Netflix CFO David Wells, as seen in Netflix's Q1 2014 earnings video.

Netflix (NFLX 1.98%) CFO David Wells spoke Tuesday at the annual J.P. Morgan Technology, Media and Telecom conference. Wells offered some useful tidbits on his company's love-hate relationship with Amazon.com, lessons learned from competing on a global scale, and why Netflix didn't bid on HBO's back-catalog content deal. He even (unintentionally?) dropped a hint on when we should expect the next big European market announcement.

Here are the 10 most important nuggets of wisdom from Wells' presentation, in no particular order, with brief notes on what these details mean for Netflix investors.

1. International surprises

We were a little bit surprised about our ability to compete in an already established market in the U.K. Very competitive market, we've been able to grow, we are pretty happy with our trajectory on our content offering in the market, and we continue to better that content offering.

When Netflix jumped over to the British Isles, Amazon had already established a beachhead on the White Cliffs of Dover. Amazon acquired European video service LoveFilm in 2011, the year before Netflix moved into its first European market. Moreover, local hero streaming service Sky Go has been around since 2006.

But Netflix has still managed to capture a significant U.K. market share. Reading between Wells' lines, this market must be doing better than just OK, or there wouldn't be a surprise to speak of.

2. The global opportunity

Wells sketched out the size of the worldwide addressable market for digital video services, starting with 700 million broadband users across the globe. Back out roughly 100 million in the American home turf and another 200 million Chinese Internet users, given the company's early U.S. entry and tough Chinese regulations, and you'd get maybe 400 million potential subscribers globally. The video streamer and DVD deliverer already sports 48 million users in over 40 countries.

But Netflix today does business across less than one-third of that addressable market. The buildout won't be complete until the company has tripled or maybe even quadrupled its geographic footprint, and then there's the trifling matter of winning hearts and minds in each new market. In short, there's a ton of international growth left to explore.

Potential expansion markets, with red squares marking probable plans and yellow diamonds signifying long shots. Red squares with exclamation points? Those markets were announced Tuesday morning. Template source: Google Maps.

3. The next foreign market announcement?

Here's that possibly unintentional hint I mentioned earlier. J.P. Morgan analyst and conference moderator Doug Anmuth asked Wells how many more markets Netflix would announce in 2014. Here's how Wells answered:

Such a tease! We still haven't confirmed anything here, but we will over the next three weeks ... a few weeks, I should say, it's likely you'll get a confirmation. I'd leave it with the language we had in the letter, which is around a "substantial expansion in Europe." I'll leave it there.

It was a short three weeks. Netflix actually announced its next wave of European openings on Wednesday morning, the day after Wells' conference presentation.

Looks like Netflix really, really wanted some more marketing experts who speak German. The wave due this year includes Germany, France, Switzerland, Austria, Belgium, and Luxembourg. The announcement will potentially add another 176 million households in highly developed, Western markets to the Netflix portfolio.

4. Lessons learned abroad

What I've learned over the last three to four years is, it's extremely difficult to suck all the content oxygen out of the air of a market. There's a lot of content. We've entered markets before where there's been certain content that was locked up or not available, or "too expensive," and we've been able to compete and add things on the margin and then suddenly something unlocks.

With or without direct competition, Wells isn't worried about oversaturating any particular market. There's always enough content available to provide for several healthy market rivals.

Bottom line: Don't expect Netflix to shy away from markets just because the local content market seems thin, or overly mature, or complicated in any other way. Get your feet wet and start competing; something will eventually come along to unlock that troublesome market.

5. Scalable technology

Expanding to new markets can be costly in terms of start-up marketing and building an initial content library. Building your brand from scratch isn't always easy, and it's never cheap. But the technology platform is not a big expense driver, because the same hardware and software works in any market.

"We have a global product. We don't have individual territory tech teams," Wells said.

6. Does new content cannibalize older titles?

When we add new deals, we still see expansion of hours viewed. So it's indicative that we're not just substituting content. We're paying attention to that each time when we're looking at new content that comes in, whether that's at a deal level or a title level.

If Orange Is the New Black simply stole eyeballs away from Weeds and House of Cards, the show wouldn't add any value to Netflix's business model. But if viewers make room for Orange alongside their usual Netflix fare, total hours per subscriber will increase. The service becomes stickier, Netflix gets lower churn and longer-term commitments, and the company wins.

That's the way Wells and his fellow Netflix executives have to think about the value of content deals. They're weighing dollar costs against expanded viewership to measure individual shows and wholesale content portfolio deals. Remember, this is a highly data-driven business.

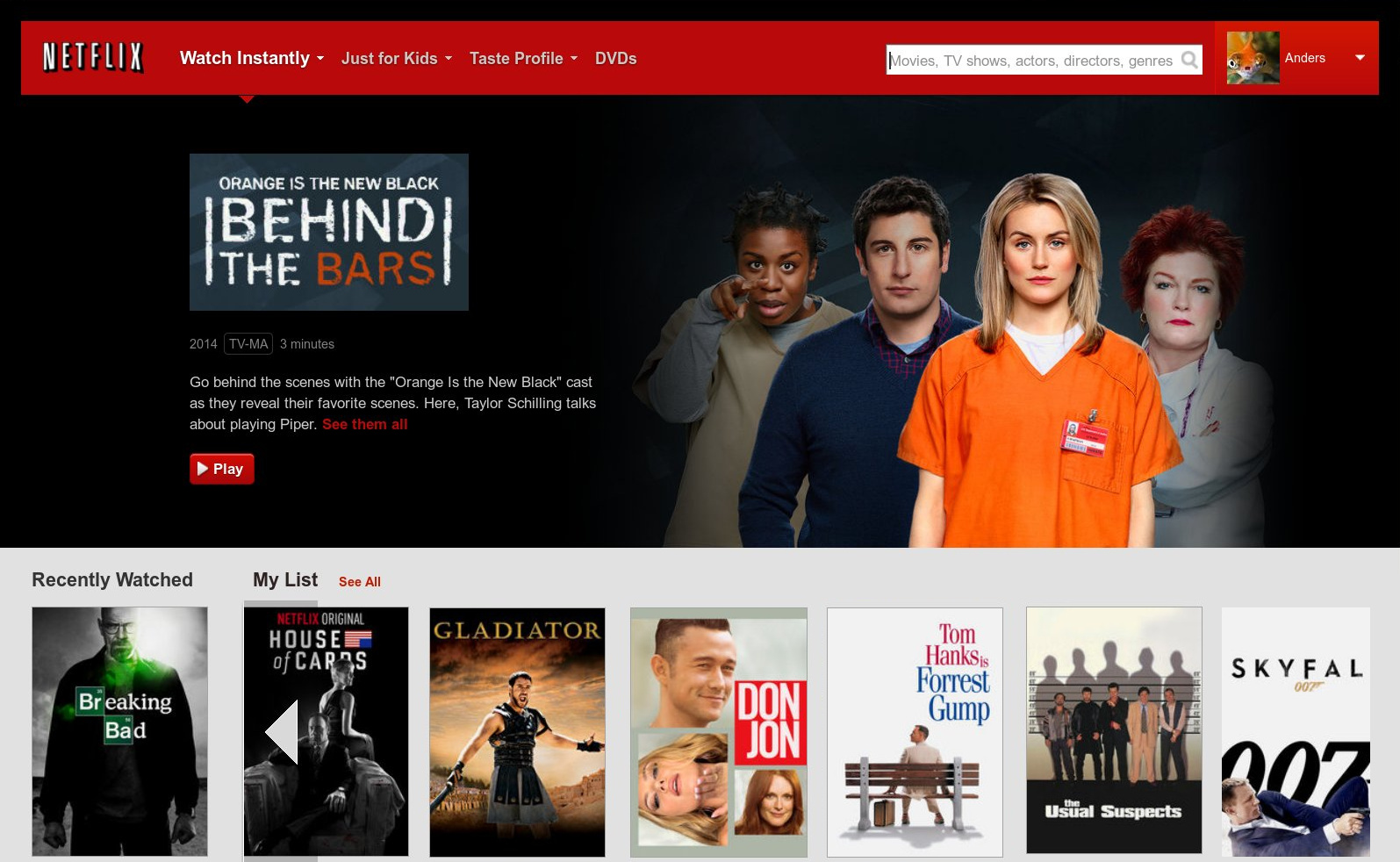

A selection of current Netflix titles. What's next?

7. Gross adds versus churn

That leads right into a discussion of gross subscriber additions versus customer churn. Which one is the bigger contributor to subscriber growth these days?

Wells said this:

They're equal contributors to net additions, right? It's a mixture. Sometimes it's hard to know whether somebody is a churn or not. As we get bigger and bigger and the prospect of saturation takes hold, obviously retention becomes a little bit more important versus adding new subscribers to the service.

So right now, straight-up new additions seem to matter a little bit more than lowering the monthly churn -- which is an unreported metric anyway.

But wait -- didn't that sound like Wells sees market saturation on the horizon? Not exactly. "Right now, we're still in a mode where we're pretty comfortable that there's equal contributions there," he said.

In other words, saturation is not an issue yet. That day will come, domestically at first and then on a global level many years later. For now, it's full steam ahead until you hear otherwise.

8. Margins versus growth

Wells said Netflix intends to grow its content spend slower than revenue. That's both for international and domestic content, and it's a long-term commitment. In short, the company has started to think about the margin expansion that comes after the current high-growth phase. That doesn't mean Netflix will stop buying content overnight, just to preserve the margin-growth strategy -- the big picture is even larger than a short-term profit goal:

We're committed to margin expansion while we're growing, but we're also committed to making a great long-term product. And if we think, opportunistically, something comes along where we get creative on some piece of content, then that's the right decision. We're willing to have margin flat for two or three quarters, and do something that is gonna strengthen our content offering.

Long-term opportunity trumps impressing Wall Street. How delightfully Foolish!

9. Why Amazon won the HBO auction -- if there even was one

"We didn't bid on HBO content. To my knowledge [HBO] didn't shop it," Wells said.

That's a bit of a shocker.

The HBO content, which started hitting Amazon Prime on Wednesday, consists of mostly older shows that are practically begging for monetization. If HBO truly went straight to Amazon Prime without starting an auction around the package, the producer probably left millions on the table. What media channel wouldn't place a serious bid on classic award-winners such as The Sopranos and Band of Brothers?

That said, Wells concedes that the deal got an important job done for HBO:

It's good older content with some conspicuous absences in the title list. It solves a problem for HBO, they probably weren't getting a lot of HBO Go traffic on those catalog titles, and they need to reach the sort of court-never market. So I would say that was probably a good deal for them.

David Wells again. Source: Netflix executive bios.

10. Amazon and Netflix: Best frenemies forever?

Finally, Anmuth wondered if Netflix would ever move away from its Amazon Web Services infrastructure, now that the two companies also compete for the same video consumers. Wells has heard this concern many times before, and the answer is still "No worries, mate."

We don't have the fear that because they compete head-to-head with us on the video side, that they would suddenly turn nasty as a cloud provider. There's too much at stake for them in terms of the viability and the reputation of that business.

So we expect to continue to be great partners together, and we help push them to have a better product and they help push us in terms of the ability to scale our network very quickly and efficiently.

What should investors take home from Wells' presentation?

If there was an overarching theme to this event, I would call it "business as usual."

Netflix shares have both surged and plunged in 2014, but the underlying business hasn't changed much. Domestic growth is still happening, with market saturation several years away. The international expansions are not only happening, but have started to finance even further empire-building as the foreign territories start turning profitable, one by one. The company has started thinking about reliable and growing profits, in order to exploit the rapidly growing customer base. Amazon may be a powerful rival, but it is also an indispensable ally for the long haul.

And the next European expansion wave is already here.