How does a 401(k) work?

Eligibility to participate in your company's 401(k) usually involves a minimum employment period. Many employers allow you to participate in the 401(k) within a month or two of your hire date.

The amount you deposit into your 401(k) with each paycheck depends on your contribution rate. Your contribution rate is the percentage of your salary you will contribute. Assuming you earn $45,000 annually, or approximately $3,750 gross monthly. A 10% contribution rate would mean you contribute $375 from your monthly paycheck toward this retirement plan.

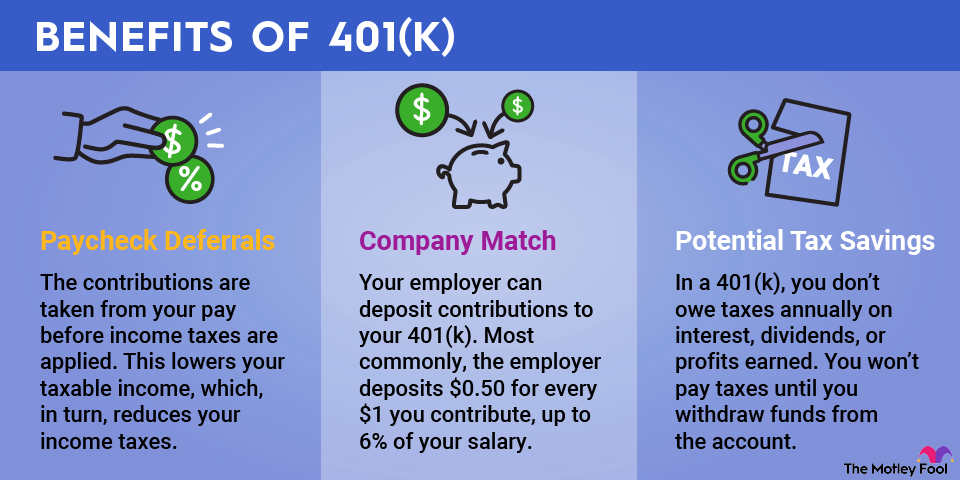

Don't panic if that seems like too much money to carve out of your income. Thanks to the 401(k)'s tax advantages, a $375 paycheck deferral will cost you something less than $375. The contributions from your paycheck are tax-deductible. Known as paycheck deferrals, these amounts come out of your pay before income taxes are applied. That lowers your taxable income, which, in turn, reduces your income taxes.

Some 401(k) plans offer matching contributions, also known as an employer match. These are deposits to your 401(k) account that your employer funds -- basically free money. Matching contributions follow a formula that your employer defines. A typical structure is for the employer to deposit $0.50 for every $1 you contribute, up to 6% of your salary.

Those are just a couple of the rules for 401(k). You also get tax-deferred investment earnings. Usually, you'd owe taxes annually on interest, dividends, and profits earned on investments you've sold. You don't have to worry about any of that in a 401(k). You can make as much as you want on your 401(k) investments, and you won't pay taxes until you withdraw funds from the account.