Yield-starved investors have been gravitating toward upstream oil and gas MLPs due to their high yields, with several offering monthly distributions. While researching the industry I came across 11 upstream MLPs and realized that deciding where to invest in this space could be difficult for many investors. I came to the conclusion that when comparing upstream MLPs long-term investors should consider four key metrics:

- Current yield

- Distribution growth: a key determinant of unit price appreciation

- Distribution coverage ratio: representing distribution security

- Valuation: EV/EBITDA, which I believe to be the most comprehensive valuation method for analyzing MLPs.

Yield + distribution growth is considered a rule of thumb for long-term total returns and by incorporating the distribution coverage ratio and valuation, I believe investors can do well comparing MLPs within the same sector. But I should note that this is merely a screening tool, a starting point for more research. Qualitative measures such as management must also be considered. Over the course of several articles I'll be looking at the entire world of upstream MLPs to see which ones are the best for long-term income investors.

EV Energy Partners (NASDAQ: EVEP)

| MLP | Yield | 10 year Projected Distribution Growth Rate | 12 Month Coverage Ratio | EV/EBITDA | 10 Year Projected Total Return |

| EVEP | 8.10% | 5.54% | 0.74 | 17.78 | 13.64% |

| IND AVG | 9.65% | 7.79% | 1.01 | 12.17 | 17.44% |

Sources: S&P Capital IQ, Yahoo Finance

EV Enterprise Partners has two main problems: its recent history of failing to cover its distribution and its overvaluation. The most concerning thing for potential investors, (or current ones) is the lack of distribution coverage. The primary reason for this is due to commodity hedges.

All upstream MLPs hedge their production, typically three to four years, to create predictable cash flows with which to pay distributions. EV Energy Partners purchased large amounts of gas and oil hedges in 2008 when prices where higher than today's levels. In 2012 the hedges ended resulting in the 30% DCF decline in 2013 that brought the distribution coverage ratio to such low levels.

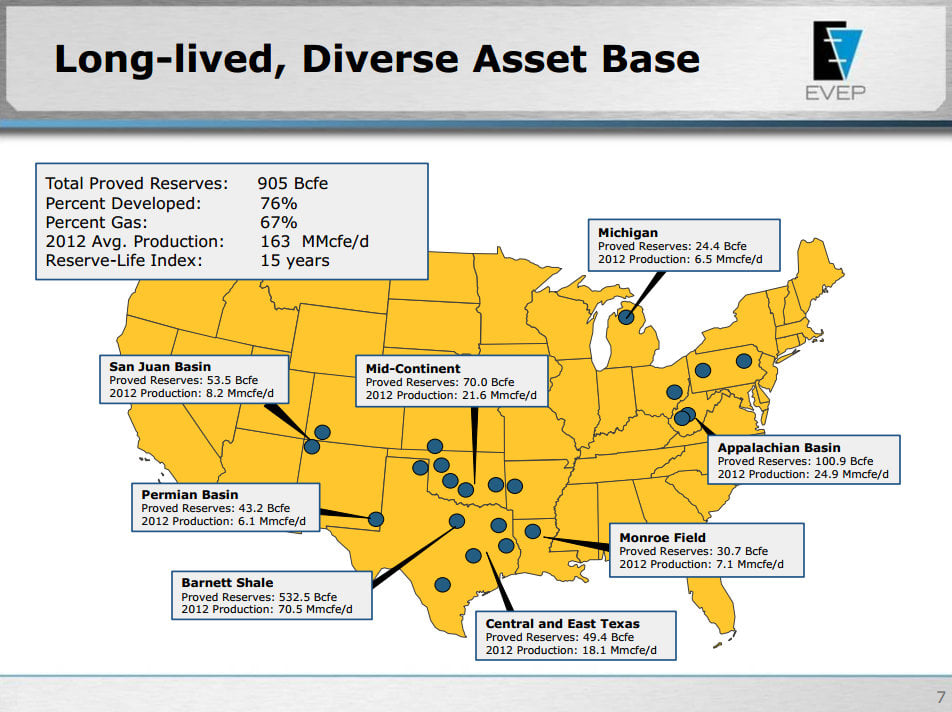

But EV Energy Partners does have a lot of potential, specifically in its Utica, San Juan, and Eagle Ford shale assets and new midstream operations.

EV Energy's Utica assets include 173,000 acres and overriding royalty rights on 880,000 acres. The MLP is diversifying into midstream operations with a 9% interest in Cardinal Gas Services and a 21% stake in an east Ohio gas gathering, processing, and fractionation facility.

EV Energy is guiding for $35 million in EBITDA from its midstream operations in 2014 and $70 million in 2015, a 33% increase of 2013's EBITDA of $209 million. With a growing midstream operation and strong growth prospects in the form of accretive well drop downs from its general partner EnerVest (private equity oil and gas driller), management is targeting a coverage ratio of 100% by the end of 2014.

Eagle Rock Energy Partners (NASDAQ: EROC)

| MLP | Yield | 10 year Projected Distribution Growth Rate | Coverage Ratio | EV/EBITDA | 10 year Projected Total Return |

| EROC | 12% | -3.65% | 0.92 | 10.84 | 8.35% |

| IND AVG | 9.65% | 7.79% | 1.01 | 12.17 | 17.44% |

Sources: S&P Capital IQ, Yahoo Finance

Eagle Rock Energy Partners is a hot mess, easily the worst MLP of the group, considering:

- November 2013: 32% distribution cut

- April 2014: suspension of distribution due to FTC slowdown of sale of midstream assets to Regency Energy Partners

- April 30, 2014: first quarter results show distribution coverage ratio of .82 compared to .77 in Q4 2013

- May 12, 2014: CFO abruptly resigns

- May 28, 2014: Eagle Rock announced line of credit has decreased from $380 million to $330 million

Foolish bottom line

In my opinion Eagle Rock Energy Partners is the weakest upstream MLP. Eagle Rock's management has proven itself a poor steward of unit holder wealth and despite its turnaround plans, I fear its poor balance sheet and high cost of capital will make securing (much less growing) the distribution very difficult. EV Energy Partners is in a better position, with solid growth prospects, but the lack of distribution coverage makes the current yield unsustainable. With a yield beneath the industry average I cannot recommend investors own EV Energy Partners, not when so many better upstream MLPs exist -- which will be covered in subsequent articles.