Are you a Call of Duty fan, or more of a Battlefield gamer? Prefer The Sims or Skylanders? What would be your choice between Diablo or Dragon Age as the better role-playing video game?

Electronic Arts (EA 0.04%) and Activision Blizzard (ATVI +0.00%) control all of these blockbuster franchises -- and many more. In fact, between them, the two publishers account for most of the video game industry's biggest titles each and every year.

And while they do compete in some of the same genres, EA and Activision oversee vastly different brand portfolios. For example, EA has a huge presence in sports games, including Madden NFL and FIFA, while Activision gets a significant slice of its revenue from retail toy sales attached to its Skylanders franchise.

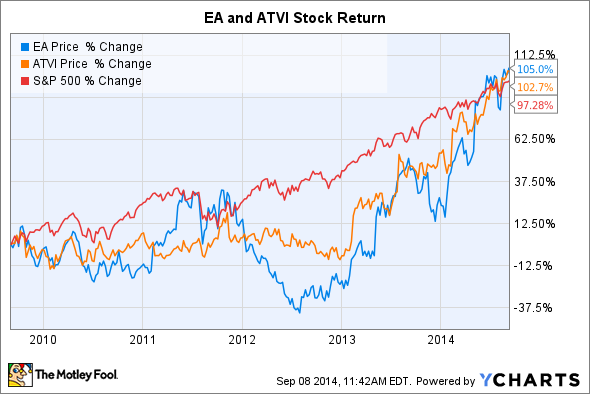

Synched-up returns

Despite these divergent business profiles, the two companies shares have performed almost exactly the same over the past five years: Each one has doubled investors' money since 2009, in line with the broader market's return.

But that correlation is no reason to treat EA and Activision as interchangeable investments. For two key reasons, Activision Blizzard stands out as the stock that's more likely to deliver better returns to shareholders over the next five years.

A more profitable past

Let's start with the two publishers' recent past. Activision and EA turned in similar sales growth performances in 2013, with each company posting a drop in revenue from the prior year. That slip was expected in both cases, thanks to a bumpy switchover from one generation of gaming consoles to the next.

From a profit standpoint, though, EA and Activision look like they have been operating in different businesses.

Source: EA and Activision's 10-K financial filings.

Last year, Activision collected $1 billion in net income, for a 22% profit margin on its nearly $5 billion in sales. EA, meanwhile, only cleared $8 million in profit off of $3.6 billion in sales for its last full year. EA has actually lost money by that standard over the past four years combined, while Activision's profit growth has been much steadier.

That earnings power gives Activision more than just bragging rights over its rival. The cash has allowed it to fund shareholder-friendly moves over the past few years, including paying a hefty dividend and buying out Vivendi, which used to be its controlling shareholder. Strong profit generation also helped the company raise the bar on its flagship products, for example by bringing in a third studio for its Call of Duty franchise and by investing heavily in the new Destiny brand.

A very promising holiday season

Those two titles, Call of Duty: Advanced Warfare and Destiny, look set to keep Activision on top of the industry again this holiday season. Sure, EA's delay of Battlefield: Hardline won't significantly hurt its business since it will mainly shift revenue into next year. But it does mean Advanced Warfare has a clear path to dominating the first-person shooter category this year.

Source: Activision Blizzard.

Meanwhile, Activision's new Skylanders game faces stepped-up competition from Disney's Infinity, but it should still generate healthy cash flow thanks to all of those profitable toy sales. Finally, the publisher's World of Warcraft franchise is on track for solid growth spurred by its first expansion pack in two years. The promising outlook for these games was one reason Activision's management team boosted its full-year forecast for sales and profits last month.

Foolish bottom line

Put all of that together, and Activision is expected to earn nearly $1.50 per share next year, according to consensus estimates. That corresponds to a forward price/earnings ratio of roughly 16, which is about the same as EA's 16.5 valuation. What investors seem to be missing at the moment, though, is that Activision isn't a carbon copy of EA, but deserves a premium valuation thanks to its steadier fiscal performance and stronger product pipeline.