News headlines occasionally remind us that the rich and famous use family trusts to manage generational wealth. The 2023 lawsuit by the Falwell Family Trust alleging unauthorized use of the late Jerry Falwell's likeness by Liberty University is an example.

What is a family trust, and how are they used by regular people? Read on to find out.

Definition

What is a family trust?

A family trust is an estate planning tool designed to benefit you and your family. As with all trust types, the family trust is a legal structure that can own assets and dictate how those assets are managed.

Typically, you'd set up a family trust to streamline wealth distribution to loved ones after you're gone, to keep your assets and distribution requirements from becoming public record, and to ensure your wealth is divvied up per your wishes.

Types of family trusts

Types of family trusts

The phrase "family trust" isn't a legal term, per se. It's a casual label applied to trusts that keep assets within the family -- which could include any relative from parent to, say, a third or fourth cousin. There are several types of trusts that can fulfill that purpose, including those introduced below.

Revocable vs. irrevocable

Every trust is either revocable or irrevocable. A revocable trust retains the grantor's right to manage the property in the trust. The grantor is the person who created the trust. Because the grantor can continue to manage the trust assets, she or he can remove assets, change beneficiaries, or even cancel the trust.

An irrevocable trust cannot be amended or terminated by the grantor. Typically, the grantor cannot directly manage the assets in an irrevocable trust.

Although the irrevocable structure is quite rigid, there are two advantages. Assets in an irrevocable trust are usually protected from creditors. They're also not included in the assessment of estate taxes when the grantor dies.

Living trust vs. testamentary trust

A living trust is created during the grantor's lifetime. Assets in a living trust do not go through probate, which is the lengthy court process of settling the grantor's estate.

A testamentary trust is created by a last will and testament. It is established after the grantor dies. Testamentary trusts go through probate.

Bypass trusts and marital trusts

Bypass trusts and marital trusts can be used together to reduce estate taxes and provide financially for a surviving spouse and children. This dual-trust strategy may be appropriate for wealthy couples whose net worth exceeds the estate tax exemption.

Typically, the bypass trust takes ownership of assets valued up to the estate tax exemption. Once in the trust, these assets are no longer included in the surviving spouse's net worth. When the surviving spouse dies, this wealth should pass to the remaining beneficiaries -- usually the children -- without the assessment of estate taxes.

The surviving spouse can usually receive income from the bypass trust. He or she may also be able to withdraw principal under certain conditions, such as chronic illness.

Any remaining assets above the estate tax exemption go into the marital trust. The surviving spouse has greater control of these vs. the assets in the bypass trust. Marital trust assets are subject to estate taxes when the surviving spouse dies.

Generation-skipping trust

A generation-skipping trust is an irrevocable trust that names a beneficiary who is at least 37 1/2 years younger than the grantor and not the grantor's spouse. This trust type falls into the family trust category when the beneficiary is also a family member, such as a grandchild.

The purpose of a generation-skipping trust is to minimize estate taxes that would otherwise be paid over two generations. There is a sticking point, though. Amounts transferred into the trust that exceed the generation-skipping tax exemption are subject to a 40% generation-skipping tax.

Trusts and taxes in practice

Family trusts and estate taxes in practice

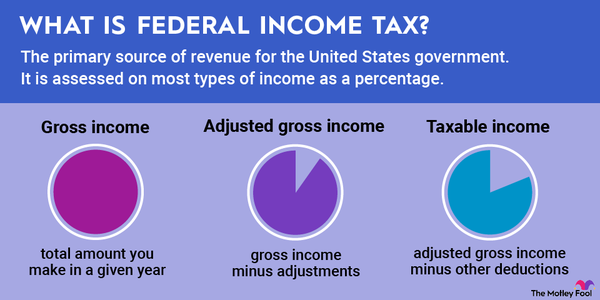

Some of these complex trust structures arose as strategies to reduce the burden of estate taxes. However, the estate tax exclusion -- at least for now -- is high enough to be irrelevant to most households.

In 2023, the estate exclusion is $12.92 million per person, or $25.84 million per couple. The generation-skipping tax exemption has the same thresholds.

Absent any new legislation, these exemption amounts will drop to $5 million, indexed for inflation, in 2026. Some estimates predict an indexed exemption of $7 million -- which still doesn't apply to most people.

That means the estate tax benefits are probably less interesting than other advantages of family trusts. What trusts do best is bypass probate and manage your wealth according to your instructions. If those outcomes are appealing, a family trust may be right for you. Talk with an experienced attorney about a family trust structure that would suit your situation and priorities.

Related investing topics

Pros and cons

Pros and cons of family trusts

The various structures of family trusts have pros and cons. On the pro side, most family trusts avoid probate, keep inheritance details out of the public record, and are difficult to contest -- more so than a will. Some family trust structures can also reduce or eliminate estate taxes.

Note that testamentary trusts do not share these benefits.

The major disadvantages of family trusts are cost and complexity. You do need the help of a qualified estate attorney to design and set up a family trust. And depending on your goals, the trust provisions can be complicated.

As well, once the trust is created, you must transfer property into the trust's name. That can be a lengthy and tedious -- but essential -- step in the process.