Nvidia (NVDA 1.05%) had a rough start to 2025, with macroeconomic concerns and tariffs weighing on the stock. But it has seemingly shaken off those fears, and year to date, the stock is now up close to 30% (as of Aug. 4), becoming the first to reach a valuation north of $4 trillion.

While its valuation is undoubtedly high, there's one thing that has the potential to send its shares up even more, and that's a strong earnings report. With Nvidia's earnings set to come out later this month, on Aug. 27, is that likely to be a catalyst that sends the chipmaker's scorching-hot stock to new heights?

Image source: Getty Images.

How has Nvidia's stock typically performed after earnings?

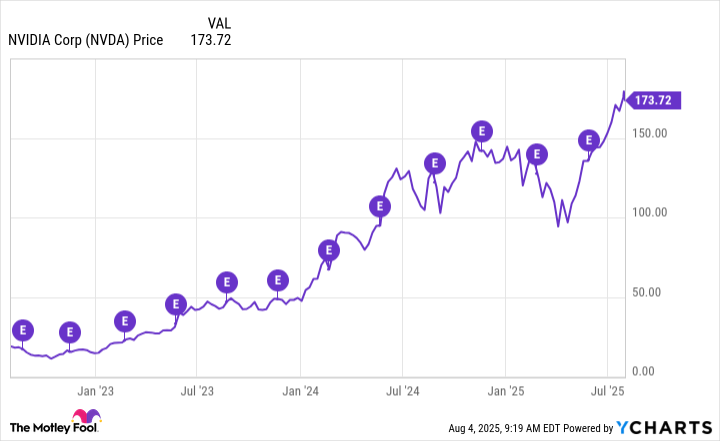

The chart shows how Nvidia's stock has performed over the past few years, while also indicating when it reported earnings. There has been notable movement following earnings in both directions, but it hasn't normally been a move straight up or straight down afterward. This suggests that other factors may play much more important roles in Nvidia's stock's performance, and that strong earnings numbers may already be priced into its valuation.

Nvidia last reported earnings on May 28. At the time, the stock was trading at around $135, and it has gone on to surge since then. But in the first few days after reporting earnings, its shares didn't take off -- a clear sign that the earnings report itself wasn't likely the reason for its recent rise in value.

Instead, the rally may be due to progress in China-U.S. trade talks, with the U.S. government recently permitting Nvidia to sell its H20 artificial intelligence (AI) chips to China. Another catalyst is tech companies still expecting to spend more on AI in the near future, indicating that demand for Nvidia's chips isn't likely to slow down anytime soon.

Could Nvidia's high valuation make it too difficult for the stock to rally after earnings?

Back in April, when the U.S. government announced reciprocal tariffs, Nvidia's stock was trading at close to 30 times its trailing earnings. And that low valuation may have made it easier for it to rally since then. But by the same token, now, with the AI stock looking much more expensive and valued at a price-to-earnings multiple of over 56, that could restrict gains from here on out, even if Nvidia does demonstrate strong growth for the upcoming quarter.

NVDA PE Ratio data by YCharts

While the stock isn't trading at the elevated premiums it was at in late 2024, if its growth rate isn't strong and its guidance isn't better than what analysts are expecting, then its upcoming earnings report may not provide the stock with much, if any, of a boost.

Should you buy Nvidia stock today?

I don't expect Nvidia's stock to surge after earnings, only because I wouldn't expect too-rosy guidance from the company at a time when there's so much uncertainty in the global economy. And with the stock trading at elevated levels again, it may not be easy to convince investors that it's a cheap buy.

However, for the long term, Nvidia can still be a good investment, given its dominance in the AI chip market. And as long as you're not in a rush to turn a quick profit on the stock, it can be a solid buy -- I just wouldn't get my hopes up for a big rally after it releases its upcoming earnings numbers.