Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Alcoa's (AA +0.00%) recent results tell us about its potential for future gains.

What the numbers tell you

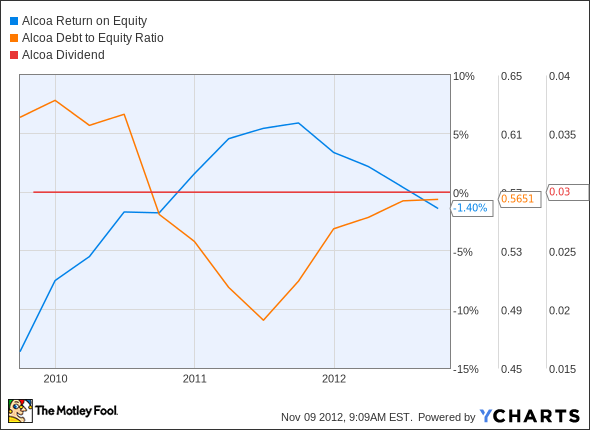

The graphs you're about to see tell Alcoa's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much Alcoa's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Alcoa's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

Is Alcoa managing its resources well? A company's return on equity should be improving, and its debt-to-equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we’ll also make sure that Alcoa’s dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Alcoa's key statistics:

AA Total Return Price data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue Growth > 30% |

27.3% |

Fail |

|

Improving Profit Margin |

(248%) |

Fail |

|

Free Cash Flow Growth > Net Income Growth |

125% vs. 88.3% |

Pass |

|

Improving Earnings per Share |

92.2% |

Pass |

|

Stock Growth (+ 15%) < EPS Growth |

(33.9%) vs. 92.2% |

Pass |

Source: YCharts.

*Period begins at end of Q3 2009.

AA Return on Equity data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving Return on Equity |

89.7% |

Pass |

|

Declining Debt to Equity |

(9%) |

Pass |

|

Dividend Growth > 25% |

0% |

Fail |

|

Free Cash Flow Payout Ratio < 50% |

36.7% |

Pass |

Source: YCharts.

*Period begins at end of Q3 2009.

How we got here and where we're going

Six out of nine possible passing grades is a rather surprising result for the currently unprofitable Alcoa, until you consider the deep hole it's had to dig out of since 2009. Despite major macroeconomic headwinds, Alcoa's managed to come closer to profitability than it was three years ago -- although it was profitable through 2011 until falling below GAAP breakeven in its most recent quarter. Alcoa's latest adjusted earnings were ahead of expectations, but its management couldn't help tamping down expectations for the future. Will we see Alcoa lose ground on our grading scale next time around? Let's dig deeper to find out.

Alcoa's latest report underscored the importance of emerging markets. Both Alcoa and more diversified mining leader Rio Tinto (RIO +0.03%) have noted significant macroeconomic headwinds thanks to weak growth forecasts coming out of China and India, among other important markets. Even Aluminum Corp. of China (ACH +0.00%), which should theoretically benefit from protective policies and home-field advantage, has slipped badly, which doesn't bode well for Alcoa's rebound in that country. However, Alcoa's global industrial focus ought to keep it afloat as long as aerospace and auto manufacturers continue to see growth.

In the aerospace sector, Boeing (BA 1.30%) has a truly massive backlog of 787 Dreamliners to work through, but those planes are primarily constructed out of carbon-fiber composites, with only 20% aluminum in the construction against 50% in the 777. Airbus' next-gen A380 remains predominantly aluminum-based, so that will remain a good source of income for Alcoa as carriers upgrade their fleets. Boeing's love of carbon-fiber construction has trickled down to terrestrial manufacturers as well, with Ford (F 1.02%) investigating ways to increase the material's use in its cars in the coming years. Aerospace and automakers may be growing, but they're also moving in directions that don't help Alcoa over the long run.

Low aluminum prices have hurt Alcoa's base-material bottom line, but the company's compensated with strong performances from its engineered products segment, turning a cheap raw material into a more profitable end result. That's a good way to overcome material weakness as long as there's strong demand for the finished product. However, as pointed out earlier, two of the world's most important aluminum-using industries are already shifting toward other materials, which could leave Alcoa out in the cold. Alcoa's also weighed down by underfunded pension obligations, which won't help the company's cash-flow issues going forward.

Putting the pieces together

Today, Alcoa has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.