Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two of the world's largest farm-focused companies will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Founded in 1902, Archer Daniels Midland (ADM 2.18%) is one of the largest food processors in the world, producing basic ingredients, animal feed, renewable fuels, and industrial chemicals. Headquartered in Decatur, Ill., the company currently operates more than 270 plants and 420 procurement facilities, staffed by approximately 27,000 people, in more than 60 countries across the globe. It also provides transportation services through two subsidiaries, ADM Trucking and American River Transportation.

Founded in 1837, Deere & Co. (DE 0.09%), owner of the world-famous John Deere brand, is one of the world's largest manufacturers of, and service providers for, agriculture and forestry equipment. Deere also manufactures construction equipment and supplies diesel engines and drivetrains used in heavy equipment. Headquartered in Moline, Illinois, the company sells its equipment through retail dealer networks, and also provides financial and related services around the world.

|

Statistic |

Archer Daniels Midland |

Deere |

|---|---|---|

|

Market cap |

$29.0 billion |

$33.0 billion |

|

P/E ratio |

21.9 |

9.9 |

|

Trailing 12-month profit margin |

1.5% |

9.4% |

|

TTM free cash flow margin* |

4.1% |

3.2% |

|

Five-year total return |

74.1% |

118.1% |

Source: Morningstar and YCharts.

* Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: endurance (dividend-paying streak)

Deere has been a dividend investor's favorite for decades, as the industrial giant has paid dividends for more than 77 years without interruption since its first distribution in 1937. However, Deere comes up short against dividend-durability champion ADM, which has paid dividends without fail since 1927, which amounts to an 87-year streak.

Winner: Archer Daniels Midland, 1-0.

Round two: stability (dividend-raising streak)

According to Dividata, Deere has increased its quarterly distributions at least once per year since 2004, for a decade-long dividend-raising streak. However, ADM has increased its dividend payments for more than 37 consecutive years, which trounces Deere's streak with ease.

Winner: Archer Daniels Midland, 2-0.

Round three: power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

ADM Dividend Yield (TTM) data by YCharts

Winner: Deere, 1-2.

Round four: strength (recent dividend growth)

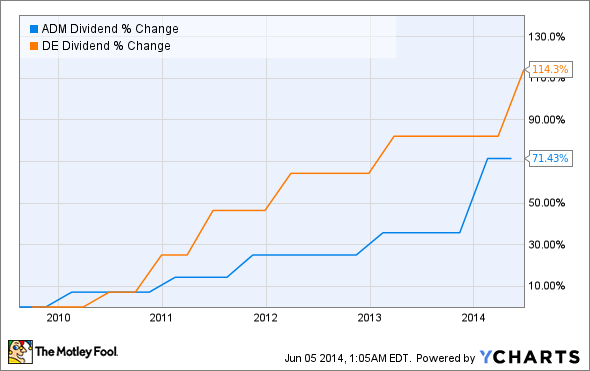

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts during the past five years.

ADM Dividend data by YCharts

Winner: Deere, 2-2.

Round five: flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

ADM Cash Dividend Payout Ratio (TTM) data by YCharts

ADM's record is a bit erratic on this chart, but its free cash flow payout ratio has only reached dangerous levels once in the past five years, as the company wrote off far more inventory than usual in 2011. Other than that, it's generally kept dividend payouts at reasonable levels relative to free cash flow.

Winner: Archer Daniels Midland, 3-2.

Bonus round: opportunities and threats

Archer Daniels Midland may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless, or constrained too tightly for growth.

Archer Daniels Midland opportunities:

- Demand for ethanol should grow with more gasoline consumption in India and China.

- ADM has a long-term plan to increase investment in Australia's GrainCorp.

- Archer's recent deal with Phillips 66 could alter the biofuel landscape.

- Archer continues to benefit from lower corn prices, as this grain is used to produce an incredible range of end products.

Deere opportunities:

- Deere introduced a line of fuel-efficient tractors for cost-conscious farmers.

- U.S. farm cash receipts should stay near historical highs of around $400 billion this year.

- Deere's ExactEmerge and MaxEmerge planters are among the fastest on the market.

- Deere will invest more into R&D to maintain its lead in agricultural equipment.

Archer Daniels Midland threats:

- The EPA's proposed emissions-reduction mandate could spike ADM's energy costs.

- A merger of ConAgra's and two other companies' milling subsidiaries will dwarf ADM's market share in grain milling.

- ADM faces trouble with its grain-trading and handling operations due to the severe U.S. winter, and China's rejection of GMO-tainted corn.

- Stanford University scientists may have created a way to capture CO2 from the air and convert it to ethanol.

Deere threats:

- Deere lowered its forecasts for corn, wheat, soybeans, and cotton due to falling commodity prices.

- AGCO's swelling inventories could lead to oversupply and price competition in agricultural machinery.

- Deere expects a 5% to 10% seasonal decline in North American agricultural machinery sales.

- Deere is also facing a shrinking agricultural equipment market in Russia and Brazil.

One dividend to rule them all

In this writer's humble opinion, it seems that Archer Daniels Midland has a better shot at long-term outperformance, due to its move to boost biofuel sales, and its ability to capitalize on lower-than-expected commodity prices. These same low prices are a thorn in Deere's side, so a farm-price rebound might very well flip the script on this battle if it's repeated in the future. You might disagree and, if so, you're encouraged to share your viewpoint in the comments section below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!