| Monday's Markets | |

|---|---|

| S&P 500 6,847 (-0.35%) |

|

| Nasdaq 23,546 (-0.14%) |

|

| Dow 47,739 (-0.45%) |

|

| Bitcoin $90,829 (-0.51%) |

|

| Monday's Markets | |

|---|---|

| S&P 500 6,847 (-0.35%) |

|

| Nasdaq 23,546 (-0.14%) |

|

| Dow 47,739 (-0.45%) |

|

| Bitcoin $90,829 (-0.51%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

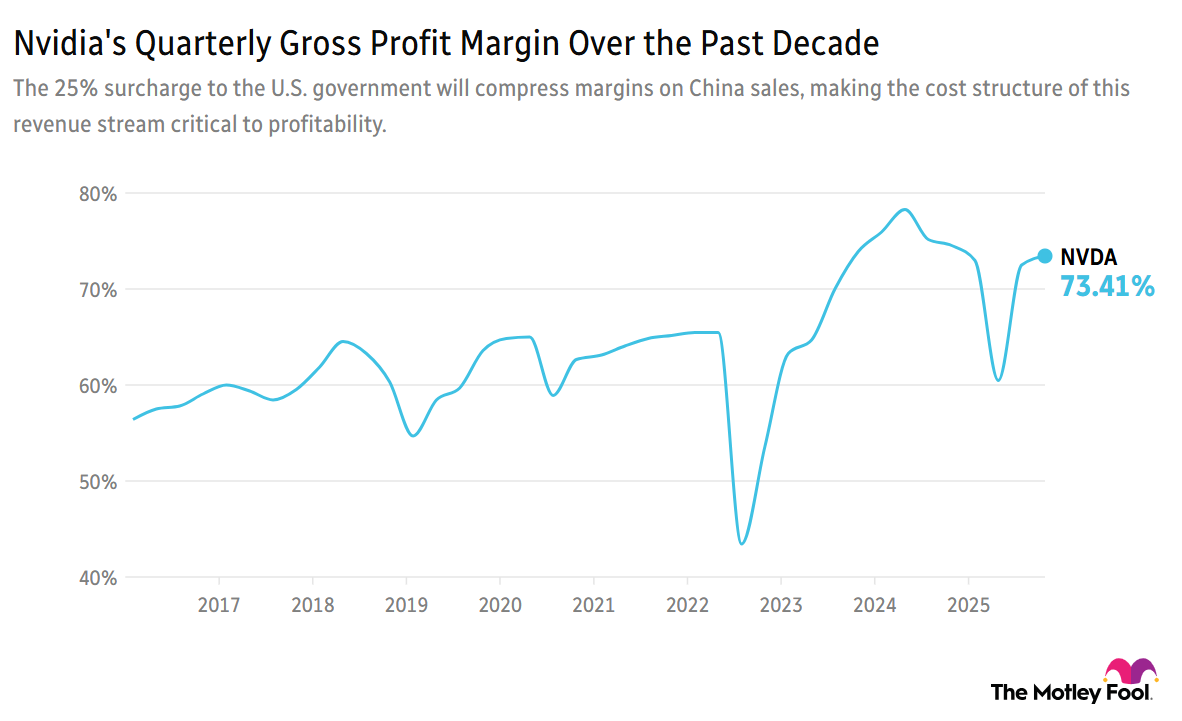

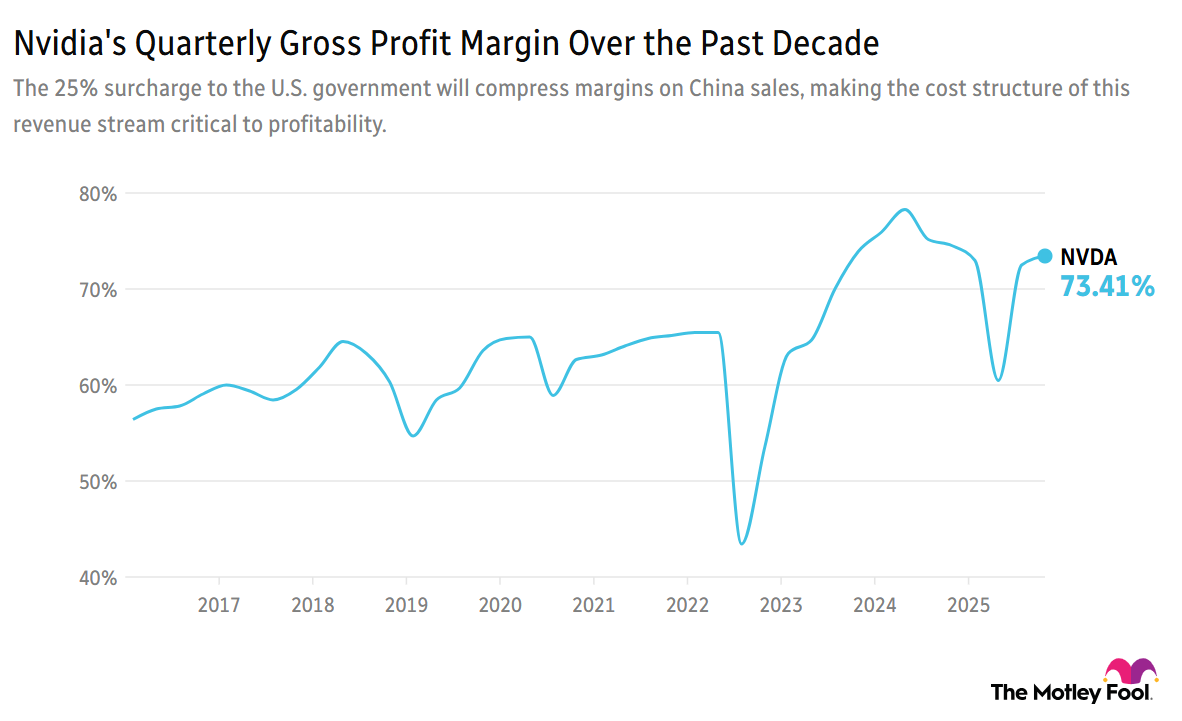

Nvidia (NASDAQ:NVDA) received the green light from President Donald Trump to ship its H200 artificial intelligence (AI) chips to approved customers in China, with a 25% surcharge payable to the U.S. government, allowing it to reopen a key market for business. The stock rose over 1.5% ahead of the market opening.

In calls with advertising clients, Alphabet (NASDAQ:GOOG) is reportedly planning to bring ads to AI-chatbot Gemini within the next year, at the same time as it gets hit with a fresh E.U. antitrust investigation.

Ford (NYSE:F) and Renault announced a partnership to launch a jointly developed electric vehicle (EV) in 2028, alongside expanding an existing collaboration in light commercial vehicles, as it aims to fight off rising Chinese competition in the European market.

Braze (NASDAQ:BRZE) is set to release earnings after the market closes, aiming to keep the two-year streak of beating revenue estimates going in a follow-up from last quarter's strong results. Braze is lagging the market by 107% since it was first brought to the RB scorecard in July 2022.

The Breakfast News email is sent to inboxes via none other than Braze! It's a fast-growing company but isn't consistently profitable yet.

Which unprofitable company in your portfolio requires the most patience -- and what milestones are you watching for? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.