Big Lots (BIG +0.00%) will release its quarterly report on Friday, and investors are concerned about the potential for the discount retailer to see its past earnings growth reverse and start to contract. Yet even if Big Lots earnings could shrink in the short run, the company still has potential to achieve long-term success even in a highly competitive area.

The discount retail space came to prominence during the recession and financial crisis, as many bargain-conscious shoppers started looking for ways to cut their expenses even further. Yet even though the industry has done reasonably well even as economic conditions have improved, a massive upsurge in competition has put the onus on every retailer to figure out how to hold onto their share of the industry pie. Let's take an early look at what's been happening with Big Lots over the past quarter and what we're likely to see in its report.

Stats on Big Lots

|

Analyst EPS Estimate |

$0.24 |

|

Change From Year-Ago EPS |

(33%) |

|

Revenue Estimate |

$1.23 billion |

|

Change From Year-Ago Revenue |

1% |

|

Earnings Beats in Past 4 Quarters |

2 |

Source: Yahoo! Finance.

Will Big Lots earnings survive the slow season?

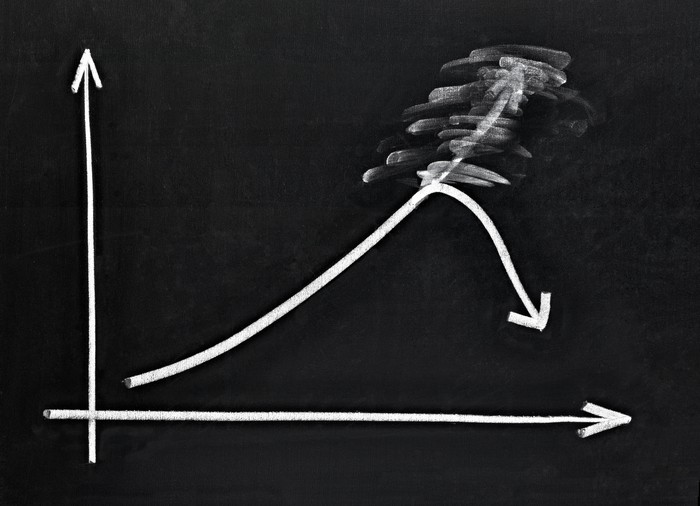

Analysts haven't been too optimistic in recent months about the prospects for Big Lots earnings, as they've slashed their estimates for July quarter earnings by a third and cut more than a dime per share from their expectations for this year and next. The stock has hit some turbulence as well, falling 11% since late May.

Most of the drop in Big Lots stock came following its April-quarter earnings report. The company managed to match earnings estimates on the back of double-digit same-store sales gains from its Canadian Liquidation World operations, but domestically, comps were down 2.9%. In addition, the company cut its projected range for full-year earnings by 4% to 6% and revenue growth guidance by a percentage point.

But another reason for pessimism may have come from the decision by prominent investor Eddie Lampert to divest his stake in Big Lots. Even though Lampert has struggled with some of his bigger retail investments, his departure is a vote of no confidence in the company's growth prospects going forward.

The big question facing Big Lots is how it can deal with ever-increasing competition in the discount space. Dollar General (DG +0.67%) has put together an aggressive expansion strategy, having opened more than 2,250 stores in less than seven years and with plans to open more than 600 additional stores during 2013. Meanwhile, Dollar Tree (DLTR +1.03%) has been focusing on essential products, undercutting competitors on price and putting a premium on execution ability that has put considerable pressure on the rest of the industry. For a while, Tuesday Morning (TUES +0.00%) tried to compete with an e-commerce presence, but it recently gave up on that experiment in the face of tough conditions.

In the Big Lots earnings report, watch to see how new CEO David Campisi handles the company's ongoing turnaround efforts. If Big Lots disappoints investors, Campisi will need to work hard to regain their trust and get the retailer moving quickly in the right direction again.

Click here to add Big Lots to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.