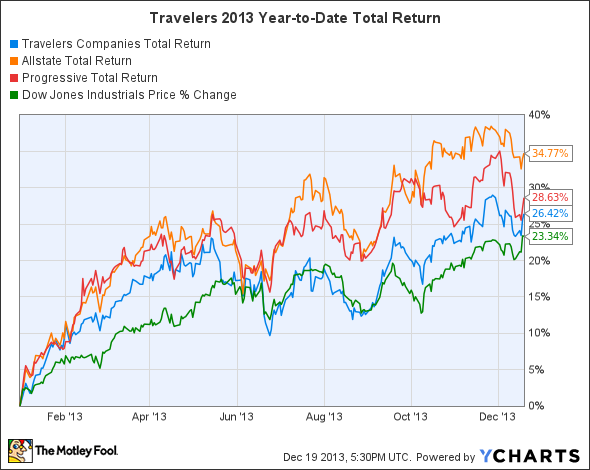

Dow component Travelers (TRV +0.07%) has done well in 2013, with a stock gain of 26% outpacing even the strong performance from the Dow Jones Industrials (^DJI 1.76%) year to date. Yet with the entire insurance industry having enjoyed a relatively benign year, Allstate (ALL +0.66%) and Progressive (PGR +0.77%) have posted even more impressive share-price gains. As a result, investors are wondering whether Travelers can keep up with its rivals and make the most of the favorable environment in the space while it lasts.

Throughout its history, Travelers has done exactly what every insurance company should: endured tough years when calamities strike while prospering when times get good. After suffering through major storm-related losses in recent years, the company finally got a well-deserved break in 2013. But that doesn't mean it didn't face new challenges, especially as rising interest rates threatened its investment portfolio. Let's take a closer look at what moved shares of Travelers in 2013.

Stats on Travelers

|

Current Trailing P/E |

11.3 |

|

1-year revenue growth |

0.7% |

|

1-year earnings growth |

7.2% |

|

Dividend yield |

2.3% |

Source: S&P Capital IQ.

Travelers Total Return Price data by YCharts.

How did Travelers stock perform so well in 2013?

As you can see above, Travelers climbed along with the broader Dow throughout the first few months of the year, enjoying a relatively quiet winter season on the catastrophic-loss front. With storms like Hurricane Sandy in the rearview mirror, Travelers was able to reap the rewards of a stronger pricing environment, boosting premium revenue and putting itself in better position to increase profits when losses normalized.

In general, Travelers was fortunate to have modest loss experience almost throughout the year. The company didn't escape entirely unscathed from catastrophic events, as wildfires in the western U.S. and a huge tornado in Oklahoma were among the highest-profile disasters to cause widespread damage and major insurance losses. Yet a quiet hurricane season prevented a repeat of the devastation that major storms dealt the East Coast during the preceding two years, and that helped shares of Allstate, Progressive, and Travelers all climb during the second half of the year.

Travelers' major challenge came from the interest rate environment. In May and June, the bond market got exceedingly nervous about the prospect that the Federal Reserve would eventually have to stop buying bonds through its quantitative-easing program, and long-term interest rates spiked higher. That caused the value of the bonds in Travelers' investment portfolio to fall, leading to the insurer reporting a drop of $1.77 billion in unrealized gains on its $63 billion bond holdings. Rates have since stabilized, and even this week's Fed move to begin the tapering process hasn't led to further losses for bonds generally.

One key question will be how Travelers positions itself among various insurance-line offerings. Travelers offers insurance to both commercial and personal customers, but it arguably has a stronger reputation on the commercial side. In personal lines, Allstate and Progressive have been more aggressive in promoting their policies through extensive marketing campaigns, and that left Travelers struggling to retain market share in areas like personal auto insurance. That hasn't necessarily caused problems for Travelers, but it could put a lid on future growth if the insurer doesn't take steps to build a bigger presence on the personal side of the business.

The gains that Travelers has enjoyed have come largely from the strong foundation it built in being prudent about underwriting and claims handling during recent tough years. Continued low losses would inevitably swing the pendulum in the other direction, forcing Travelers to compete on price and reducing premium income. For now, though, shareholders can be satisfied that Travelers gave them excellent results in 2013 and that the insurer is in a good position to keep giving rivals like Allstate and Progressive a run for their money in the future.

Click here to add Travelers to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.