3 Ways to Send Forms W-2 to Your Employees

Many of us associate January with writing New Year’s resolutions and joining gyms. The first month of the year is also big for accounting, in part because it’s when many annual tax forms, including Form W-2, are due.

Form W-2 details an employee’s earnings and tax withholdings for the previous calendar year. Your business must distribute Form W-2 to employees by the federal deadline: Jan. 31, or the next business day if it falls on a holiday or weekend, as is the case in 2021.

Employees use Form W-2 when filing their individual income taxes. It also won’t hurt to have the forms at your side to corroborate payroll costs when doing your business taxes.

The 3 ways to send W-2 forms to your employees:

- In person

- Electronically

- Through the mail

Your employees aren’t the only ones who expect copies of Form W-2. The Social Security Administration (SSA) and most states require that you submit Form W-2 by the same date. Check with the tax authorities in states where you have employees for more information on deadlines and other filing requirements.

There’s no shortage of vendors to help you generate Form W-2. Payroll software, tax software, accounting firms, and other online tools exist to help you produce, file, and share Forms W-2.

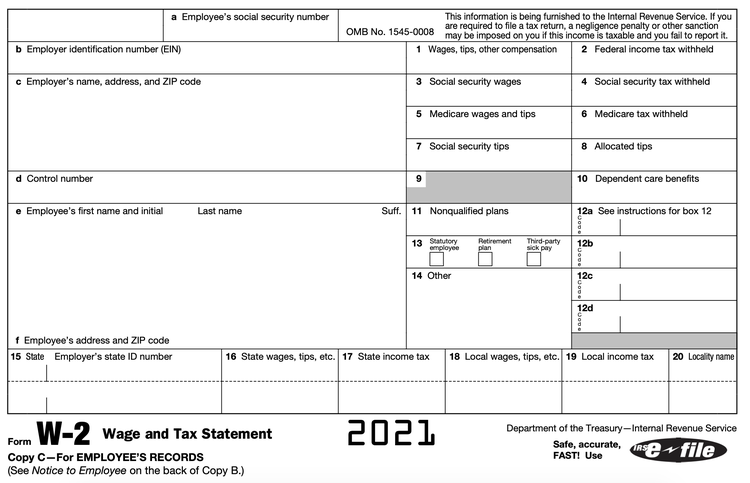

You’ll receive six marked W-2s for every employee. You’re required to send copies B, C, and 2 to employees, while the remaining three go to the SSA, your state or local government, and your filing cabinet.

Employees receive copies B, C, and 2 of their Form W-2. Image source: Author

Don’t create Forms W-2 for independent contractors. Instead, issue a Form 1099-NEC for each contractor to whom you pay $600 or more in one year.

Here’s some more detail on how to send employees their Forms W-2.

1. In person

If all of your employees work in a central office, it might be most convenient to share Forms W-2 by handing them out at work.

Your W-2 provider -- whether it’s tax software, an accounting firm, or you -- can generate and mail the forms to your office. Printing W-2 forms for employees with your office printer is also an option. The employee copy of the W-2 doesn’t need to be printed with special paper or ink like the IRS version.

From there, put each form in its own envelope and distribute it to each employee. Use privacy envelopes to protect sensitive data from prying eyes.

Make sure all your employees know when Forms W-2 are ready. As a business owner, you’re responsible for ensuring all employees receive their Forms W-2 by the IRS deadline.

2. Electronically

Businesses with remote workforces can send out their Forms W-2 electronically.

You’ll need consent from each employee to receive their Forms W-2 digitally, but it’s unlikely you’ll run into too many problems. We live in an age where 90% of taxpayers e-file their taxes, according to the IRS, and having a digital copy makes the e-filing process easier.

You have two options for sharing W-2s electronically: via email or an employee self-service (ESS) portal.

Most SaaS payroll software companies set up portals for employees to view their pay stubs, change their federal and state withholding, and download tax forms. Though the W-2s should automatically post to the ESS once they’re available, send a notice to employees when they’re ready for download. The portal will also allow employees to consent to electronic W-2 delivery.

Absent an online portal, businesses may also send their employees their W-2s by email. Depending on your staff size, it could take anywhere from a few minutes to a few hours -- and the risk of carpal tunnel -- to get these emails out.

Sending financial information by email engenders security concerns. Encrypt W-2s with unique passwords so that only the rightful recipients can open them. The password could incorporate the last few digits of the employee’s Social Security number (SSN) and a zip code, for example.

3. In the mail

When in-person and electronic delivery options fail, put your employees’ W-2 through the mail.

Again, you have two options for mailing W-2 forms to employees: directly from the payroll provider or through you.

The service you used to generate the W-2 will likely offer to send employees their W-2s straight to their door, cutting you out of the process. While it might cost you some extra money, it’s likely that employees will get their forms faster and with fewer errors.

However, you may also print, package, and send the W-2s yourself. Make sure you’re using privacy envelopes to protect employees’ Social Security numbers and other personal information.

Note: Forms W-2 filed by mail with the SSA must be accompanied by a Form W-3, which summarizes all employees’ W-2s. E-filers don’t need to create a Form W-3.

Don’t be late for this very important date

(I played the White Rabbit in my middle school production of Alice in Wonderland. Can you tell?)

Generating, filing, and issuing Forms W-2 should be at the top of your payroll management to-do list starting on Jan. 1. The IRS imposes severe penalties on small businesses that fail to file and share Forms W-2 on time.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles