Universal Display (OLED +1.51%) caused a commotion last week. The next-generation display and lighting researcher reported phenomenally strong third-quarter results, causing the stock to jump more than 18% overnight. A week later, Universal Display shares have continued to climb on the back of positive analyst notes, and are now hovering just below 52-week highs.

There's no question that Universal Display is doing well, but do you know exactly why this stock is thriving? Here are three big takeaways from the earnings report and conference call that you probably haven't seen anywhere else.

Fool by numbers: All the trends are positive

As OLED screens became standard issue in Samsung's market-leading products, Universal Display's revenues have absolutely exploded over the last five years. The top line has ballooned from $11 million in 2008 to $125 million over the last four quarters, and Universal Display expects to fill this graph out with a $143 million total for 2013. With just three quarters in the books, the company has already exceeded its previous full-year sales guidance, which topped out at $125 million:

OLED revenue (TTM) data by YCharts.

With increasing sales come economies of scale, and Universal Display has been solidly profitable for nearly two years now.

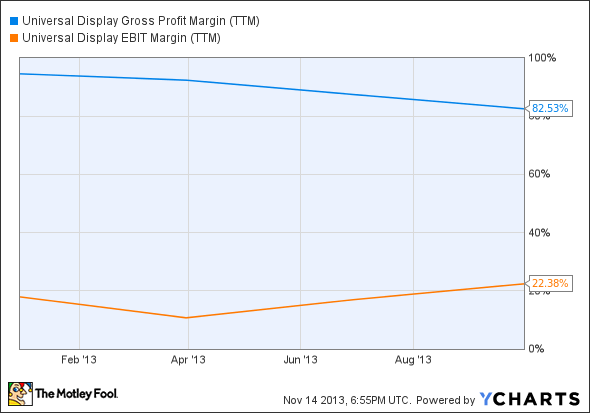

More Fool by numbers: Don't lose sleep over gross margins

All that glitters isn't gold, and some investors might worry about Universal Display's shrinking gross margins. However, there's a perfectly logical explanation for the gross margin downtrend, and everything works out to solid operating margins:

OLED gross profit margin (TTM) data by YCharts.

Universal Display used to be a pure intellectual property wrangler. That all changed in 2011, when the company signed a long-term contract with largest customer Samsung.

Under the new agreement, Universal Display's pure IP royalties are augmented by materials sales. These OLED products are cooked up by specialty chemicals manufacturer PPG Industries (PPG 0.22%), and then passed on to Samsung with a healthy middle-man markup. Universal Display's take-home margin on these sales amounted to 68% in the third quarter.

This arrangement is Universal Display's replacement for demanding volume-based royalties, allowing the company to take part in Samsung's market success. It also ensures that everybody up and down the supply chain knows exactly who to do business with. Materials sales accounted for 92% of Universal Display's third-quarter revenues, noting that this quarter fell in between two $20 million Samsung royalty checks.

The PPG pass-through arrangement also adds a significant cost of goods sold to Universal Display's income statement, so the company trades in some gross margins for higher revenues. Bottom-line results aren't damaged at all, and Universal Display gains a tighter hold of its overall supply chain.

Pricing will firm up

Speaking of margins, chances are that the gross margin plunge will firm up in the next few quarters. That's because Samsung has enjoyed volume discounts on red and green OLED materials as its manufacturing operations ramped up, but those discounts have just about reached their respective maximums already.

"Due to the strong volume run rate, we did have volume pricing pressure in the quarter," said Universal Display CFO Sid Rosenblatt. "We believe, though, that we are nearing the tail end of our agreed upon cumulative volume pricing breaks."

As if that wasn't perfectly clear, an analyst later wondered whether there was "any room for future price-downs." CEO Steven Abramson shot that notion down with authority. "We are pretty close to the end of the volumes discounts," he said.

So there you have it: Universal Display's sales are skyrocketing, the margins that truly matter are solid at the moment, and the company looks to become even more profitable as market demand for OLED products continues to scale up from here. As a shareholder, this is all music to my ears.