In the maze of information at investors' disposal, there's one ratio that makes life simpler: return on equity, or ROE. It helps to quickly spot which company is reliably churning profits out of shareholders' money. A higher number indicates that a company is generating more returns, and vice-versa. An ROE measure becomes more effective when broken down into finer parts, however. Nearly a century back, in the 1920s, E.I. du Pont Nemours and Company devised a model to deconstruct ROE, which has been refined over the years to build an extremely handy investor tool.

Putting the extended DuPont model in to play, let's compare the two stalwarts in aviation, Boeing (BA 0.02%) and Airbus (EADSY +1.74%). The ongoing recovery in the commercial segment has pushed order backlogs to record high levels, and it would be interesting to see how the duo stacks up against each other.

At first glance

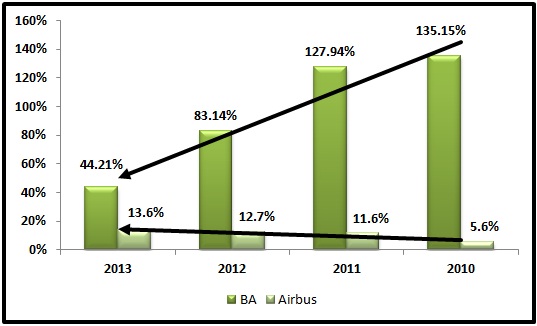

When we look at the ROEs of the two companies, the first thing that stands out is that Boeing earns a much higher returns on shareholders' equity. In the last four years, however, the gap with Airbus has reduced considerably. Some apparent questions come to mind. First, in the commercial aviation duopoly, why is there such a marked difference in the returns generated by the two companies? Next, why have the trend lines for the two companies moved in opposite directions in the past four years? To get to the answer we would need to deconstruct the ROE.

Chart prepared by author, Data source: Morningstar

Behind the scene

According to the extended DuPont model, ROE is a product of five factors:

Chart prepared by author

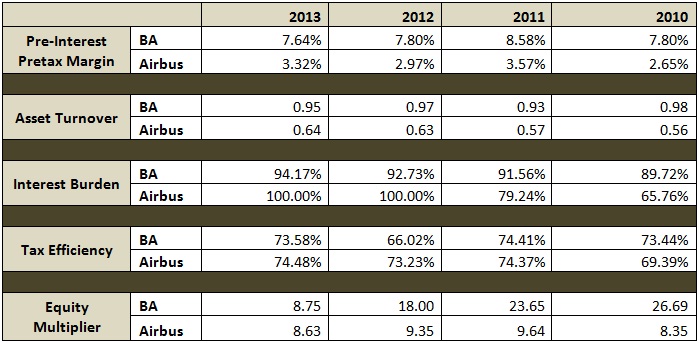

It's important to segregate these components in order to define the quality of return that a company is generating. A company could get a tax break in a particular year or raise debt, which would increase overall ROE although there would be no change in its ability to generate higher returns. In such situations, looking at the ROE alone could be skewed. Let's see how Boeing and Airbus compare on the above five parameters.

Raw data from Morningstar, ratios computed by author

Fundamentally different

It's clear that though the commercial aviation market is a two-horse race, there's a marked difference between the profitability of the two companies. Boeing generates higher profits; the trend line is tilted because the company has lowered debt, which has lowered its equity multiplier. There's been no significant change in the company's core pre-tax pre-interest margin.

In contrast, the low ROE for Airbus comes from its lower pre-tax pre-interest margin as well as lower asset turnover ratio. The reason for this can be found in the history and past strategies of the company. Airbus was formed out of the national aviation companies of France, Germany, Britain, and Spain and went public in 2000. Over the past 13 years, the company more than doubled its sales, but profits stagnated. Airbus' profitability remained constrained by its overbearing work culture and its policy of undercutting prices to drive volumes, something that the company is trying hard to overcome.

In a 2013 interview, Airbus CEO Fabrice Brégier told Wall Street Journal that Airbus is chasing a target of doubling its profit margin by 2015 "through greater efficiency and revamped management." With over 150,000 employees and subcontractors, "it's a big block, and a difficult block to move." On the contrary, Boeing has been more profit oriented. Its reflection is also found in the way that both companies have managed their assets. Boeing has extracted more out of its assets than Airbus.

Future outlook

Boeing and Airbus are working hard on their profitability, particularly in the commercial segment, which is witnessing a recovery. The central theme for both is the same: execute the backlog, increase production rate, avoid delays and cost overruns with big programs like 787 and A350, and cut costs.

Bloomberg data shows that Boeing has a narrow-body backlog of more than seven years of production for 737, while Airbus' is for more than eight years for its A320s. For wide-bodies, 787s have a backlog of nearly four years of production, while the A350s' is 5.6 years of production.

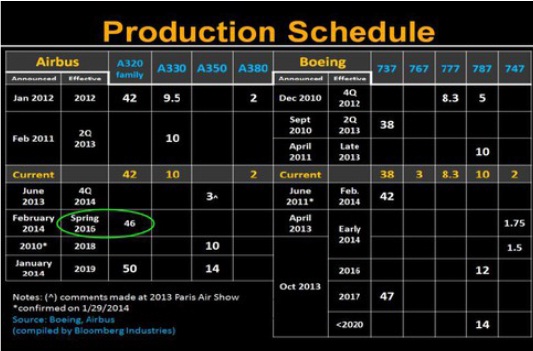

They are trying to make more planes in lesser time, with major thrust on narrow-body planes that carry higher margins. Boeing has increased the number of 737s produced per month to 42 from 38, and according to a Bloomberg report, this could rise to 46 in 2016 and finally max out at 47 later in the decade. Airbus produces 42 A320s a month at present, and plans to raise this to 46 in 2016 and go up to 50 over the next five years.

Source: Bloomberg

Boeing's commercial aircraft margins (excluding development and R&D costs) were at 19.5% in the first quarter, while Airbus' stood at 5.9% before one-offs. Even if Boeing's margin remains at the current level and Airbus attains the "moderate growth" that management has forecast, the gap between Airbus' profitability and ROE won't narrow in the coming period.

Final take

Boeing and Airbus are solid companies and stand to gain from the uptick in commercial aviation. Both are trying to maximize profitability, which offers future upsides to investors. However, Boeing is ahead of Airbus in terms of profitability, enabling it to generate more returns for shareholders.