Assessing the greatest business contribution Jack Welch has made to General Electric Company (GE +0.82%) is a worthy endeavor from an academic perspective, but what does it mean for contemporary investors? In reality, the company is vastly different from the one that Welch left in 2001, but there are still many conclusions from Welch's time that are relevant to the company today. Let's take a look at Welch's tenure and what it means to current investors in the stock.

What Jack Welch did

It's not an exact exercise, but there are three (interrelated and overlapping) ways to look at a CEO's contribution to a company:

- Strategic -- the decisions made to position the company in certain end markets

- Operational -- how a company competes within its chosen end markets

- Administrative -- how a company is run internally

Welch's legacy is probably best seen in the operational and administrative aspects of how GE is run. Upon becoming CEO in 1981, he embarked on making an aggressive change in management philosophy. Throughout his time at the helm, the company made more than 1,000 acquisitions as Welch set to out to grow the company into a multifaceted conglomerate. Operationally speaking, he was determined that the company would maintain a leadership position in every industry entered -- an emphasis that would lead to the company becoming a rather disparate collection of businesses by the time Immelt took over.

From an administrative perspective, integrity, productivity, a hatred of bureaucracy, and a love of what Welch called "speed" were integral. Welch realized that speed of thought, in decision-making, action, and communication, was critical in running a company of General Electric's size and complexity. Along the way, Welch acquired the moniker "Neutron Jack" due to his propensity to fire underperforming or unproductive employees.

It worked. In fact, it worked so well that the management principles that Welch embodied have become the blueprint for some of the most successful industrial companies in the U.S. Roper Industries and Danaher are two examples of highly acquisitive and diversified industrial companies that focus on lean operational and administrative practices in the manner that Welch ran General Electric.

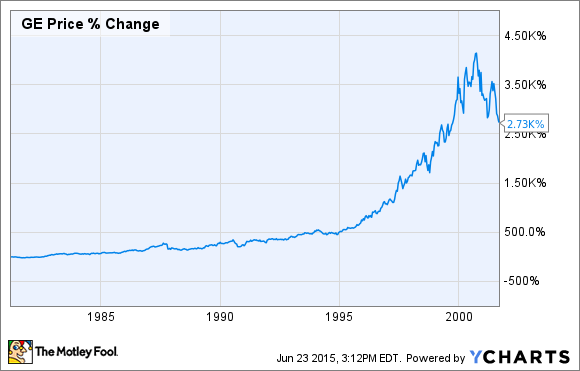

Welch's management philosophy changed the way American manufacturing companies worked, and the following chart demonstrates the returns he generated for General Electric investors in the process.

What about strategy?

The strategic aspect is arguably the most contentious consideration of Welch's reign. He was undoubtedly an operational and administrative genius, but those aspects might have led him to structure the company in a way that shareholders would come to regret after he left.

You can't just look at the company when he was in charge, because the strategic decisions he made had their repercussions well into the Immelt years. Indeed, as I outlined in a previous article on the subject, Welch left the company with a heavy exposure to the power industry, an ill-fitting broadcasting company (NBC), and a minimal (positive) exposure to commodities.

Source: General Electric Company presentations.

The rest is history. Almost as soon as Immelt took over, the 9/11 terrorist attacks hit the commercial aerospace industry, while power was beset with half a decade of sluggish spending.

Moreover, rising oil prices left the company's plastics operations (representing nearly 80% of materials segment operating income in 2001) under pressure at a time when the company had hardly any oil-and-gas solutions. Moreover, Immelt is often criticized for allowing the company's financial arm to grow too large in the 2001-2008 period, but GE Capital Services was already the largest profit contributor in 2001.

What it means for General Electric Company

Looking ahead, General Electric plans to generate at least 90% of its profits from its industrial businesses by 2018, and is shifting toward a strategic focus on its core strengths. As you can see in the following chart, the oil-and-gas and healthcare businesses are far larger contributors now.

Source: General Electric Company presentations.

All told, the company is likely to become more strategically balanced in future years. In a sense, the days of acquiring a relatively disparate collection of businesses and turning them into best-in-class companies is over for GE.

Indeed, Immelt has repeatedly outlined his intent to retain, acquire, and invest in the businesses and technologies where General Electric has leading market positions -- just as Jack Welch did. However, it will be carried out in the company's core industrial businesses in future. The days of the sprawling conglomerate are over for the company, but Welch's legacy lives on in the administrative and operational spheres.