Modified Adjusted Gross Income

The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

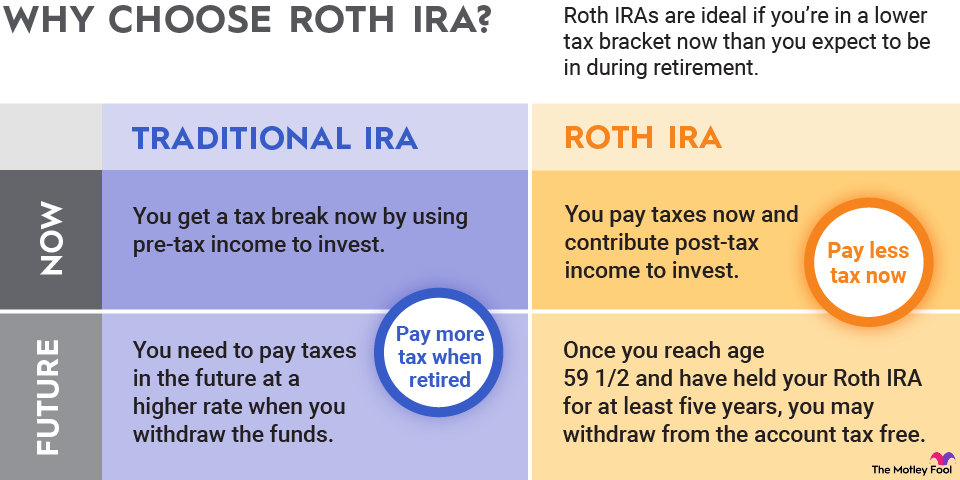

A Roth IRA is an individual retirement account that enables your money to grow tax-free. What's unique about Roth IRAs is that you can withdraw money without increasing your tax liability if you follow certain rules. Unlike with most other retirement accounts, Roth IRA distributions in retirement are not considered as taxable income.

A Roth IRA isn't a specific type of investment, but rather a type of investment account. You still choose which specific securities, such as stocks, bonds, certificates of deposit, mutual funds, and exchange-traded funds (ETFs), to hold in your Roth IRA. Whether your Roth IRA gains or loses money is determined by the overall performance of the securities you choose. (You can invest in things other than what most IRA custodians offer, like cryptocurrency, if you choose a self-directed Roth IRA.)

You cannot deduct Roth IRA contributions from your taxable income as you can with contributions to traditional IRAs and 401(k)s. But once you reach age 59 1/2 and have held your Roth IRA for at least five years, you may withdraw any amount of money from the account completely tax-free. Because Roth IRA contributions are made with after-tax dollars, you can withdraw those contributions (but not their earnings) at any time without being taxed or penalized.

To be eligible to contribute to a Roth IRA, you need to generate earned income. Salary, hourly wages, bonuses, tips, self-employment income, and commissions -- all of which you generate by working -- qualify as earned income. Investment income, Social Security benefits, retirement distributions, unemployment compensation, and alimony do not qualify as earned income.

Your eligibility for a Roth IRA also depends on how much money you earn. If your income exceeds a certain amount, which varies based on your tax filing status and living situation, then you are prohibited from contributing to a Roth IRA. The only way for a high earner to still fund a Roth IRA is to use a backdoor Roth IRA strategy, which entails contributing to a traditional IRA and then converting it to a Roth IRA. This workaround, while permissible, requires you to pay tax when you convert the funds.

To determine whether you are eligible to contribute to a Roth IRA, you'll need to know your modified adjusted gross income (MAGI). To calculate your MAGI, you'll first need to know your adjusted gross income (AGI). Your AGI and MAGI will either be identical or very similar. The IRS website states that your MAGI is typically your AGI plus any tax deduction that you receive for making student loan interest payments.

Roth IRAs are subject to both income and contribution limits. Not only are you prevented from contributing to a Roth IRA if your income exceeds a certain amount, but also, for those eligible to contribute, the amount of money annually that you may invest is capped. (You need to make sure not to make excess contributions.)

The Roth IRA contribution limit is $7,000 in both 2024 and 2025, if you are younger than age 50. If you are 50 or older, then the contribution limit increases to $8,000 for both years. That extra $1,000, known as the catch-up contribution, is meant to help older people to "catch up" on investing as they near retirement.

Based on your tax filing status and MAGI, the table below specifies how much -- if anything -- you can contribute to a Roth IRA.

The way that Roth IRAs work, they confer many benefits, including:

The Roth IRA and traditional IRA have many features in common and a few important differences. You can generally use both types of accounts to invest in the same types of securities like stocks, bonds, mutual funds, and ETFs. Additionally, with both types of accounts, your investments grow tax-free.

The key differences between Roth and traditional IRAs include: