Every company has one number that defines its success more than any other. For investors in Transocean (RIG +1.28%), which owns the world's largest offshore drilling fleet, that number is...

17.9 years

This is the average age of every offshore rig in Transocean's fleet, including rigs under construction, and it's one of the oldest in the industry. Only two fleets -- Ensco's (ESV +0.00%) and Diamond Offshore's (DO +0.00%) -- are older than Transocean's, but Transocean also happens to have the largest deepwater fleet in the industry, and rig age has become particularly important for deepwater exploration in the aftermath of the catastrophic Deepwater Horizon disaster in 2010. That disaster hit Transocean hard, as it owned Deepwater Horizon and later agreed to pay a $1.4 billion fine for the part it played in the deadly incident; since that time, a number of industry peers have focused attention on the comparative youth of their rigs, which tends to imply greater safety and reliability.

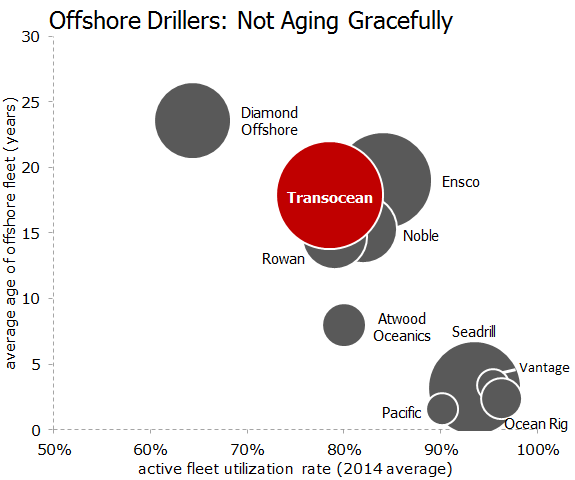

The link between rig age and reliability is easily seen in the following graph, which plots every major deepwater rig operator's average age against its overall fleet utilization rate (a measure of how much use rig fleets actually see against how much they could be utilized):

Sources: Company fleet status reports and Rigzone data. Note: Includes rigs under construction. Size of bubbles corresponds to total fleet size.

As you can see, there's a clear link between average fleet age and total fleet utilization -- Diamond Offshore, with the oldest fleet in the industry, suffers the lowest utilization rates, with Transocean and other similarly aged fleets all operating at roughly 80% of their potential capacity. Young fleets, most of which are focused on ultra-deepwater (UDW) exploration, are all operating at close to full capacity.

There are a few caveats to this list, of course. Transocean has 12 rigs under construction, more than any other deepwater operator save for Seadrill (SDRL +0.00%), and more than half of these are UDW rigs. These rigs help push Transocean's UDW fleet age down to 7.9 years, which isn't exactly in spring-chicken territory compared to its peers, but it's still much more modern than its overall fleet. On the other hand, Transocean's deepwater fleet (those rigs that operate at depths of 4,000 to 7,000 feet) is not only the largest in the industry, it's also the oldest by a wide margin:

|

Operator |

Deepwater Fleet ... Fleet Age |

Ultra-Deepwater Fleet ... Fleet Age |

Deepwater and UDW Rigs as % of Total Fleet |

|---|---|---|---|

|

Transocean |

12 ... 34.3 years |

36 ... 7.9 years |

52.8% |

|

Ensco |

5 ... 17.4 years |

19 ... 5.3 years |

32% |

|

Seadrill |

3 ... 2 years |

32 ... 2.6 years |

50.7% |

|

Diamond Offshore |

7 ... 15.8 years |

12 ... 6.3 years |

43.2% |

|

Noble Drilling |

2 ... 31.5 years |

16 ... 14.1 years |

50% |

|

Rowan |

None |

4 ... (0.5) years* |

12.1% |

|

Atwood Oceanics |

3 ... 32 years |

6 ... 0.7 years |

64.3% |

|

Ocean Rig |

None |

13 ... 2.4 years |

100% |

|

Vantage Drilling |

None |

4 ... 1.5 years |

50% |

|

Pacific Drilling |

None |

8 ... 1.6 years |

100% |

Sources: Company fleet status reports and Rigzone data. Note: Includes rigs under construction. Deepwater = 4,000 to 7,000 feet, UDW = more than 7,000 feet.

*Two Rowan UDW rigs are still under construction, and two were built in 2014.

A creaky deepwater fleet is a problem for Transocean, since we've already established the link between age and utilization rates. Few competitors break out utilization rates just for deepwater rigs, but Transocean does, and the numbers aren't pretty -- its 34-year-old deepwater fleet has a utilization rate of just 66.4%, compared to a 90.2% utilization rate for active UDW rigs. Transocean commands hefty day rates for its deepwater fleet, which generate $382,000 on an average day in operation, so this low utilization rate seriously hurts the company's earnings potential.

Transocean's weak deepwater utilization isn't likely to improve anytime soon, as there is an industrywide oversupply of deepwater and UDW rigs that's bound to worsen when more than five dozen new rigs come online next year. Only 35% of Transocean's fleet is under 10 years old, which puts many of its rigs at risk of being pushed out of service by the coming glut of new and modern rigs coming online over the next few years. Almost all of Transocean's rigs are going off-contract by the end of 2016, and the creakiness of many of these rigs relative to those in other offshore fleets makes it unlikely Transocean's utilization rates will improve significantly over the next two years.

As the world's largest offshore operator, Transocean has the resources to reinvigorate its fleet, but it won't be a cheap or a rapid process, and Transocean is hardly the only operator making a real effort to build out newer rigs. Investors should tread cautiously around the entire sector during this period of oil weakness, but especially so when it comes to older fleets like Transocean's.