Beaten-down biotechs have an odd way of making heroic comebacks. But to catch lightning in a bottle by bottom feeding in the biotech arena, you need to understand why the company's share price cratered in the first place -- and what needs to unfold for the stock to come roaring back,

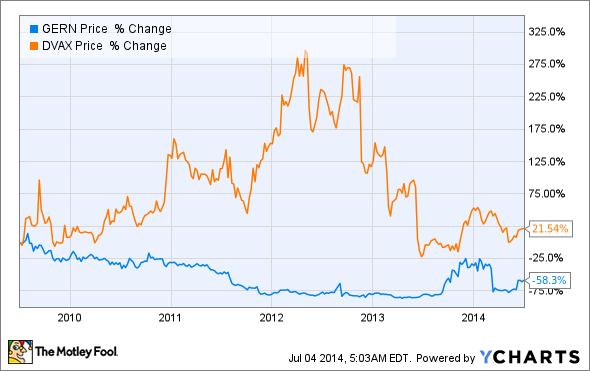

Dynavax Technologies (DVAX +0.06%) and Geron (GERN 0.72%) are two small-cap biotechs that have fallen on hard times due to regulatory issues surrounding their flagship clinical candidates. And although both companies have rebounded since their dramatic declines, they are still trading well below their former highs. With this in mind, let's consider which company has the better chance of regaining its former market share going forward.

Dynavax's hepatitis B vaccine could spark a comeback

Dynavax's share price cratered last year after the Food and Drug Administration requested additional clinical trial data to more thoroughly explore the safety profile of Heplisav, the company's experimental hepatitis B vaccine. Although a late-stage trial showed that the vaccine is more effective in a broader array of patient populations than GlaxoSmithKline's (GSK +2.38%) Engerix-B, the study wasn't sufficiently powered to detect rare but serious side effects.

Dynavax has since initiated a new late-stage trial that will both provide further insight into Heplisav's safety profile and investigate the vaccine's efficacy in type 2 diabetics. This trial is expected to conclude in late 2015 -- putting it on track for new regulatory filings in both the U.S. and EU by early 2016. With a commercial opportunity that is projected to hover around $700 million per year in peak sales, Dynavax looks undervalued at its current market cap of $415 million.

Geron's troubled blood cancer drug might ignite a rally

After a tumultuous history of clinical trials with a handful of potentially revolutionary new medicines, Geron's new management has decided to focus squarely on developing imetelstat as a treatment for a diversity of blood-based cancers. So far, imetelstat has shown impressive efficacy results as a treatment for myelofibrosis, with some patients even going into complete remission.

What's noteworthy about this result is that the only approved drug for myelofibrosis, Incyte's (INCY +0.58%) Jakafi, does not result in disease remission, meaning that imetelstat could be a breakthrough therapy for this difficult to treat disease.

Even so, imetelstat has showed some worrisome signs of increasing the risk of liver toxicity in its ongoing clinical trials -- leading the FDA to place a clinical hold on the drug last March and causing shares to plummet by over 50% in a single day.

Since then, the agency has lifted the partial hold for the myelofibrosis trial, but it remains in place for other indications such as essential thrombocythemia, polycythemia vera, and multiple myeloma. The company also cannot initiate any new clinical trials for the drug until this issue is resolved.

Going forward, Geron is required to perform additional preclinical studies to clarify imetelstat's safety profile before the full hold can be released. While some investors are arguing that the agency will release the hold sooner rather than later, it's important to understand that these new studies won't be completed for at least a few months, if not longer.

Foolish wrap-up

Clinical trials are inherently risks, given that something goes wrong more often than not. So, there is a real chance that neither one of these companies will reach and/or surpass their former glory.

That being said, I am cautiously optimistic that Dynavax will ultimately see Heplisav through to an approval. My belief is based on the fact that no major red flags popped up in the clinical trial data thus far that would suggest it will turn out to be unsafe -- or at least its benefits won't outweigh the risks in certain difficult to treat subpopulations.

By contrast, imetelstat's safety profile has proven to be a real concern, leading to the clinical hold in the first place. Perhaps the ongoing preclinical studies will warrant lifting imetelstat's hold for other indications, but Heplisav looks like the safer bet, in my opinion. And given that the potential upside for each stock looks roughly similar, I think Dynavax is a better speculative buy in this case.