A trustee is a person or entity who’s appointed to manage assets held in trust on behalf of a third party. There are few formal restrictions on who can serve as a trustee. However, it’s essential that a trustee act as a x. In this article, you’ll learn about trustees, their duties, and their responsibilities.

What is a trustee?

What is a trustee?

A trust is a legal arrangement created to hold and manage assets on behalf of someone else, known as the beneficiary. The trustee is the person or entity responsible for managing trust assets.

Trusts are often created for estate-planning purposes. Virtually anyone can be appointed as trustee in such cases. In fact, people who establish a revocable living trust -- the most common type of trust because it can be amended as long as the donor is living and able to make sound decisions -- frequently appoint themselves as trustee. Often, they’ll name a successor trustee who assumes responsibility for managing trust property when the donor dies or becomes incapacitated. Many people who establish a trust for their heirs name the same person they’ve chosen as the executor of their estate to serve as trustee.

For large or complex estates or in situations where family disputes are likely, the creator of the trust may opt to appoint an independent trustee. A bank or financial institution can serve as a trustee, as can a financial professional or attorney.

Bankruptcy is another situation that usually requires the appointment of a trustee who is responsible for overseeing the distribution of property to creditors and other claimants. In bankruptcy cases, trustees are appointed by the United States Trustee Program (USTP), a component of the U.S. Justice Department.

Duties and responsibilities of a trustee

Duties and responsibilities of a trustee

A trustee assumes legal ownership of trust assets and becomes responsible for managing them according to the instructions in the trust document. Trustees have a fiduciary role, which means they’re required to act in the best interests of the trust’s beneficiaries. Some common responsibilities of trustees include:

- Understanding the instructions of the trust document, as well as the intentions of the trust creator.

- Making required distributions, as well as those allowed at the trustee’s discretion.

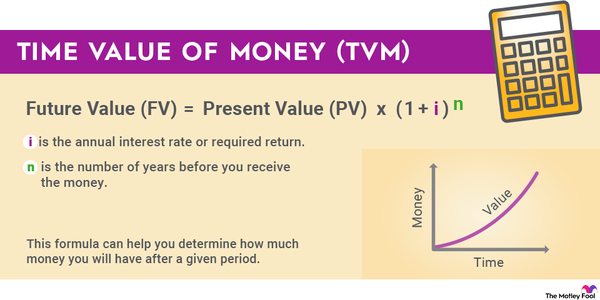

- Choosing suitable investments.

- Periodically updating beneficiaries and providing them with financial statements and tax documents.

- Keeping detailed and accurate records of trust assets, including income, expenses, and any transactions.

- Filing tax returns on behalf of the trust.

- Maintaining proper insurance on trust property.

- Seeking outside expertise when necessary. For example, the trustee may need to hire an attorney or CPA if they encounter a legal or tax issue.

A trustee is a fiduciary, so they’re prohibited from putting their own interests ahead of the interests of the trust’s beneficiaries.

What conduct is prohibited for trustees?

What conduct is prohibited for trustees?

Because a trustee is a fiduciary, they’re prohibited from putting their own interests ahead of the interests of the trust’s beneficiaries. Trustees must avoid conflicts of interest by keeping trust property separate from their personal property. They must also avoid favoring one beneficiary over the other (which can happen when the trustee is also a beneficiary). Failure to keep detailed records of any transaction related to trust assets is considered a breach of the trustee’s duty.

Trustee malfeasance occurs when a trustee commits an offense that results in harm to the trust’s assets or beneficiaries. Examples include criminal activity like fraud, as well as self-serving conduct or negligence. For example, a trustee who fails to invest assets according to the trust documents may be considered negligent by a court.

If beneficiaries believe trustee malfeasance has occurred, beneficiaries may be able to petition the court to have the trustee removed. Beneficiaries can also sue a trustee if they believe a breach of duty has occurred. If illegal activity such as embezzlement occurred, criminal penalties would apply as well.

Example of a trustee’s role

Example of a trustee’s role

Suppose you plan to leave your assets to your adult child when you die, but you’re concerned that he’d squander his inheritance if he received a large amount of money. So you create a revocable living trust for your property and name yourself as trustee while designating a close family friend as successor trustee to manage the assets if you die or become incapacitated.

When you die, your friend whom you chose as trustee must make distributions according to your instructions and also invest the assets according to your wishes. For example, maybe you specify that your son will receive annual distributions of $25,000, but you included a provision requiring that additional distributions can only be made for health, education expenses, maintenance, and support. As trustee, your friend would have to use his discretion to determine whether a distribution was appropriate. He’d be obligated to make a distribution if your son requested money for surgery or to complete his master’s degree, but not if your son were seeking to buy a new boat.