Over the past couple of decades, stock buybacks have become a big part of how companies use their profits to return capital to shareholders. While buybacks remain below their all-time high, U.S. companies spent $773 billion buying back their own shares in 2023 and are expected to buy back $885 billion in stock throughout 2024.

Despite their surge in popularity, stock buybacks -- also known as share repurchases -- are not well understood by many investors. Sure, the basic concept is simple: A company buys shares of its own stock.

However, the process behind buybacks and the reasons companies might choose to buy back their stock remain a mystery to many, as does the answer to whether stock buybacks are good for investors. In this article, we'll dive into the basic knowledge investors need about stock buybacks and why knowing how they work is important.

Understanding stock buybacks

When a company has excess profits or otherwise has accumulated cash on its balance sheet, it can use the money in a few different ways, including:

- Reinvest profits into the business by developing new products or increasing its inventory.

- Acquire other businesses.

- Pay a dividend to shareholders.

- Use the cash to buy back shares of its own stock.

Many companies use some combination of these methods. For example, many stocks that pay dividends also buy back shares.

The mechanics of stock buybacks are usually quite simple. First, the buyback program is established. The company's board will authorize the buyback, typically for a specific dollar amount with an expiration date. For example, you might read that "Company XYZ's board of directors has approved a $500 million buyback authorization, beginning on July 1, 2024, and ending on June 30, 2025."

To be clear, a buyback authorization doesn't mean the company will buy back any shares. In fact, buyback authorizations go unused quite frequently. But the authorization gives management the ability to do it.

Next, the company buys back shares if management chooses to do so. It typically does so on the open market, just like you and I would buy shares of a stock. In some cases, buybacks can be done directly from shareholders through a process known as a tender offer.

Finally, the repurchased shares are absorbed by the company, and the number of outstanding shares decreases.

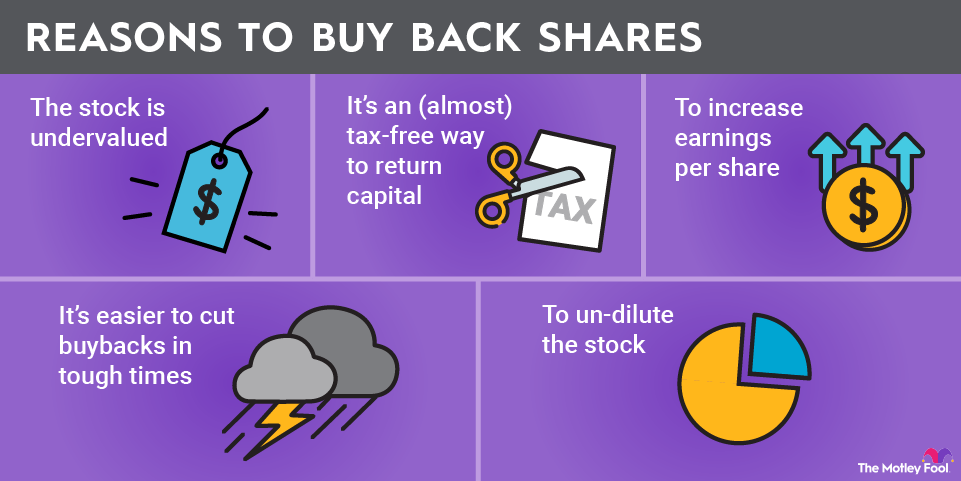

Why do companies buy back their shares?

At first, it might sound odd that companies buy back shares of their own stock. Why not just give that money to investors directly as dividends? But there are some solid reasons for doing so. Specifically:

The stock is undervalued

//If you could buy a $100 bill for $50, wouldn't you do so as often as possible? That's essentially one of the biggest reasons companies choose to buy back stock.

Intrinsic Value

If a company's board of directors thinks its stock is trading for a significant discount to its intrinsic value, it may choose to act aggressively with buybacks. We've seen this quite a bit in the financial sector in recent years, and this is the reason Warren Buffett has given regarding Berkshire Hathaway's (BRK.A +2.40%)(BRK.B -0.65%) stock buybacks.

For example, during the 2022 bear market, many companies in industries and sectors that historically don't buy back shares -- such as rapidly growing tech companies and real estate investment trusts (REITs) -- implemented buyback programs. The most common reason cited was that management believed the stock was a bargain relative to its intrinsic value.

An (almost) tax-free way to return capital

Dividends are generally taxable income unless you own stock shares in a tax-advantaged account, such as an individual retirement account (IRA). To be sure, the tax rates imposed on most dividends are better than those on ordinary income, but we're still talking about a tax hit on dividends between 15% and 23.8% for most investors.

Meanwhile, when a company uses excess profits to buy back stock, it doesn't create a taxable event for shareholders. It's worth noting that the recently passed Inflation Reduction Act contained a 1% excise tax on buybacks (assessed on the company), but this is still far less than the tax hit investors would face if the company chose to pay it out as a dividend instead.

Increase earnings per share

Companies generally don't like to acknowledge this one, but the reality is that buybacks can make a company's earnings growth appear better than it actually is. Let's say that Company X has 10 million outstanding shares and earns $20 million in profit this year. Simple math shows that its earnings per share (EPS) for the year was $2.

However, let's say the company buys back 1 million shares of stock -- reducing its share count to 9 million -- and earns $20 million again next year. Now, because there are fewer shares, the company's earnings are $2.22 per share. It appears that earnings grew by 11%, even though the company generated the exact same amount of profit.

It's easier to cut buybacks in tough times

If you're a new investor, you might not realize this yet, but few ways to lower a stock's price are as reliable as cutting a longstanding dividend. As a result, companies often don't start or increase a dividend unless they're fairly certain the payout will be sustainable.

On the other hand, buybacks come and go, and investors don't really worry about them -- at least not to the extent that they worry about dividend cuts. If a company buys back $10 million in stock this year and $8 million next year, investors won't give it nearly the same scrutiny as if the dividend was cut by 20%.

So, companies might choose to use profits for buybacks instead of committing to paying a dividend since this would give them more financial flexibility in the future.

Un-diluting the stock

Finally, another reason for buybacks is to offset dilution from stock-based compensation. If a company's employees exercise options for 1 million new shares, it will dilute the stock. Over time, stock-based compensation can have a highly dilutive effect, but stock buybacks can be strategically used to keep the share count from rising too much.

How stock buybacks affect the market

Stock buybacks don't directly affect the market or investors, aside from perhaps lowering dividends. When it comes to investors, buybacks can be a fantastic way to create value, especially if they're done for the right reasons, such as a stock trading for less than its intrinsic value.

Although stock buybacks technically just move money from one place (a company's balance sheet) to another, they often increase a stock's price. As mentioned, buybacks can make earnings growth look significantly stronger than it truly is, and investors use metrics such as earnings growth rates and the price-to-earnings (P/E) ratio when valuing companies.

Pros and cons of stock buybacks

Generally speaking, stock buybacks are a shareholder-friendly way to use capital. But like most investing topics, there are pros and cons and good and bad ways to use stock buybacks. For example, many companies buy back stock regardless of price or valuation and can end up paying more than intrinsic value, especially in strong market environments.

With that in mind, here's a list of some of the pros and cons of stock buybacks that investors should be aware of:

Pros of Stock Buybacks | Potential Drawbacks of Stock Buybacks |

|---|---|

Shareholder value can be created if stock is bought back for less than its intrinsic value. | Many companies buy back stock just to boost earnings per share and sometimes overpay. |

They can make earnings growth look stronger. | They reduce available cash on a company's balance sheet. |

Buybacks offset dilution from stock-based compensation. | Buybacks are subject to a 1% excise tax. |

They are a more flexible way to return capital than paying dividends. | They can use capital that could have been used in more productive ways (such as investing in new technological innovations). |

Stock buybacks return capital to shareholders but aren't taxable on the individual level like dividends. |

The bottom line on stock buybacks

In most cases, companies returning capital to shareholders, either in the form of buybacks or dividends, is a good thing. In many ways, buybacks have some significant advantages over dividends, especially if the stock is truly trading for less than its intrinsic value.

Related investing topics

However, like most investing topics, there isn't a one-size-fits-all answer to whether stock buybacks are good or bad for investors. They should be evaluated on a case-by-case basis.