This week's surge pushed my Netflix (NFLX 0.99%) stock investment over an awesome milestone: the return passed 1,100%.

Or, to put it in Foolish lingo, "After Thursday's spiffy-pop, Netflix is a 12-bagger for me."

Sure, it's only a paper gain since I haven't sold any shares. And it could drop right back down in a few trading days. Still, the jump got me thinking about what went into this super return. So here are five things I learned through investing in this stock.

1. Think really long term

By the IRS' definition, long-term investing requires holding a stock "more than a year before you dispose of it." In my case it has been nearly seven years (and counting) with Netflix, and no disposing whatsoever.

The stock was trading at $31.93 per share when I made my first purchase on May 2, 2008. At that time revenue came exclusively from Netflix's 8 million DVD-by-mail subscribers. The company had also made its first step into Internet video by striking a deal with Microsoft to embed a limited streaming service into the Xbox 360 console.

I wish I could say I knew then Netflix would balloon into a $30 billion streaming juggernaut. But I didn't have a clue. As I remember it, I bought shares for two reasons: It was a Stock Advisor recommendation and I was a happy DVD subscriber myself.

2. Get to know the company

Over the next few years I listened to every quarterly conference call I could and I studied Netflix's business. I found it more interesting than the dozen or so other companies in my portfolio, which focused my attention.

Source: Netflix.

That knowledge turned out to be valuable as the stock rose to double, triple, and quadruple my buy-in price. Yes, I was tempted to sell at those price points and "lock in" some gains. But I was more interested in seeing how the DVD and streaming video strategies would play out. I developed trust in CEO Reed Hastings and his team. Instead of selling I bought the stock three more times at higher prices ($43.06, $52.15, and $159.81 per share).

3. Do nothing almost all of the time

I've owned Netflix stock for roughly 2,000 trading days. Over that time I tinkered with my investment on exactly four occasions. In other words, I was active for 0.2% of the time and passive for 99.98% of the time.

Warren Buffett has said the cornerstone of his investment style is "lethargy bordering on sloth." The idea is that if you did your homework when you bought the investment, then the rest just requires patience. With price quotes, Wall Street will make continuous offers to buy your stock, but the answer is almost always, "No thanks."

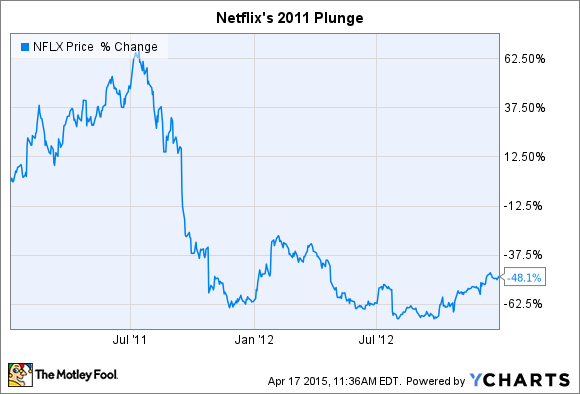

4. Hold through the pain

Netflix shares plunged by 50% or more on a couple occasions during my holding period. In fact, it cratered by over 80% at one point.

Looking back, I think it's the fact that I didn't sell at these times that earned me the crazy returns that followed. Fellow Fool Morgan Housel put it like this: "Most of what matters as a long-term investor is how you behave during the 1% of the time everyone else is losing their cool."

To get this extraordinary return I had to hold Netflix for an unusually long time while enduring some painfully high volatility. That brings to mind this great quote from Charlie Munger: "The surest way to get what you want is to deserve what you want."

5. The math is on your side

When my Netflix investment hit a 100% gain, I can remember friends and family giving me the same prudent-sounding advice: "Sell half."

The impulse makes sense. You've doubled your investment, so why not cash out that gain and let the rest, the "house money," ride. Looking at it this way builds in a math-based tendency to sell that grows as a stock price increases.

Here's some math that points to the opposite conclusion. For every doubling of a stock price, the next double gets easier:

| After 100% | After 200% | After 300% | After 400% | After 500% | After 1000% | |

| Percent gain needed for next doubling | 50% | 33% | 25% | 20% | 17% | 10% |

At current prices, it would take a rise of just 8% to make Netflix a 13-bagger in my portfolio. That's useful to keep in mind when I'm tempted to sell the stock just because the price has gone up.