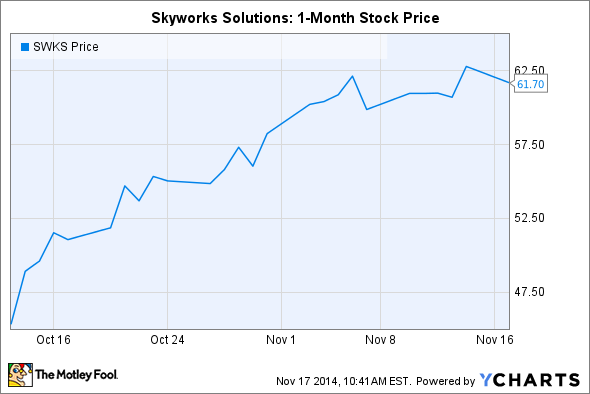

One of the constant challenges that investors in Skyworks Solutions (SWKS +1.99%) face is figuring out how much of the company's success comes from its close supply relationship with Apple (AAPL +0.43%). Clearly, having its semiconductor components included in several of the most popular Apple devices available plays a major role in how well Skyworks does. Yet Skyworks also has plenty of exposure to manufacturers other than Apple, and so to some extent, Skyworks' impressive gain of nearly 40% in a single month shows not only the favorable prospects for Apple's iPhone 6, but also a better outlook for the broader global mobile-device industry. Let's take a closer look at Skyworks Solutions to parse out the contributing factors that have helped drive the stock up to new all-time record highs once again.

What sent Skyworks soaring

The good news from Skyworks came in two separate pieces. In mid-October, the company boosted its revenue and earnings guidance for its fiscal fourth quarter, calling for a $38 million higher sales figure to $718 million and adjusted earnings per share of $1.08, up from its original guidance for $1 per share. CEO David Aldrich attributed the better than expected guidance on "the broad-based strength of our business and our ability to capitalize on positive underlying market trends to connect everyone and everything."

Source: Skyworks.

Then, earlier this month, Skyworks confirmed its strong results, reporting revenue in line with its updated guidance and 51% higher from year-ago levels. Earnings came in even better than Skyworks had expected, and Aldrich highlighted the company's role in advancing mobile connectivity, the Internet of Things, mobile payments, and on-demand music and video media services as some of the drivers of its record results. Skyworks raised its dividend, and it also projected better than 50% revenue growth in the first quarter of fiscal year 2015 as margins continue to improve. An announced $300 million stock buyback program only added icing to the cake for Skyworks investors.

The long climb for Skyworks Solutions

Of course, as impressive as a 40% rise is, it's only the latest in a long trend of soaring stock prices for Skyworks Solutions. Over the past year, the company has seen its shares more than double in value as investors have grown more optimistic about Apple's long-term prospects and its implications for the broader mobile-device market.

More importantly, Skyworks has its sights set on more than just being an Apple supplier. Around the world, customers are looking for ways to improve the quality of the wireless signals they receive in order to improve quality and speed in their products. Especially in light of the rise in demand for high-bandwidth applications like streaming video and music, Skyworks' ability to deliver customized solutions that can take advantage of technological improvements in antenna and high-precision signal filters and tuning makes it an attractive choice for original equipment manufacturers seeking smart solutions. In addition, Skyworks is going beyond its core focus to take on different types of analog products to offer advances in navigation and power-management operations.

What's next for Skyworks Solutions?

Skyworks remains confident that its overall growth will continue. "These multi-year technology trends are setting the stage for us to outperform the broader semiconductor industry in the December quarter and for the foreseeable future," said Aldrich, and given how closely tied Skyworks is to the health of the mobile arena, the company has the ability to keep growing as long as customers still want to buy end products with its chips. Investors should keep their eyes open to make sure Skyworks doesn't become too dependent on Apple, but as long as the relationship is mutually beneficial, Skyworks shareholders have a lot to gain from working together to meet strong consumer demand.