"In the short run, the market is a voting machine, but in the long run, the market is a weighing machine."

--Benjamin Graham

The New York Stock Exchange recently updated its stock market margin-debt data, showing that Main Street and Wall Street are continuing to dump billions in borrowed dollars into the stock market.

*All data provided by the NYSE.

Borrowed money in the stock market, known as "margin debt," hit an all-time high of $412.45 billion in October. This puts margin debt, adjusted for inflation, 7% below levels seen during the housing bubble and above highs set during the dot-com bubble.

Three highfliers benefiting from a market rally

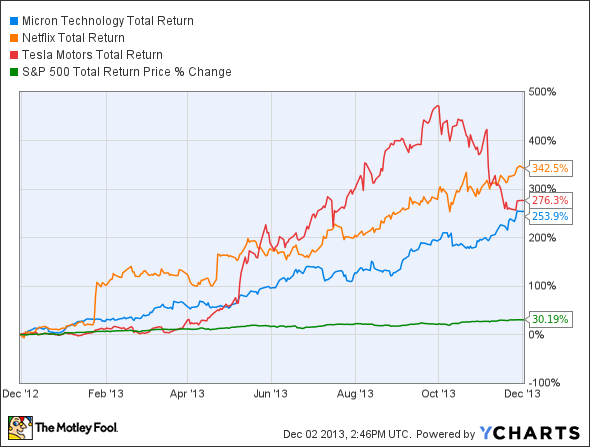

History shows that this is typical market behavior when big-name companies such as Micron Technology (NASDAQ:MU), Netflix, and Tesla Motors all rise more than 100% in a year and the S&P 500 also hits all-time highs.

MU Total Return Price data by YCharts.

Of the three stocks above, Micron Technology looks to be valued the most rationally at 9.6 times next year's earnings, compared to 90.33 and 83.6 for Netflix and Tesla Motors, respectively. The fuel igniting Micron's share rally has been optimism around the consolidation of the memory market and notable investments from investing legends Seth Klarman and David Einhorn. After underperforming the S&P 500 from 2010 through 2012, Micron has pushed deep into outperformance territory this year. Investors should keep an eye on Klarman and Einhorn to see what the big-time investors do with their positions in the company going forward.

Final takeaway

In the following video, Motley Fool analyst Blake Bos goes over the margin-debt data, gives examples of how margin debt works in the market, and explains how he uses this troublesome data.