In a previous article, I discussed the problems that ZeniMax/ZeniMax Online's The Elder Scrolls Online would face in attempting to generate an MMORPG (massively multiplayer online role-playing game) following from a single-player fan base.

My reasons were simple -- the franchise had long been a single-player sandbox affair, the target audience was used to hundreds of hours of entertainment from a single purchase, and ZeniMax didn't properly account for the shift of gaming trends from MMOs to MOBAs (multiplayer online battle arena).

This week, ZeniMax officially announced the "Imperial Edition," a massive collector's edition of the game, which will be released for the PC on April 4 and for Sony's (SNE 0.83%) PS4 and Microsoft's (MSFT +0.30%) Xbox One in June.

Let's take a closer look at what the "Imperial Edition" of the upcoming game actually contains and what it means for gamers.

What is 'The Imperial Edition'?

The Elder Scrolls Online: Imperial Edition contains the following physical items: a statue of Molag Bal, the Daedric Prince of domination and enslavement, a 224-page Emperor's Guide to Tamriel, a Map of Tamriel, and a collector's edition box.

Within the game, players get a white Imperial horse, a pet Mudcrab, two Rings of Mara, and the ability to play as an Imperial in any alliance.

The Elder Scrolls: Imperial Edition. (Source: ZeniMax/Bethesda)

The entire package (physical/digital content) costs $99.99, while a digital version (with only the digital goods) costs $79.99. In addition, pre-ordering the game also grants gamers The Explorer Pack, which contains a pet Scuttler, four bonus treasure maps, and the ability to play as any of the nine races while in any alliance.

By comparison, the standard digital version of the game will cost $59.99.

Is The Elder Scrolls Online overpriced?

This leads us to an interesting question -- at $60 to $100, is The Elder Scrolls Online overpriced for a subscription-based MMO?

In my opinion, absolutely.

For the $59.99 it costs for the standard digital edition, gamers get one free month of online access, after which they must pay a subscription of $14.99 per month.

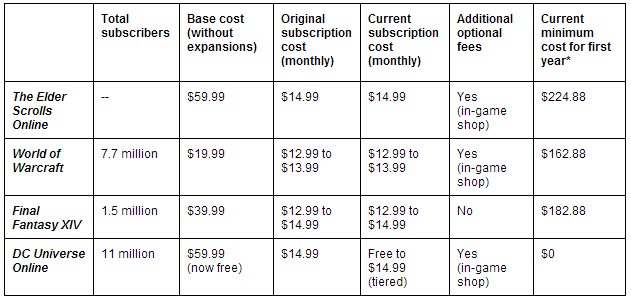

Let's compare that to several of the top MMOs on the market today -- Activision Blizzard's (ATVI +0.00%) World of Warcraft, Square Enix's Final Fantasy XIV: A Realm Reborn, and Sony/WB Games' DC Universe Online -- for a clearer comparison.

Source: Industry/company websites, author's calculations. *without expansions, in-game transactions, or taxes included.

The Old Republic, which was initially priced similarly to The Elder Scrolls, became free-to-play last November after its subscriber base fell to under 1 million -- which serves as an ominous warning for ZeniMax's pricey newcomer.

Moreover, the current MMO market is saturated with free-to-play games that rely completely on in-game transactions rather than old-fashioned monthly fees.

Old fans won't be lining up to buy The Elder Scrolls Online, either

Now that we've established that The Elder Scrolls is going to have a tough time winning over MMO players, we need to look at the core market that ZeniMax is counting on to support the game -- the longtime fans of The Elder Scrolls series.

Skyrim. (Source: Nextgengamingblog.com)

Unfortunately, that's going to be a tough sell.

The Elder Scrolls games have always been single-player role-playing games in large, open worlds populated by quest-giving NPCs (non-player characters). The games are also vast and nearly endless, lasting for hundreds of hours in a market dominated by games that usually only last 10.

Today, gamers can purchase The Elder Scrolls V: Skyrim Legendary Edition (which includes the three expansion packs) for $50 to $60 online. That game alone contains enough content to last most gamers several months. If players get tired of the "vanilla" (store-bought) version of the game, they can modify the game via a vast library of mods available online -- which can add new characters, items, buildings, and quests to the already massive game.

ZeniMax/Bethesda encourages gamers to change the game as they see fit -- the game's launch menu is specifically designed to load extra data files to alter the gaming experience.

Therein lies the problem -- The Elder Scrolls gamers like personal, one-player experiences that last for months, and the freedom to modify their worlds as they see fit. MMOs are the polar opposite -- they force players into a company/server-defined online world overseen by moderators and populated with other living players.

Combine that fact with the $225 per year price tag for the first year of The Elder Scrolls Online, and ZeniMax has inadvertently created a very unappealing package for longtime fans of the series.

The bottom line

On a personal note, I've been a huge fan of The Elder Scrolls games ever since Morrowind (2002).

As much as I also love Oblivion (2006) and Skyrim (2011), I personally believe that The Elder Scrolls Online is a misstep that will simultaneously fail to dent the MMO market and alienate Bethesda's original fan base. What's worse, the disaster could delay the long-awaited Elder Scrolls VI.

However, as I noted in my previous Elder Scrolls article, if ZeniMax captures roughly 21% of its 16.3 million Skyrim gamers (3.4 million subscribers), the game would generate $51 million in monthly revenues, helping it quickly recoup its original production costs.

What do you think, fellow gamers? Do you think The Elder Scrolls will be the next World of Warcraft or the next Star Wars: The Old Republic? Please share your thoughts in the comments section below!