So, you've been saving and investing money in an IRA to prepare for retirement, but when do you actually get to use the money?

When you have an individual retirement account, or IRA, the questions around taxes, penalties, limits, and requirements can become complex. In this article, we'll discuss the rules, penalties, and more about IRA withdrawals, so you'll know exactly what you can and can't do.

Rules for IRA withdrawals

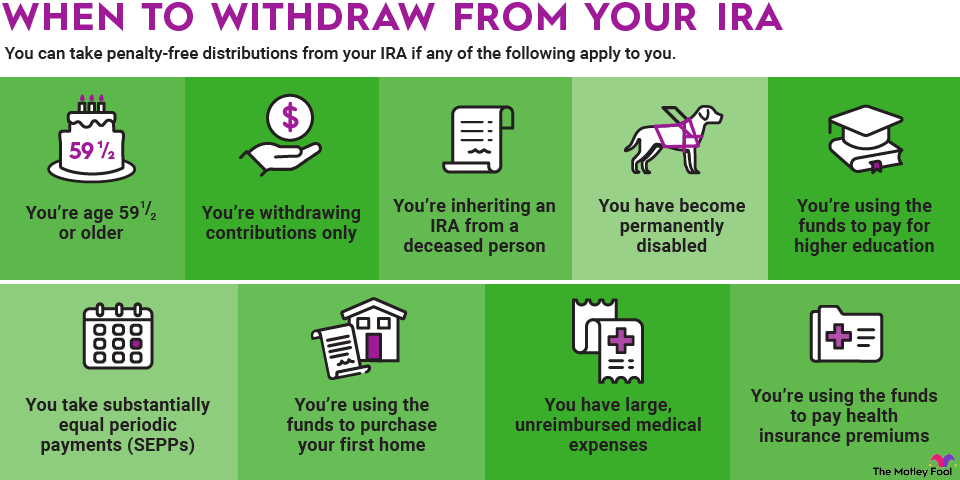

You have the ability to withdraw from your IRA without penalty once you've turned 59 1/2, You are not required to do this, but if you need the money in retirement, it's all yours without penalty. In all likelihood, you'll owe taxes on the withdrawals from a traditional IRA, while Roth IRA withdrawals are generally tax-free as long as the account has been open at least five years.

There are some exceptions that allow you to withdraw money from an IRA even sooner, and we'll get to those in a bit.

Mandatory withdrawals

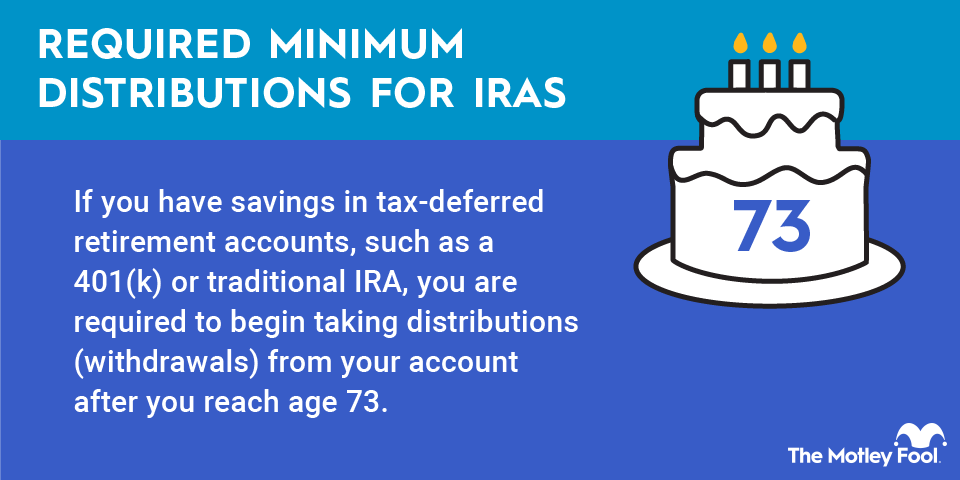

You won't be required to take money out of your IRA until you turn 73, which is when mandatory withdrawals, called required minimum distributions, or RMDs, begin. The RMD age used to be 70 1/2, but the original SECURE Act of 2019 pushed it back to 72. The Secure Act 2.0, which became law in late 2022, raised the RMD age to 73. The RMD age will increase again to 75 in 2033.

For your first RMD, you must withdraw a certain amount by April 1 of the year following the year you turn 73. Thereafter, all RMDs will be due by December 31 of each year.

Note that your RMD, when it comes time to withdraw it, is a minimum amount. You do have the option to take more if you need it. However, keep in mind that when planning your retirement withdrawal strategy, this will result in more taxable income in the year you take the distribution. The RMD is intended to create a smoothing effect in terms of the income your account generates, as well as the tax revenue the government receives. This is all based on your life expectancy, and you'll need to calculate your RMD every year after you reach 73.

Note that RMDs don't apply to Roth IRAs. You're never required to take money out of a Roth account during your lifetime if you don't want to.

The 60-day rule

One of the riskier ways to temporarily access IRA funds without taxes or penalties -- if you really need the money -- is to attempt a 60-day IRA rollover. This IRS rule allows you to take money out of your traditional IRA and use it for any reason as long as you return the full amount before the end of 60 days. You're allowed to do this once per 12-month period.

Unless it's a real emergency, or you're 100% sure you will have the funds available (pre-withholding) to redeposit to your IRA, it's generally best to avoid the 60-day rollover. Missing the 60-day window or failing to repay the money at all will result in taxes and penalties on the entire amount distributed. Given the opportunity cost of losing tax-deferred growth, plus the unnecessary expenses, it's usually not worthwhile to do this.

Other special circumstances

Both traditional IRA and Roth IRA owners are eligible to withdraw up to $10,000 to assist in the purchase of a first home. Note that if two spouses are buying a home together, each is eligible to withdraw up to $10,000 for a total of $20,000. However, while this amount would be distributed penalty-free, the account owners would still owe income tax on the amount withdrawn if the account is a traditional IRA.

Another major exception to the early withdrawal penalty is qualified education expenses. For example, if you withdraw from your IRA to help send your kids to college, it is allowed under this exception. In fact, many people use their IRAs (especially Roth IRAs) as alternatives to college savings accounts like 529 plans.

Finally, there are a few circumstances that can qualify for hardship withdrawals, which can often avoid the 10% penalty that typically applies to early retirement withdrawals. Expenses that qualify as hardship withdrawals are true emergencies or unusual circumstances, such as:

- Unreimbursed medical expenses over 7.5%.

- Qualified expenses if you're a military reservist called to active duty.

If you're thinking of taking from your IRA, think about whether your expenses fall into one of the big three expense categories: health, education, and housing. If they don't, and it's not a true emergency, you might consider alternative methods of covering the expenses.

Related investing topics

Putting it all together

Your IRA is intended for one thing: retirement. There are ways to access IRA funds early if you read the fine print and adhere to restrictive rules. In general, though, it's best to use your IRA for long-term funds that you don't immediately need and certainly not as a vehicle for borrowing or short-term liquidity. This is all to say that for best results, you should keep things simple and use these accounts for their intended purposes.