A 401(k) is a retirement savings plan sponsored by employers. You fund the account with money from your paycheck and invest that money in the stock market, earning some tax perks in the process. That's the basic (and slightly dull) definition of a 401(k).

What is a 401(k)?

The more interesting angle is what a 401(k) can do for you. The 401(k) is a powerful resource for achieving financial independence, especially when you start using it early in your career. Put another way, if you like money and wish to have more of it in the future, you can use a 401(k) to make that happen.

Read on for a closer look at how the 401(k) works, when you can withdraw funds from a 401(k), and what happens to your 401(k) if you change jobs.

How does a 401(k) work?

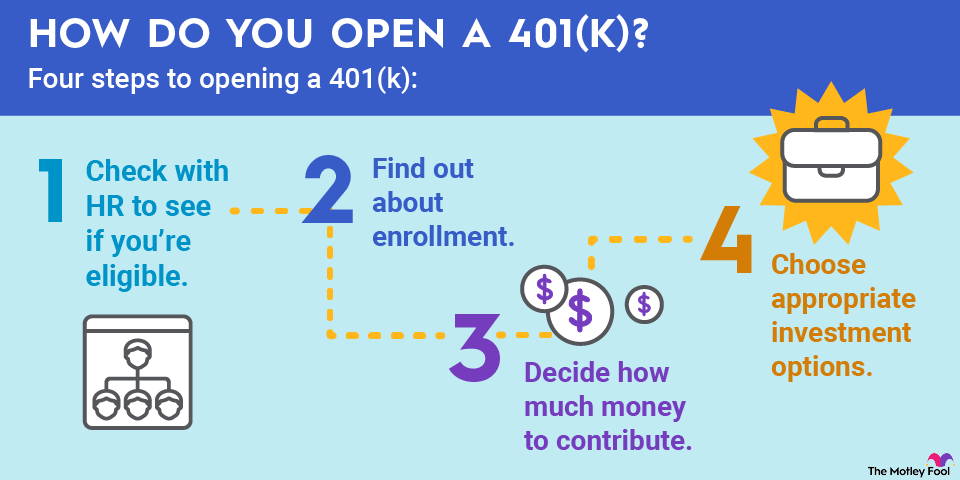

Eligibility to participate in your company's 401(k) usually involves a minimum employment period. Many employers allow you to participate in the 401(k) within a month or two of your hire date.

The amount you deposit into your 401(k) with each paycheck depends on your contribution rate. Your contribution rate is the percentage of your salary you will contribute. Assuming you earn $45,000 annually, or approximately $3,750 gross monthly. A 10% contribution rate would mean you contribute $375 from your monthly paycheck toward this retirement plan.

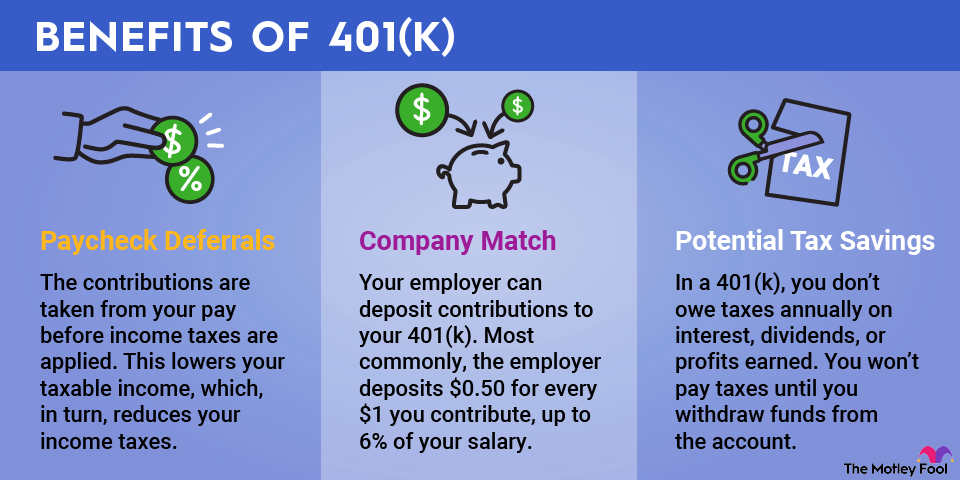

Don't panic if that seems like too much money to carve out of your income. Thanks to the 401(k)'s tax advantages, a $375 paycheck deferral will cost you something less than $375. The contributions from your paycheck are tax-deductible. Known as paycheck deferrals, these amounts come out of your pay before income taxes are applied. That lowers your taxable income, which, in turn, reduces your income taxes.

Some 401(k) plans offer matching contributions, also known as an employer match. These are deposits to your 401(k) account that your employer funds -- basically free money. Matching contributions follow a formula that your employer defines. A typical structure is for the employer to deposit $0.50 for every $1 you contribute, up to 6% of your salary.

Those are just a couple of the rules for 401(k). You also get tax-deferred investment earnings. Usually, you'd owe taxes annually on interest, dividends, and profits earned on investments you've sold. You don't have to worry about any of that in a 401(k). You can make as much as you want on your 401(k) investments, and you won't pay taxes until you withdraw funds from the account.

How much can I contribute to a 401(k)?

Even if you wanted to, you probably can’t put all of your paycheck into your 401(k). This is because the IRS sets limits on 401(k) contributions. There are caps on how much you can contribute from your paycheck and on how much you and your employer can contribute in total. The numbers can change from year to year, but the limits for 2025 and 2026 are below.

- You can contribute up to $23,500 (2025) and $24,500 (2026) from your salary to your 401(k). Exceptions apply to highly compensated employees, or HCEs.

- If you are 50 or older, you'll be allowed additional paycheck deferrals of $7,500 per year in 2025 and $8,000 in 2026. These are called catch-up contributions. In 2025, you can make an additional catch-up contribution of $3,750 if you're between the ages of 60 and 63 under new Secure Act 2.0 rules, bringing your total catch-up contribution to $11,250. This super catch-up contribution will remain at $11,250 in 2026.

- Total contributions cannot exceed your pay, or $70,000 (2025) and $72,000 (2026), whichever is less. These limits don't include catch-up contributions. Total contributions include your paycheck deferrals, matching contributions, and any other employer-funded contributions.

- If you overcontribute to your 401(k), contact your plan administrator.

- You can contribute to both a 401(k) and an IRA or Roth IRA, but there are certain limitations.

What is a Roth 401(k)?

Some 401(k)s allow you to make Roth contributions. A Roth 401(k) contribution has a different tax structure than your standard 401(k) deposit. While the traditional 401(k) contribution is tax-deductible up front and taxable when you withdraw funds, the Roth contribution is the opposite. You get no tax deduction for a Roth contribution, but your withdrawals in retirement are tax-free.

Withdrawing from your 401(k)

The 401(k) is a retirement plan, so the government restricts withdrawals in your younger years. There are a few exceptions, but most withdrawals made before age 59 1/2 are subject to a 10% penalty.

Retirement withdrawals: You can start taking retirement withdrawals once you've reached age 59 1/2. You may be able to begin withdrawals at age 55 without penalty if you no longer work for the company. The IRS taxes these withdrawals as ordinary income.

Required minimum distributions: If you don't need the money, you can leave it in the account until April 1 of the year after you turn 73 (previously 72). After that, you must take annual distributions by Dec. 31 every year. These are known as required minimum distributions, or RMDs. The amount of your 401(k) RMD for each year depends on your age and your year-end account balance. RMDs only apply to traditional pretax 401(k)s. As of 2024, Roth 401(k)s no longer have RMDs.

401(k) loan: Your plan may allow you to borrow against your 401(k) balance without incurring a penalty. You do pay interest on the loan; however, you’re paying interest to yourself. And, if you change jobs, you usually must repay the loan by the time your next tax return is due.

401(k) rollovers

If you change jobs, you can take your retirement money with you. Depending on your account balance, your former employer may require you to withdraw your funds from the plan.

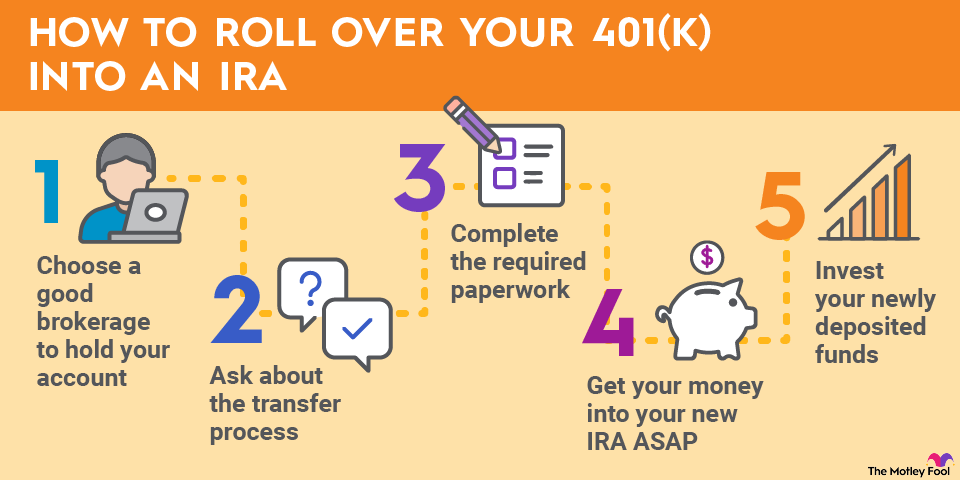

Either way, you'll want to do what's called a 401(k) rollover so you can avoid any taxes or penalties. There are two main types of rollovers:

- Direct rollover: You ask your plan administrator to send your funds directly to a different retirement account -- either an individual retirement account (IRA) or a 401(k) plan with your new employer. No taxes are withheld from your funds.

- 60-day rollover: If your old employer sends your 401(k) funds to you directly, you have 60 days to deposit those rollover funds to an IRA or a different 401(k). This gets tricky because your plan will withhold 20% in taxes from the direct payment. But you must deposit the full account balance, including the withheld taxes. If you deposit a lesser amount, you will report the difference as taxable income on your next tax return.

Here's an example to clarify the 60-day rollover. Say your 401(k) balance is $5,000 when you leave your job. Your employer sends you a check for $4,000, with $1,000 withheld for taxes. You have 60 days to deposit the full $5,000 into another retirement account. If you deposit only the $4,000 you received, you will report $1,000 as taxable income. You’d also owe a 10% penalty if it’s an early withdrawal.

Understand all the ways you can take money out of your 401(k)

401(k) for financial independence in retirement

The 401(k) makes it easy to build wealth for retirement. Once you set your preferences, the work of saving and investing happens behind the scenes. Plus, you have tax savings and, possibly, matching contributions that expedite your savings momentum.

Here's what it comes down to: The earlier you start contributing to a 401(k), the more you'll get from its benefits and the wealthier you can be when you retire.

401(k) vs. other retirement accounts

Compare the 401(k) to other retirement plans: