Photo Source BP media relations.

When you strip away all of the ancillary things about investing, you are left with the basic idea that you want your money to work for you. The most effective way to do that is to identify great companies that produce superior returns, hold on to them, and let the company's earnings power do the heavy lifting. One of the challenges of this type of investing, though, is identifying those top companies.

One method is to look at a single metric: return on equity. It is quite possibly one of the most bare-bones ways to see how much of a return you can expect per dollar invested in the company. Today, two of the world's largest oil companies -- ExxonMobil and Chevron -- will square off to see which would generate better returns for you over the long run.

By the numbers

Return on equity is simply a company's earnings from continuing operations divided by its total shareholder equity. Looking at the returns for these companies over the past five years, ExxonMobil has consistently outperformed Chevron by a few percentage points. Going back further, this remains the case: Over the past 15 years, ExxonMobil has on average maintained a 4% return on equity advantage.

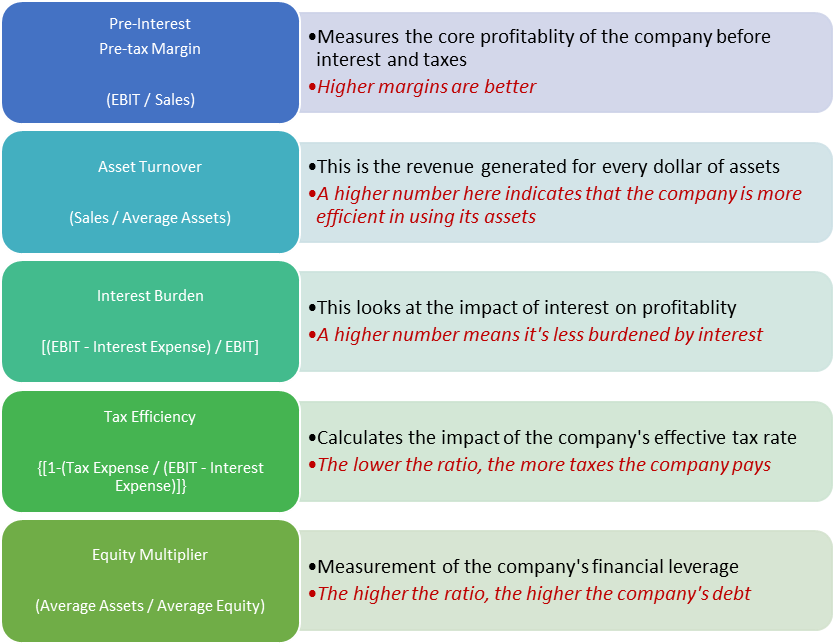

While these historical numbers are helpful, return on equity is a pretty crude way of calculating a return. After all, companies can boost returns on equity by issuing debt, which may not necessarily mean the company is more profitable. For a better estimate of returns, we can break down ROE into its components using a method pioneered by DuPont back in the 1920s.

The DuPont model for return on equity separates the calculation into five different components.

Chart courtesy fellow Fool Matt DiLallo.

Using this model, let's see what makes ExxonMobil that much better at generating returns than Chevron.

Data Source: S&P Capital IQ, author's calculations.

If you look at the breakdown of returns, the differences between interest burden and tax efficiency are negligible. Chevron has a slightly better net income margin, but what puts ExxonMobil ahead is asset turnover and its capital structure -- as denoted by the difference in equity multiplier.

Making sense of the numbers

On the surface, you might think both companies operate in the same way. Both are integrated oil and gas companies with assets that encompass the entire value chain of oil, ranging from the actual production of the fuel (upstream), the transportation network (midstream), and the refining and sales of the finished product (the downstream). However, if you look at both companies' assets, you will notice that ExxonMobil has a much larger percentage of assets in the downstream side of the business. According to both companies' most recent financial statements, Chevron generated 70% of its revenue from refining and chemical operations, while ExxonMobil's downstream segments produced 89% of total revenue. Refining and chemical are a very high-sales, low-margin businesses. Also, assets on this side of the business may require significant capital up front, but the maintenance capital is considerably smaller than for the upstream business, and the value of downstream facilities has been depreciated for many years. Add these things together and a company with more downstream assets will naturally have a higher asset turnover.

There may be a noticeable difference between the two companies' equity multiplier numbers, but if you look at the debt-to-capital figures, ExxonMobil and Chevron respectively come in at 10.37% and 13.21%. Both are very low numbers, and the difference between the two isn't huge. But why the discrepancy? One possible explanation may lie in Chevron's assets. According to Chevron's most recent management presentation, more than 40% of its total working capital is in pre-producing assets. That's a lot of capital not generating a return. Once these assets are up and running, it should lead to a big boost in earnings, and ultimately increase the company's returns.

What a Fool believes

Looking at the numbers, ExxonMobil has an advantage from a return on equity basis, and it likely can thank its downstream assets for that. Going forward, though, there is a real possibility that Chevron could make a run at ExxonMobil in terms of returns if it can bring several of its pre-producing assets online in the next couple years. Ultimately, you will likely come out on top by investing in either these stocks: ExxonMobil generates a better return today, while Chevron looks to have a little more upside in the future. The more important thing to consider when buying shares of either of these companies is to identify a good price for each company's shares and have the patience to wait for that price -- the price you pay will ultimately dictate returns on these companies for years to come.