Hawaiian Holdings (HA +0.00%), the parent company of Hawaiian Airlines, is my top long-term pick in the airline sector because of its unique combination of growth and value. Hawaiian Airlines' strategy is oriented toward bringing tourists to Hawaii for vacation. To that end, the company is rapidly expanding into high-value markets in Asia and Oceania. As a result, Hawaiian posted 19% revenue growth last year, and the company is expected to grow by 15% and 11% in the next two years, respectively.

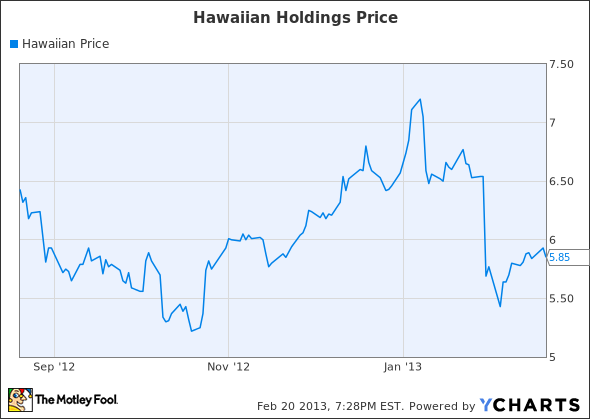

In spite of these solid growth characteristics, Hawaiian trades for less than six times trailing earnings. While Hawaiian's stock rallied in late 2012, a prominent analyst downgrade and weak Q4 earnings have driven shares down by nearly 20% since early January.

Hawaiian Holdings Six-Month Price Chart, data by YCharts

This has created an attractive entry point for long-term investors. As I will discuss later, earnings volatility is a natural consequence of Hawaiian's rapid growth, but the company's long-term earnings prospects are very good.

Recent performance

In 2012, Hawaiian performed very well in the first half of the year, posting EPS of $0.21 after losing money in the first half of 2011. However, the company began to hit turbulence in Q3, before suffering a disappointing Q4 loss. Hawaiian cut its Q3 unit revenue guidance in the middle of that quarter, and then had to do the same thing in Q4. Moreover, last month the company projected a high-single-digit decline in unit revenue for the current quarter.

With this recent string of revenue disappointments, it would be natural for investors to wonder whether there is a flaw in the Hawaiian Airlines business model. However, there are two key factors to keep in mind. First, Hawaiian's recent expansion has focused overwhelmingly on long distance international routes. These long distance routes generate significantly lower unit revenues compared to Hawaiian's corporate average, but they also have lower unit costs. Thus, excluding fuel and special items, Hawaiian Airlines achieved a 6% reduction in unit costs last year. Lower unit costs should fully offset lower unit revenue from these routes over time.

Second, Hawaiian faced overcapacity on a number of its routes last year, which drove down fares. These capacity increases were driven primarily by Alaska Airlines' (ALK +1.10%) rapid expansion in the West Coast-Hawaii market and Hawaiian's own growth, and to a lesser extent by Allegiant Travel's (ALGT +1.64%) entry into that market. However, all three carriers have realized that they expanded West Coast-Hawaii capacity too quickly and have pared back their growth plans for 2013. Beginning this spring, a more rational level of industry capacity should improve pricing power for Hawaiian and its competitors on West Coast-Hawaii routes.

Asia/Oceania: the real growth story

Hawaiian's travails on the West Coast have certainly hurt performance in the past year. (For that matter, overcapacity on routes within Hawaii also dragged down profitability in 2012.) However, the key to Hawaiian's future lies in the company's rapid growth in international markets. In the airline industry, there is almost always a trade-off between growth and short-term profitability. That said, Hawaiian's current growth will position it well for higher profit in the years ahead, as its newer markets mature.

Airline executives and analysts generally agree that it takes at least two years for new routes to "mature" and reach peak profitability. During that time, the airline needs to engage customers so that they become aware of the new service. Hawaiian Airlines faces an especially difficult task, because it has begun operations in a variety of new countries, with different customs and -- in some cases -- different languages. It may thus take a little longer than average for Hawaiian to build brand awareness in its new markets.

This is critical for understanding the company's future earnings trajectory. Since November 2010, Hawaiian has begun service to six new international destinations: Tokyo, Seoul, Osaka, Fukuoka, Sapporo, and Brisbane, along with a new domestic route to New York. Hawaiian plans to add another three international destinations in the next few months: Auckland, Sendai, and Taipei. The Tokyo and Osaka markets have already (more or less) matured, but demand is still ramping up in the others. With much of its capacity deployed in new markets, Hawaiian's margins have been artificially depressed for the past two years.

Long term earnings power

If we look back to 2009 and 2010 (i.e. before Hawaiian embarked on its strategy of rapid international growth) the company delivered pre-tax margins of 8.2% and 6.3%, respectively. This compares to a pre-tax margin of just 4.4% last year. Based on the current growth trajectory, revenue will approach $3 billion by 2016, while growth will have slowed to a moderate pace. With slower growth, Hawaiian's pre-tax margin is likely to return to the 6%-8% range. This implies EPS of approximately $2-$3, up from non-GAAP EPS of $1.06 last year.

With strong long-term earnings growth likely at Hawaiian, the stock looks like a bargain at less than $6. Based on my expectation for 2016 EPS of at least $2, I believe the stock has upside to $20 over the next three years.