Synovus Financial Corp. (SNV +0.00%) is a regional bank that has a few things going for it that make it worthy of an investment consideration -- but there is one trend that investors need to keep an eye on that may escape the casual observer.

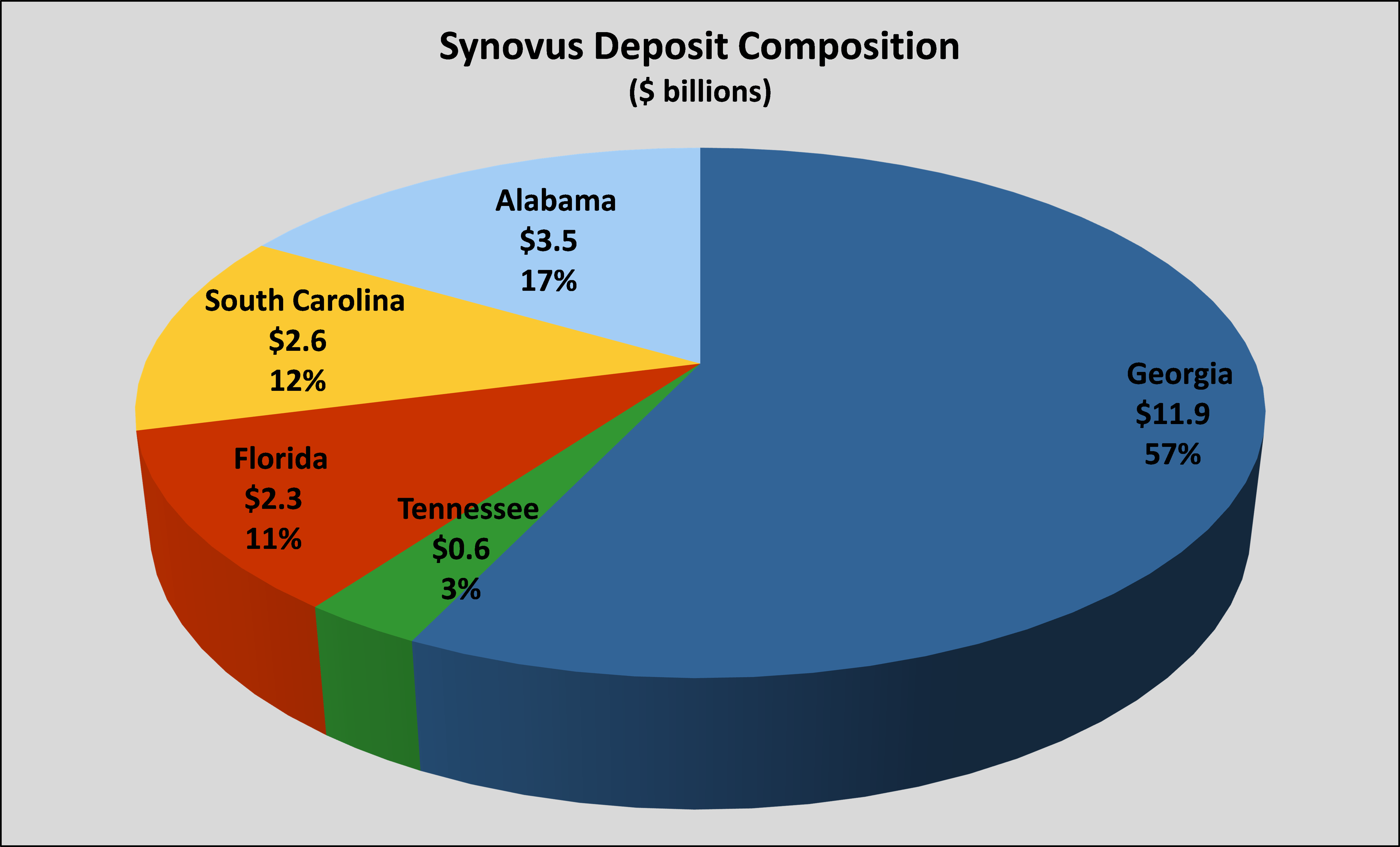

The Columbus, Ga.-based regional bank operates principally in three states: Georgia, Alabama, and South Carolina, and more than 85% of its deposits are held in those three states and the remainder of its deposits held in Florida and Tennessee, as shown in the chart below:

Source: Federal Deposit Insurance Corporation.

While Georgia, Alabama, and South Carolina may not conjure the thought of a heated banking battle ground, Synovus actually faces stiff competition from five better-known competitors:

|

Bank |

Market Share |

|---|---|

|

Wells Fargo |

15.1% |

|

SunTrust (STI +0.00%) |

11.6% |

|

Bank of America (BAC +1.55%) |

10% |

|

Regions Financial (RF +0.65%) |

8.2% |

|

BB&T (BBT +1.78%) |

6.7% |

|

Synovus Bank |

5.3% |

Source: Federal Deposit Insurance Corporation.

As you can see, there is a good mix of national competitors like Bank of America and Wells Fargo and a host of regional ones as well, including three other banks that are principally located in the Southeast, including SunTrust, Regions Bank, and BB&T.

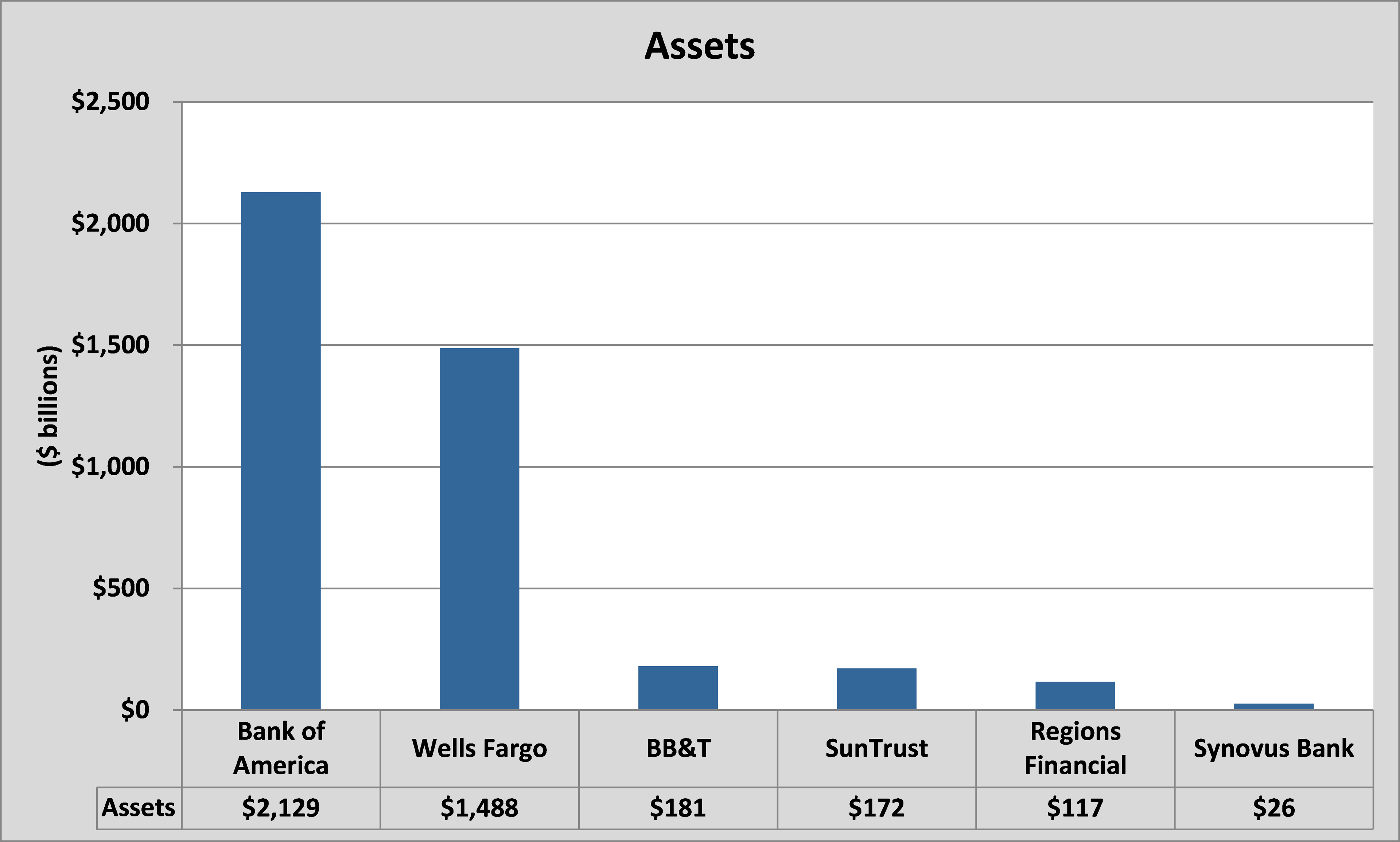

It's also mighty impressive that Synovus is even able to compete with these banks, especially when you consider that it only has $26 billion in assets and the other banks average $685 billion, which is a staggering difference:

Source: Federal Reserve.

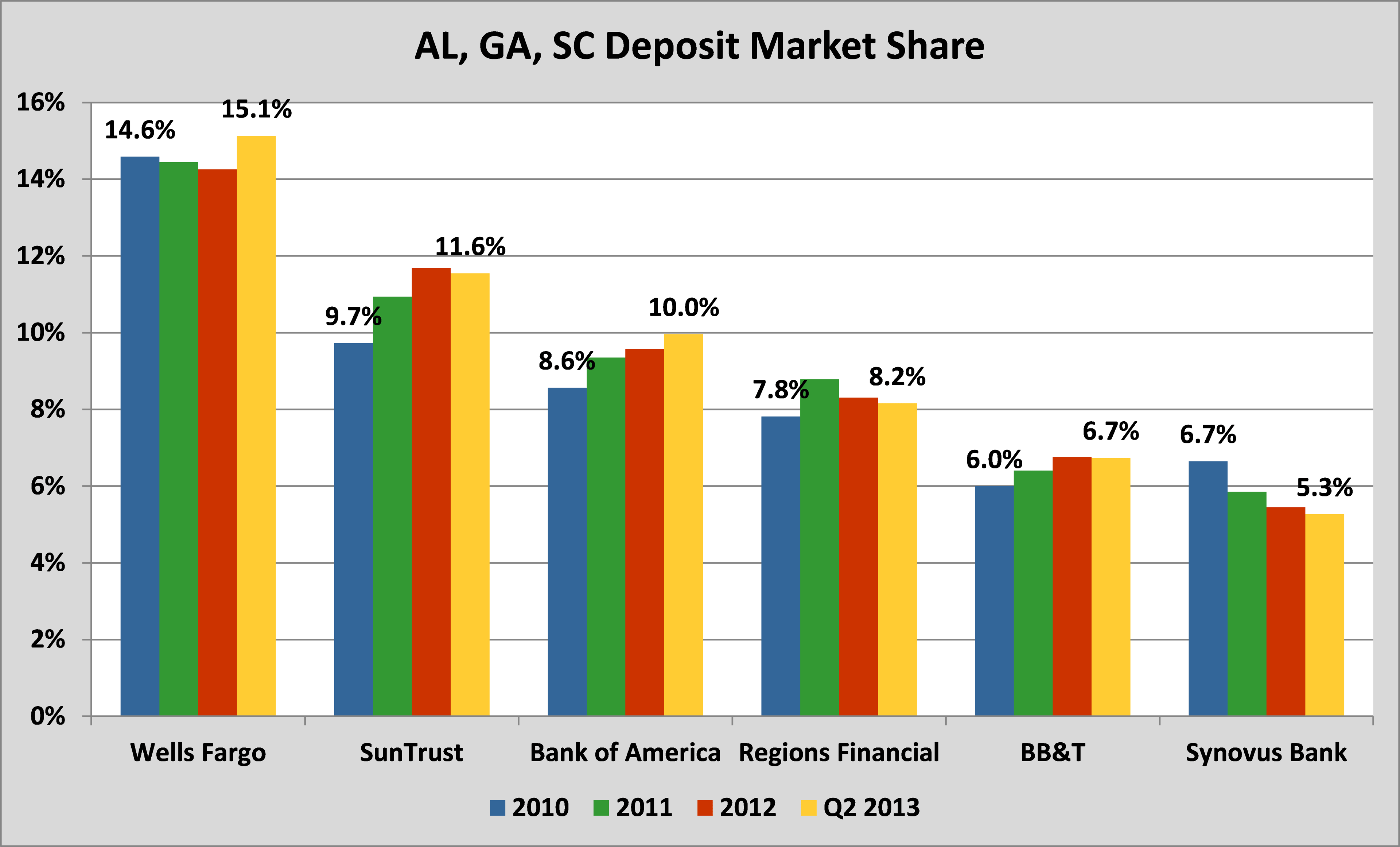

As mentioned earlier, the reason for this is the reality that Synovus is heavily concentrated in these three states, and as you can see in the chart below, the same cannot be said for any of its competitors:

|

Bank |

% of Bank's Deposits in AL, GA, SC |

|---|---|

|

Synovus Bank |

86.1% |

|

SunTrust |

30.4% |

|

Regions Financial |

29.9% |

|

BB&T |

16.8% |

|

Wells Fargo |

5.6% |

|

Bank of America |

3.3% |

Source: Federal Deposit Insurance Corporation.

So should investors be concerned about Synovus' high level of concentration in these markets? Typically, the thought is that it shouldn't as countless other regional banks only operate in a few select states but are still great companies. However, somewhat troublingly, over the last few years, Synovus has steadily watched its market share shrink, even in the face of continuing ire directed toward megabanks.

Source: Federal Deposit Insurance Corporation.

In fact, Synovus has not only watched its market share decline, but it has seen its deposits shrink from $22.2 billion in 2010 to $20.9 billion in the most recent quarter. By comparison, SunTrust (which has led the way in market share growth) has watched its deposits from $32.4 billion in 2010 to $39.5 billion in the most recent quarter.

While Synovus has highlighted in its most recent annual that a large reason for the decline stemmed from its decreasing reliance on more expensive forms of deposits for funding -- it is nonetheless something to continue to monitor. Year to date, Synovus has had its noninterest bearing deposits (the inexpensive ones) fall by $300 million, while its brokered deposits (the expensive kind it specifically mentioned it was attempting to shed) rise by $200 million.

Although deposits aren't the most exciting thing, market share in core areas is something to be monitored -- so keep an eye on how these things progress for Synovus relative to its peers.