Growing about 26% in the last 12 months, the industrial sector has presented some great investment opportunities and looks to remain a notable area of the market for long-term investors. The machinery companies that provide services to the railroad industry have been helping to drive this sector's growth.

Recent, booming industry demand

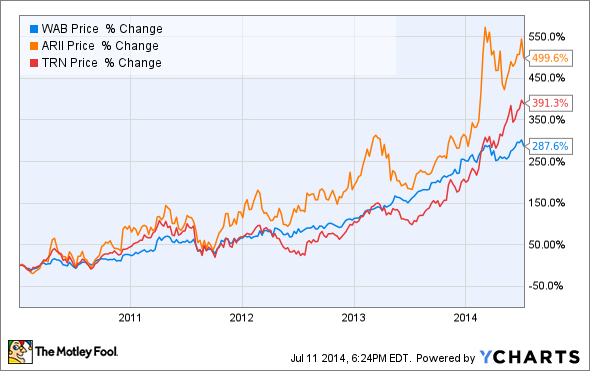

Since the beginning of 2010, railroad servicing companies like Trinity Industries (TRN 1.53%), Westinghouse Air Brake Technologies (NYSE: WAB), and American Railcar Industries (NASDAQ: ARII) have seen their stock prices climb roughly 391%, 288%, and 500%, respectively.

So what has driven this growth? Bloomberg Businessweek reported that between 2010 and 2013 there was a 1,300% increase in demand for rail cars that carry shale oil because parts of the United States and Canada don't have the framework to pipe the oil to refineries, so they must resort to transporting it by rail. This increase in demand has helped spark the recent expansion of this industry which doesn't seem to be slowing down.

Now if you're already considering adding exposure to railroad service companies to your investment portfolio, then I suggest you take a closer look at Greenbrier Companies (GBX 2.09%). The company has grown more than 200% in the last 12 months and is leading the way as one of the fastest developing investments.

The business model of Greenbrier

Greenbrier is a manufacturing and servicing company that tailors its business model to the production and servicing of rail and freight transports. With a $1.8 billion market-cap it's the 11th largest company that services the railroad industry.

It operates in three segments: manufacturing; wheels, repairs, and parts; and leasing and services. The manufacturing segment offers about 20 different types of freight car and vessel options. The wheels, repairs, and parts segment provides reconditioning, finishing, and production of freight car parts. The leasing and services segment offers operating leases and "by-the-mile" leases for about 8,300 railcars, as well as management services for about 235,000 railcars.

Revision in earnings forecast

Greenbrier recently reported its 2014 third quarter filings in which its stock jumped about 12% following the release. Since then the company's current year earnings forecast has been readjusted to expect about a 54% in growth and almost another 20% in growth by the end of the company's next reported year.

A dynamic approach for future expansion

Chairman and CEO William A. Furman sees a strong future for Greenbrier. PR Newswire quoted Furman on the company's business outlook:

We are investing in capital projects with high returns where we will quickly recoup our investment. We are also pursuing growth opportunities in areas core to our business that will diversify our revenue base throughout the cycle. The future looks bright for Greenbrier, and we remain committed to improving operations in each segment and enhancing the long-term trajectory of key metrics, such as gross margins, EBITDA and ROIC.

Furman and Greenbrier have already followed through with engaging these plans by joining Watco Companies to create GBW Railcar Services which will increase the company's share in the progressing tank car repair market. The company also recently received a reward for its leadership in tank car safety in which it will develop 3,500 units for the "Tank Car of the Future" design, which will allow the transportation of hazardous goods at any speed.

It seems that Furman plans to expand the company through a diversification growth strategy that should alleviate some of Greenbrier's risk and help it gain market power through the economies of scope. With the strategy under way, it should facilitate the company's ability to access more of the growing demand that has developed in the market while also allowing it to mitigate some of the industry's cyclical risk by diversifying its production base.

Consider the rewards and risks

Despite the recent success and the future outlook of the company, Greenbrier is still a small-cap growth stock. So consider the fact that along with the potential for astronomical returns still comes a larger than average probability of significant price fluctuations and losses.

Risk and return aside, we can still depict that there is a lot of room for growth. Even more optimistically, there is already plenty of existing competition for Greenbrier to steal; if it continues to grow and achieve the financial goals it has set for itself, it could very well begin to apply substantial pressure to its leading competitors and potentially rise from from its place as the 11th largest railroad service company.

Rail cars are a core piece of what drives the growth of Greenbrier's financial statements. So, as demand grows for transportation goods, so will it for the services of a company like Greenbrier. However, if you're considering about investing, remember it's not just as simple as industry growth equaling company success. You must consider the company's future operating strategy as well as the potential downturns it could experience along the way. Either way, Greenbrier is still worth deliberation.