Buying an investment is a way to make your money grow. It all starts with the cold, hard cash you put down and increases through interest, inflation, the growth of a company, or a combination of the three.

What is equity?

Equity, generally speaking, is the value of what you own. It’s a very simple concept, but one that we don’t consider enough as investors. For first-time investors or people considering a new investment, the term may turn up again and leave them looking for a better understanding of the concept.

Like the equity in your home, the equity in your investments is the value of your investments, less any money you have borrowed against them. Say you borrowed $250,000 against your $350,000 home, leaving you $100,000 in equity. If you then bought $150,000 in investments but had to borrow $50,000 against the purchase to do it, you’d still have $100,000 in equity. Easy, right?

Types of equity

There are several kinds of equity that you can accumulate as an investor. We won’t consider your residence as an investment since your primary goal is to live there, not make money from it. Other types of investment equity include:

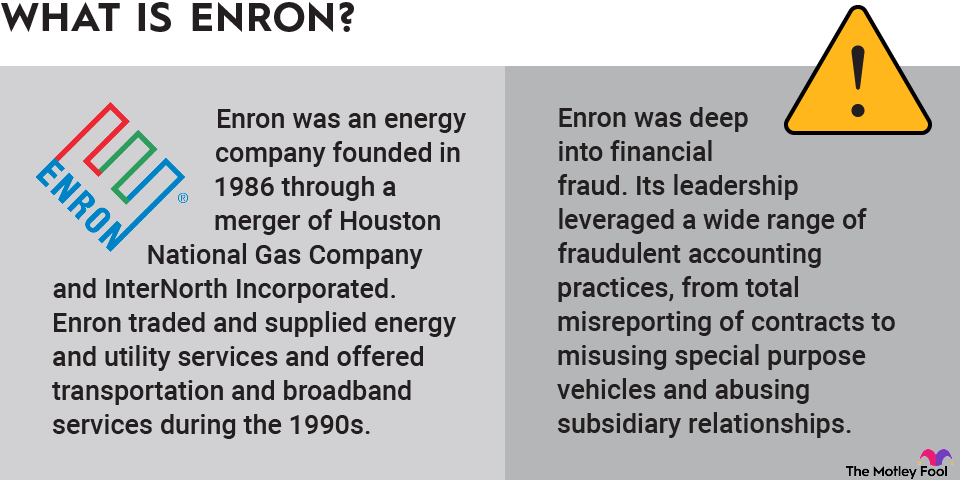

Business equity: Do you own a business or part of a business? The equity of your business investment is the value of the business and all the things and real estate it owns, minus any outstanding deliveries, debt, and other commitments (leases, for example).

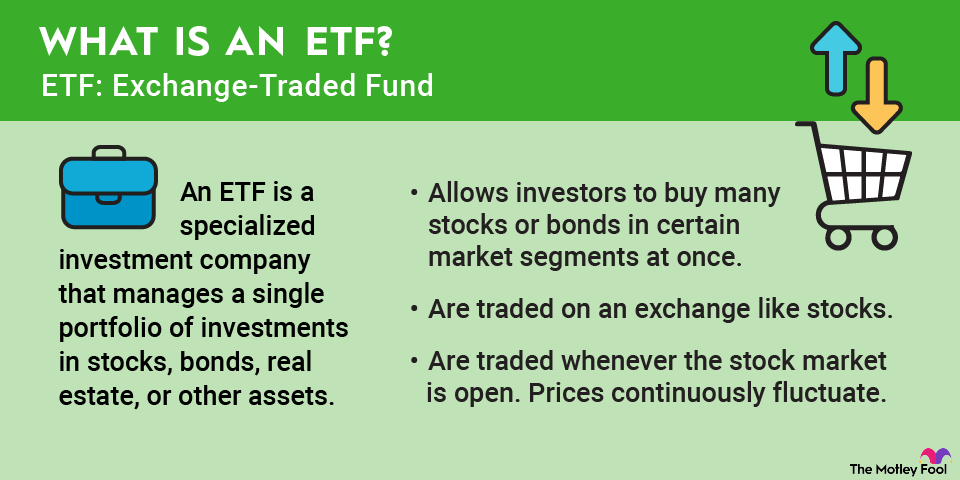

Equity in equities: Owning equities means that you own some kind of regulated investment with the goal of making money. Maybe that’s a certificate of deposit or a bond, or maybe it’s stocks. Regardless, the equity of your equities is how much of their value that you own outright.

Shareholder equity: Shareholder equity is something you’ll see appear on a balance sheet if you’re checking out a company’s financials. This is how much of the company is owned by the shareholders, meaning people like you who have bought different types of stock offerings or received them as part of a compensation package.

What can you do with equity?

Equity is essentially an untapped source of potential. Just like you can tap the equity in your home when you’ve paid down a certain percentage of the mortgage, you can often borrow against other types of equity to help you achieve your goals faster. With any kind of equity-based borrowing, it’s important to understand what you’re borrowing for, where the value of the securing asset is likely headed, and how much you’ll pay in interest and fees for the return you’re seeking.

Interest Rate

For example, you can borrow against the equity in your business to buy a new piece of equipment that might increase your ability to fill orders. If the rate of increase in business will more than outpace the interest rate you’re paying, it’s a good use of your equity. The same can be done with the equity in many types of securities using a margin loan, although the risk you face of not coming out ahead can be considerably higher.

Related investing topics

Equity versus equities

It’s important to understand that there’s a subtle but important difference between equity and equities. The two terms are not interchangeable. An equity is a specific class of investments regulated by the U.S. Securities and Exchange Commission (SEC). They include stocks and mutual funds. A key feature of an equity investment is that you have an expectation of earning dividends or making a profit from holding the shares you acquire.

Equity, on the other hand, describes how much of a thing you own. As noted above, you have equity in your equities, but you can also have equity in private businesses or other types of financial securities. Equity is about how much of something someone owns -- yourself or a pool of shareholders. This can be important when evaluating a new investment. You may want to know how much of the company is still controlled by its original owners or how much is available to leverage in case of a downturn.