Wasn't Gorilla Glass supposed to be the next big thing for Corning (GLW 7.96%)? The maker of protective glass for all manner of electronics reported its earnings yesterday morning, and the market was not pleased with the results. Adjusted earnings of $0.29 per share showed a 4% year over year improvement and beat Wall Street's $0.28 EPS estimate, and $2 billion in net sales also beat the Street.

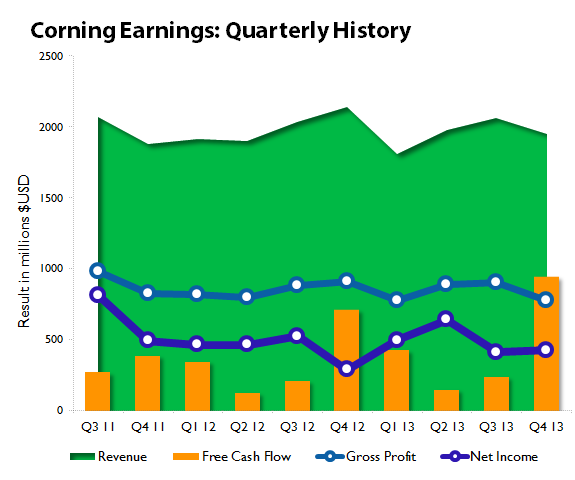

However, the company warned that prices on large display panels for TV sets would suffer further erosion in 2014 -- analyst Steven Fox of Cross Research anticipated a sequential price decline of as much as 6% in the current quarter. As display glass sales were already down 5% year over year in the fourth quarter, and with Corning anticipating display glass volume to decline in the first-quarter, this unwelcome information sent investors skittering for the exits. Shares ended up roughly 6% lower by the close yesterday. If you look at Corning's financial performance on a longer timeline, you might better understand why that happened:

Source: Morningstar and Corning earnings report.

Revenue fell from both the year-ago quarter and the previous quarter, but net income managed to rise slightly on both bases. It's important to point out that Corning's year-ago result had neither the sizable boost from other income (up this year thanks to a large legal settlement over the use of "fusion technology" in China) nor the same weighty drag of various expenses -- R&D and restructuring cost Corning $89 million more last year.

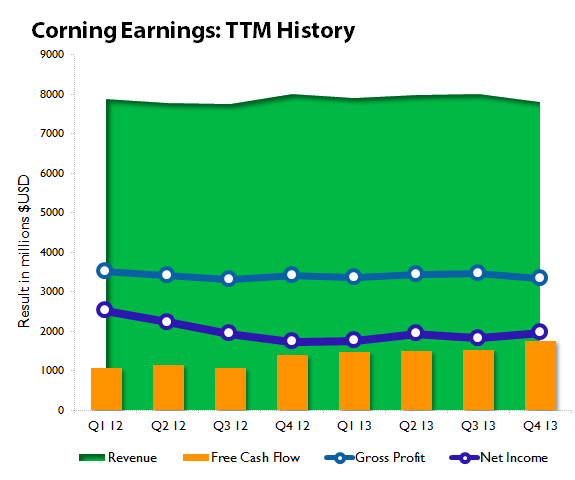

What's more interesting is the upward momentum in Corning's free cash flow, which was up 83% from the end of 2011 to the end of 2012, and up again another 33% for 2013 against 2012's result. This could actually be somewhat worrisome for Corning shareholders, as the company's capital expenditures were almost $200 million less in the fourth quarter of 2013 as compared to the year-ago period. On a full-year basis, Corning spent about $800 million less in capital expenditures in 2013 than it did in 2012. Since Corning has not shown much in the way of long-term progress, except on its free cash flow metric, this isn't an encouraging sign of imminent growth. Its trailing 12-month history shows a company that's been largely stuck in neutral:

Source: Morningstar and Corning earnings report.

Corning's various operating segments all reported as well, and examining their results against the year-ago quarter can give us a more complete picture of where the company might be going.

|

Segment |

Q4 2013 Revenue |

Percentage of Total Revenue |

Growth (Decline) vs. Q4 2012 |

|---|---|---|---|

|

Display Technologies |

$616 million |

32% |

(23%) |

|

Optical Communications |

$605 million |

31% |

12% |

|

Environmental Technologies |

$238 million |

12% |

9% |

|

Specialty Materials |

$285 million |

15% |

(29%) |

|

Life Sciences |

$210 million |

11% |

14% |

Source: Corning earnings report. May not equal 100% due to rounding.

However, what's more important here is segment net income. A year and a half ago, Corning was almost entirely reliant on Display Technologies for profitability. Has it managed to diversify its earnings? Let's take a look:

|

Segment |

Q4 2013 Net Income |

Percentage of Net Income |

Growth (Decline) vs. Q4 2012 |

|---|---|---|---|

|

Display Technologies |

$263 million |

72% |

(26%) |

|

Optical Communications |

$26 million |

7% |

(51%) |

|

Environmental Technologies |

$37 million |

10% |

270% |

|

Specialty Materials |

$25 million |

7% |

14% |

|

Life Sciences |

$14 million |

4% |

No profit in Q4 2012 |

Source: Corning earnings report. May not equal 100% due to rounding.

The answer is no -- Corning remains ever-reliant on large-panel glass sales to TV manufacturers for the vast bulk of its earnings. Corning bulls have been touting Gorilla Glass, the Specialty Materials segment's principal product, for some time, but there remains little evidence that this product can ever become Corning's bread and butter. Even if you examine Specialty Materials against Display Technologies on a full-year basis, it's clearly Display Technologies that drives Corning's bottom line. Over the course of 2013, Display Technologies earned a total of $1.6 billion in net income while Specialty Materials earned less than a tenth that much: its annual segment net income came to $137 million in 2013.

Corning has actually moved to increase its direct exposure to large panel manufacturing, as it recently brought its joint venture with Samsung in-house. This will boost the top line somewhat, and might improve other results as the company generates greater efficiencies, but the joint venture's primary benefit arrived in the form of regular dividend payments to Corning, which will now simply be recorded as regular income and free cash flow instead. That has the drawback of boosting tax rates, which will be about 5% higher in 2014 than they were in 2013. Combined with further display glass price declines, these factors seem likely to produce underwhelming results for a while.

Corning has been hoping Gorilla Glass would become the next big thing, profit-wise, for some time, but there's no indication yet that this is likely or even possible in a world that already has over a billion smartphones. Investors have enjoyed a rebound over the past year thanks to Corning's absurdly low valuations in 2012, but without genuine growth momentum forthcoming for the bottom line, it may not have much higher to go.