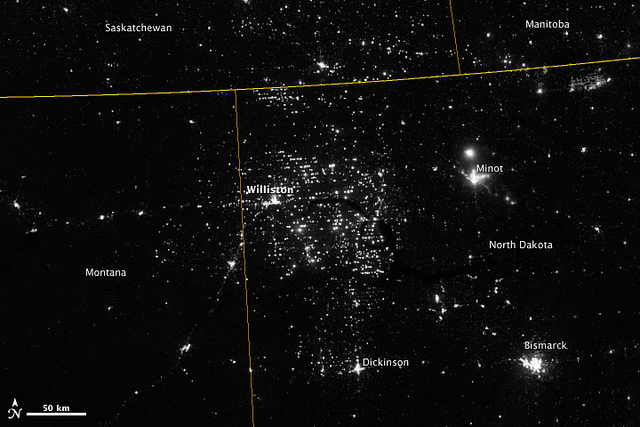

Bakken natural gas flaring at night as seen from space. Photo credit: Flickr/NASA Goddard Space Flight Center

The above photo was taken from space. It shows what appears to be a scattering of cities in Northwest North Dakota. The only problem is that this part of North Dakota is among the least densely populated in the U.S. What NASA took a picture of was oil wells where the natural gas is being flared off.

America's energy boom has actually made natural gas the surprising loser of the boom. In the Bakken, for example, 29% of the natural gas that is produced in association with oil is flared off. This is because wells are either not connected to natural gas pipelines or if a well is connected the infrastructure is inadequate. Natural gas has become an afterthought.

Last year, for example, Bakken focused oil producer Kodiak Oil & Gas (NYSE: KOG) produced 6.6 billion cubic feet of gas as well as 4.8 million barrels of oil. But because of the lack of pipelines or system capacity, Kodiak Oil and Gas was forced to flare 3.3 billion cubic feet of natural gas, or half of its total natural gas production. This didn't have a major impact on Kodiak's operations last year as 89% of its production was oil. Still, Kodiak flared enough natural gas last year to heat a small city for one year.

The good news is that companies like Kodiak Oil & Gas are flaring less gas. The company noted in its last quarterly report that while it is still flaring natural gas it has connected a majority of its wells to pipelines. As more pipelines are built it will lead to additional volumes of natural gas being captured and sold.

The Bakken isn't the only place that natural gas has become an afterthought. Companies like EOG Resources (EOG +0.84%) are not investing any money to grow dry gas production in the U.S. The only reason EOG Resources is still modestly growing its gas volumes is because it's producing gas in association with oil or natural gas liquids in places like the Bakken or Eagle Ford Shale. This has dry gas shale plays like the Barnett and Haynesville seeing little investment.

The issue is that the price of natural gas just isn't high enough to justify these investments. Our energy boom has created too much supply. That has cost a lot of jobs as well. Chesapeake Energy (CHK +0.00%), for example, slashed 10% of its workforce this year. The nation's number two natural gas producer has been forced to cut costs due to low natural gas prices. Like EOG Resources and Kodiak Oil & Gas virtually all of the natural gas production that Chesapeake Energy adds this year will be natural gas that is found with oil and natural gas liquids. Dry gas drilling, except for in some sections of the Marcellus Shale, just isn't profitable to drill.

What's most interesting is that until demand picks up, the price of natural gas isn't likely to budge much because we have plenty of associated natural gas that is still coming online. As new pipelines are built in the Bakken, it will enable the state to reduce its flaring so that the 29% that's currently flared can be used. Combine that with the continued focus on liquids and natural gas will continue to be the surprising loser of America's energy boom.