Rivalry in the aviation industry is not limited to big aircraft manufacturers. Smaller players like Canadian Bombardier (BDRAF +1.62%) and Brazilian Embraer (ERJ +0.55%) are also engaged in a fierce battle to outdo each other in the regional and business jet segments. There's a lot going on with these two companies as both gear up for the launch of their latest commercial jets – Bombardier with the CSeries and Embraer with the E2 E-jets. Amid all the action and updates about new orders and cancellations, what matters to investors is which of these companies would fetch more returns for them. So, let's look at the return on equity (ROE) for the duo and see which fares better.

DuPont Analysis

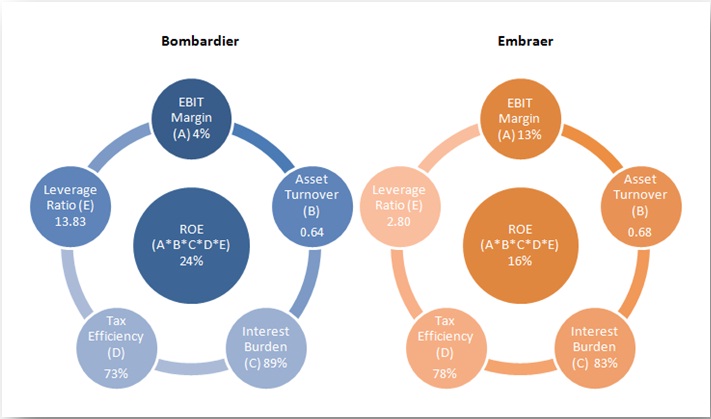

In the last 12 months, Bombardier has generated around 24% ROE while Embraer has generated 16%. At a glance, this suggests that Bombardier is doing a better job at churning out profits from shareholders' funds. But, we'll only be scratching the surface if we evaluate the companies on just the ROE metric; it's equally important to understand the quality of the returns. A century-old way of decomposing the ROE into different constituents is the DuPont analysis. It computes the ROE as a product of five ratios that provide insights about a company's profitability, management efficiency, interest burden, tax efficiency, and financial leverage. So, let's see how Bombardier and Embraer stack up in terms of each of these parameters.

Bombardier versus Embraer

Data source: Morningstar, chart made by author.

As soon as we break out the ROE into different components the situation changes completely. We see that Embraer is far more profitable than Bombardier with a superior EBIT margin. Both companies fare comparably in terms of asset turnover, which shows the amount of sales generated from each dollar worth of assets. Their interest burdens and tax efficiencies are also similar. But, the reason why Bombardier's ROE exceeds Embraer's despite lower profitability is because of the difference in their leverage ratios.

Leverage ratio is computed by dividing average assets by average equity. The Canadian plane maker relies more on borrowed funds for doing business while its Brazilian counterpart has a more balanced capital structure. Stockholders' equity makes up only 13.87% of Bombardier's total liabilities and equity, whereas it makes up 27.89% of Embraer's. So, Bombardier's higher ROE is not due to its higher profitability, instead it's on account of its capital structure. In contrast, Embraer has a lower ROE, but the same is supported by its core profit generating capability.

Different business models

The difference in profitability is mostly on account of the different routes that the two have taken for the development of their latest planes. In 2008, Bombardier announced its CSeries program to build a single-aisle plane from scratch, something that had not been done in decades. The company budgeted $3.5 billion for the development program and envisaged this as a game changer. The CSeries planes would not only burn 20% less fuel, and reduce CO2 emissions and noise, it's seating would range from 108 to 160. This would enable it to take share from the smaller planes manufactured by giants like Boeing and Airbus. The planes were slated to enter service in 2013 and expected to generate annual revenue in the range of $5 billion to $8 billion.

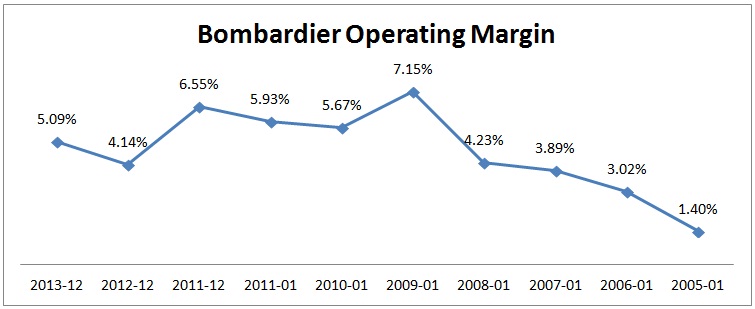

But, things turned out differently. Technical snags and engine issues kept delaying the service entry, and the CSeries planes are still waiting to take to the sky. The latest update is that the Swedish carrier that was going to be the launch customer has cancelled its order following engine troubles in April. This could mean that the plane would now enter service as late as 2016. And the development cost has already exceeded $4.4 billion, suppressing profitability for the past few years. In the recent second quarter, Bombardier's EBIT margin was 5.6%, and the company expects this to remain in near 5% throughout 2014. The company is aggressively cutting costs to counter the cash drain by the CSeries program.

Data source: Morningstar, chart made by author.

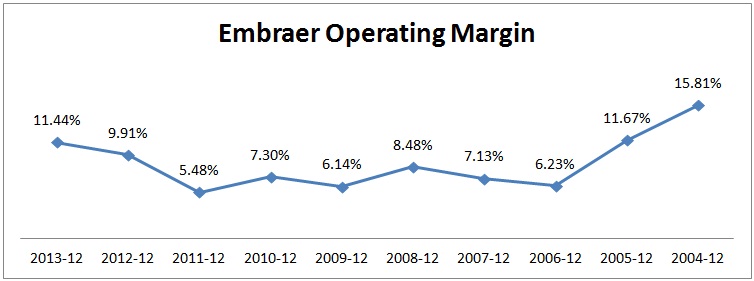

As Bombardier struggled with its development program, Embraer decided to reengineer its E-Jets rather than build a whole new aircraft. It announced its E2 E-Jets program in 2011 that earmarked a modest investment of $1.7 billion. The E2 E-Jets claim double-digit cutback in fuel, noise, emissions and maintenance costs. Embraer launched the E2 E-Jets at the Paris Air Show last year. With the conclusion of the development program, the company's research expenses have dropped sharply, boosting operating profits to $186.8 million in the recently concluded second quarter from $135.3 million in the same period last year.

Data source: Morningstar, chart made by author.

Net-net

Bombardier may be having a higher ROE than Embraer, but the metric is inflated by its higher leverage ratio. In contrast, Embraer's ROE is a more accurate reflection of the profits that it can earn with shareholder's money. While it's true that Bombardier is planning to save $100 million annually from its restructuring program, its profitability is unlikely to improve materially until it resolves issues arising from the CSeries program. Embraer is looking at better days ahead with delivery of the first E2 E-Jets beginning in 2018.