Comparing the tenures of Jack Welch and Jeff Immelt as CEO of General Electric (GE +1.67%) is almost a pointless endeavor from an investor's perspective. In the end, the primary focus of General Electric investors is shareholder return, and in the 13 years of Immelt's leadership, the stock's return (adjusted for dividends and stock splits) is just 9.4% compared to Welch's 5,400% during his 20-year stint as CEO, from 1981 to 2001. The difference is stark. However, Immelt is a much better leader than those numbers might suggest; here's why I think he's taking the company in the right direction.

Size and market conditions matter

First, Welch inherited a smaller and nimbler company (revenue of $26.8 billion) than the one ($130 billion) he would hand over to Immelt. At a certain point in a company's growth, it becomes harder to continually generate increasing profit growth, and/or increase return on capital employed, or ROCE.

ROCE is simply earnings before interest and taxes, or EBIT, divided by capital employed (total assets minus current liabilities) -- a great way to see how well a company is working its assets. The chart below shows how ROCE declined with revenue growth. Readers should note that the decline in ROCE (blue line) began before Immelt took over in September 2001.

GE Return on Capital Employed (Annual) data by YCharts.

Second, Welch's relentless takeover activity resulted in increasing the company's debt-to-equity ratio. In fact, Welch made nearly 1,000 acquisitions during his tenure. An acquisition-led strategy is easier to execute when the economy keeps growing, because future economic growth makes it easier for the acquired companies to generate the cash flows required to pay off the increased debt.

Third, Welch's timing was good. Although he started during a difficult recession in the early 1980s, the economy only suffered one (mild) recession in 1991 before Immelt took over in 2001. In contrast, Immelt took over a few days before 9/11, an event that contributed to the economy slowing even more. A U.S. recession began in November 2002, and a few years later the economy entered another in 2008-2009.

General Electric's positioning

Fourth, back in 2001, the company wasn't structured to deal with rising oil prices. In 2003 (the year the economy started to grow meaningfully again) just 1.5% of segmental operating income came from the company's oil and gas segment. Meanwhile, two segments that could be expected to suffer with high oil prices -- energy (largely industrial gas turbines) and aviation -- contributed 22.6% and 10.5%, respectively.

Oil prices seemed to rise from the day Immelt took over:

WTI Crude Oil Spot Price data by YCharts.

Rising energy prices helped to hold back investment by U.S. utilities, while the global airline industry (also reeling from 9/11) was only profitable for two years during 2001-2009.

Source: IATA, U.S Energy Information Administration.

It's easy to blame Immelt, but recall that he took over the company that Welch left -- a company forged in an era of low oil prices.

Housing and credit boom

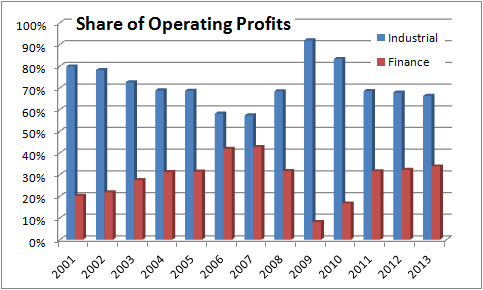

Fifth, while some of General Electric's segments suffered in the early 2000s, its finance arms flourished in the era of the housing and credit boom. The following chart demonstrates how Immelt allowed the company's finance arm to grow.

Source: General Electric Company presentations.

The resulting financial crisis left the company horribly exposed, but Immelt wasn't alone in failing to foresee the great financial crisis.

Where Immelt is taking the company

In a sense, Immelt seems to be restructuring the company in order to deal with previous risks.

-

Significant investment in expanding its oil and gas solutions. Oil and gas contributed 10.5% of total segmental profit in the first nine months of 2014.

-

Renewed focus on aviation, which should ensure the company benefits from the upturn in commercial aviation.

-

Commitment to reducing the size of GE Capital and returning cash to shareholders.

-

Sale of non-core businesses such as the home appliance business to Electrolux.

-

Planned acquisition of Alstom's power business, which is intended to refocus the company on its core strengths in power.

Where next for General Electric?

From this analysis, it's clear that market conditions were favorable for Jack Welch, and his leadership genius resulted in sensational returns for investors. On the other hand, Immelt has been dogged by unfavorable market conditions, while also making decisions that, only with the benefit of hindsight, proved to be mistakes.

However, in reducing the company's exposure to rising oil prices and the credit markets, Immelt seems to be addressing those issues. Moreover, he has focused the company on areas where it has leadership, such as aviation, and power and energy. In short, I think Immelt has put the company in better shape to deal with a range of market conditions, and investors might start to see the benefits of this work in coming years.