years, indentured servants worked without pay until fulfilling the terms of the debt, at which point they were set loose with little more than the clothes on their back and the experience earned from their first years of toil in the New World.

Many didn't make it across the Atlantic. Many died in debt. Others found fantastic success. But for the vast majority of early American colonists, indentured servitude was the only way to make it at all.

A bridge to a broken future

Today, we see this tradition reborn in the debt load carried by millions of young Americans who went to college because they were told that they had to if they wanted to get a good job. Student loan debt now exceeds all forms of non-mortgage debt in the United States. More than 40% of all 25-year-olds now carry student loan debts, and more than 15% of that debt-laden cohort has fallen behind on payments. The New York Times and other publications have written on the trend of increasingly demanding degree requirements for jobs that shouldn't need one, like receptionists, couriers, or sales agents at rental car outlets.

To get a good job, you need a degree. That's truer now than it's ever been. Today's high school graduates face unemployment rates of more than 8%, but people with a bachelor's degree can feel more secure with a 4.5% unemployment rate. However, to get a degree, in nearly every case, you gotta pay to play. And in many cases -- just as occurred in the 17th and 18th centuries -- simply booking passage was no guarantee of future success.

I'll spare you the anecdotal sob stories of the guy who took out a hundred grand in student loans to get a master's degree in pottery, only to discover that he couldn't find a job above barista level. Those stories are easy to find, and easier to latch onto than hard numbers about broad trends. But consider this: There are more people under 30 with student loans than there are with degrees. Even if we add in the percentage of people under 30 who have some college experience and are likely to get a degree at some point, we still find that nearly 70% of all current and prospective degree holders in that age group -- about 30% of the entire group -- will come out of college saddled with some collegiate debt.

Sources: New York Federal Reserve and U.S. Census Bureau.

Data includes estimates of eventual graduates with current attainment of "some college." Estimates based on graduation rates reported by the National Center for Education Statistics .Includes any degree attainment, including technical certificates and associate's degrees.

This graph doesn't quite show the full picture, since it's pretty rare to find an 18-, 19-, or 20-year-old with a college degree -- Doogie Howser types notwithstanding. It's also quite possible that a number of people will leave college with student loans but no degree to show for the effort. But it's important to look at America's potential future workforce, and calculating likely graduation rates will do the trick.

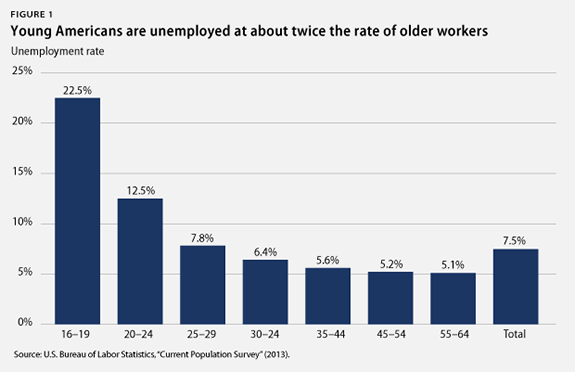

However, these indebted graduates aren't exactly coming into a labor market that's primed to put them to work. The Center for American Progress offered a wide range of statistics this past June on the labor woes of young workers. It's still fresh enough to be relevant, as U.S. labor force statistics haven't changed very much in two months. The younger you are, the worse your chances of landing a job:

Source: Center for American Progress.

Keep in mind that unemployment statistics don't count those who aren't actively looking for work, and there are more than 8 million "potential graduates" in our tally of the under-30 age group that could be largely absent from the current unemployment calculations while they work on their degrees.

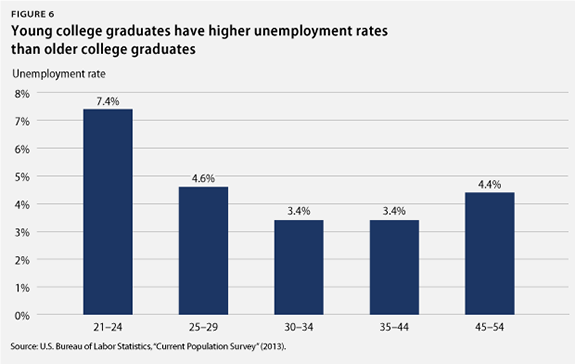

Having a degree does help, but not as much as you might think for younger workers:

Source: Center for American Progress.

The CAP also offers two startling statistics for this underemployed group: A young person will lose out on at least $45,000 in potential wages if he or she remains unemployed for more than six months, and the real wages for young college graduates have declined by 8.5% since the turn of the century. That's almost four times the median student loan of $12,800, which many people took on to avoid precisely that sort of situation. The CAP also notes that half of all college graduates are working jobs that don't actually require college degrees, like the receptionists and couriers I mentioned, as well as retail sales associates, restaurant service workers, and cashiers.

Why is that? Why should so many educated young people be stuck in these low-paying jobs? It could be that the job market itself has changed. More than a fifth of the entire American workforce has been stuck in a part-time job since the official end of the recession:

Source: St. Louis Federal Reserve.

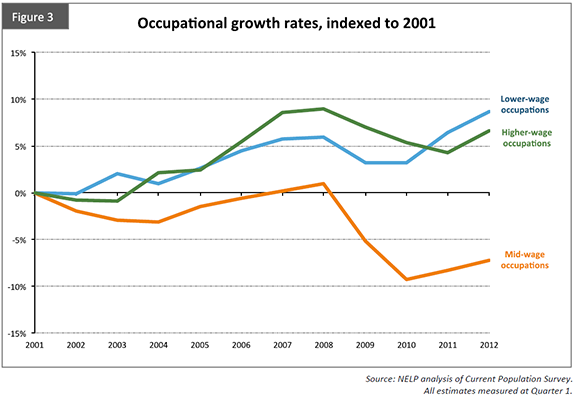

If you're having trouble making this out, it's simply the number of Americans working part-time divided by total American nonfarm employment. It's been high before, but with one critical difference -- every time it's spiked past a one-fifth ratio, it's gone down quickly. Not so today. One of the major reasons is that it's simply the extension of a decade-long trend that's hollowing out the middle class, which is where most people expected to be after getting their degree in the first place. The National Employment Law Project has noted, on more than one occasion, that the financial crisis eviscerated mid-wage jobs while actually boosting the growth of low-wage jobs as a part of the overall labor force:

Source: National Employment Law Project .

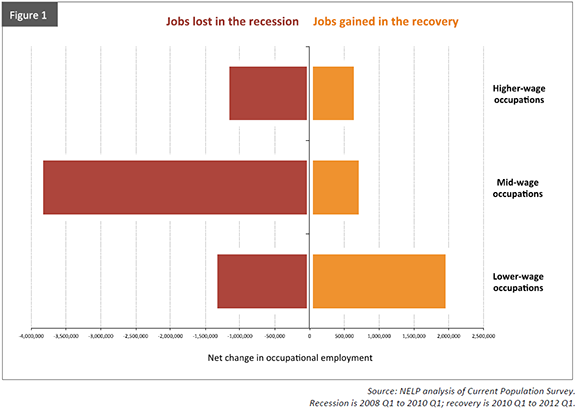

Yes, high-wage occupations have grown as well, but there aren't quite as many of those jobs to go around. If you look closely, you'll see that there are fewer high-paying jobs now than there were before the recession:

Source: National Employment Law Project.

New college graduates will wind up working the latte line or answering the phone in an office. That's where the jobs are found nowadays. Mid-wage occupations were 60% of the lost jobs during the recession, but only 20% of the post-recession job gains. On the other hand, nearly 2 million new low-wage jobs have been added since 2010, accounting for 58% of job growth during the recovery. Under the NELP's definition, lower-wage occupations range from $7.69 to $13.83 per hour. At the upper end of the scale, that's worth about $28,750 in annual pay -- and this rosy assumption anticipates that these low-wage jobs offer 40-hour work weeks and at least some paid vacation, which is rarely the case in reality.

The future doesn't look that much better. Many of the occupations projected to add the most jobs by 2020 are rather low-wage: retail sales, home health aides, office clerks, fast-food workers, and so forth. Recent grads will not only have to compete against each other for these jobs, but they have a flood of displaced but experienced (former) middle-class workers to contend with as well. All this competition just serves to keep pay low: The average median annual wage across all of these new jobs, weighted by the number of new jobs added, is $32,700. A lot of that is thanks to the outsized impact of nursing salaries -- take those new jobs out of the picture, and the average annual wage of the other high-growth jobs drops all the way down to $30,000.

In time, however, even high-demand nursing graduates might find themselves in a vicious fight for a shrinking job pool. They won't be alone -- a number of students wind up snagging sheepskins of rather uncertain long-term value:

Source: National Center for Education Statistics.

In the past 40 years, the U.S. population has grown by 50%, but the number of annual visual arts graduates has tripled. Business programs have graduated more than three times as many people as they did in 1970. It probably should come as no surprise that the degree track most responsible for "streamlining" the American workforce -- the pre-MBA business grad -- is now churning out more graduates by far than any other program. Much of the growth in math and engineering graduation figures comes from the computer sciences, which barely existed as a degree path four decades ago. Without computer science added in, math and engineering graduation rates don't keep up with population growth.

Education, the one degree track in long-term decline, also happens to be the one most welcoming to new graduates, according to Georgetown University's Public Policy Institute. Only 5.7% of recent education grads are unemployed, compared with 7.3% of recent business grads and nearly 10% of recent social science grads. Even recent math and computer science grads are having a tough time -- 9.1% of them are unemployed.

Nursing graduates aren't broken out in these numbers, but the American Association of Colleges of Nursing has the figures we need: More than 80,000 students graduated from baccalaureate nursing programs in 2011. At that rate, all the new nursing jobs set to be added by 2020 (about 700,000) will be filled up by some point in 2019. When you add in the 24,000 graduates from nursing master's programs, it looks as if those positions will be filled by 2017. More eager students join these programs each year, despite alarming statistics showing that more than a third of all 2011's new registered nurses had failed to find a job in the field several months after their graduation.

Pieces of a bigger picture

But let's say the average college grad gets a job making $30,000 a year. Let's say it's near The Motley Fool's headquarters in Northern Virginia. After taxes, he makes $1,890 per month. If he moves in with two buddies, he'll wind up paying about $600 in rent and $100 in utilities. Now we're down to $1,190. A decent used car will cost about $300 a month, using a conservative estimate that includes the monthly payment, insurance, and gas. Down to $890. Food is important, so our new grad has to spend about $300 a month for that basic necessity (young guys eat a lot). That takes us down to $590 in available cash. Take out another $100 for a cell phone and $100 for monthly entertainment, and you're down to $390.

My fellow Fool Morgan Housel notes that the median student loan would result in a monthly payment of roughly $130 a month under relatively ideal conditions. That leaves $260 a month to spend or save -- if that, since these are all very rough back-of-the-envelope figures and could easily understate the true costs of living -- and many of our recent graduate's friends won't be so lucky. Only 39% of current student loan borrowers are actively paying off their loans and haven't fallen behind. The rest (that would be the delinquent 15% of our under-30 borrowers) might be looking at our $30,000-a-year grad and thinking, "Maybe I should've gotten that degree instead."

Debt weighs more heavily on people who have lesser means to repay. There are mechanisms to delay student loan repayment, but unlike all other forms of debt, the only way out is to pay off the loan. The $322 billion in outstanding student loan debt weighing down the under-30 age group might not mean as much to you as the roughly $1 trillion in total student-loan debt weighing down the entire country, but in nearly every case, the debt of older Americans is at least backed by experience, which is worth a leg up in a tough job market. A quarter of all delinquent student loans are held by people under 30, and once the penalties start it can quickly become a death spiral without the option of bankruptcy to clear the slate, or the opportunity for professional advancement and greater earnings to make up the difference. At least the old system of indentured servitude had fixed-length contracts and a clean slate at the end.

For millions of young Americans, a college degree has become the price of entry to the job market. The jobs they get when they've finished may not need a degree at all -- but few employers want to be left with the uneducated remainders of the workforce, so a trend toward stricter degree requirements, regardless of necessity, seems all but inevitable. With less experience than older graduates, the millennial generation is already at a disadvantage when it comes to getting a decent job in a tough market. Forcing the bulk of that entire generation through the college-loan wringer just so they can get half a shot at a better future will be counterproductive for the entire country if the best jobs on offer for an inexperienced graduate are behind the counter of a coffee shop.