Studies show that 75% of all stock market statistics are useless at best -- and dangerous at worst. Sifting through analysis can be tough for individual investors, and more information can be an enemy of level-headed investing decisions. Here are three stock statistics that should always be taken with a grain of salt and a pinch of perspective.

3. Gross margins

Gross margins are the easiest answer to the question: How much did it cost a company to sell its product? Gross margins don't take into account overhead, variable costs, depreciation, taxes, or a variety of other expenses that add up (or really subtract down) to calculate net profit.

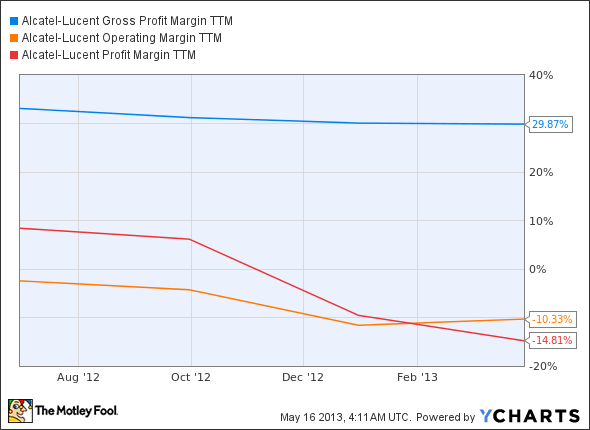

For a networking and communications company like Alcatel-Lucent (NYSE: ALU), its gross profit margin clocks in at 30%. That means Alcatel spends $0.70 of every dollar in sales on selling its product. But while the company's gross margins have slumped around 3% in the last year, operating margins have dropped nearly 10%, and profit margins are down almost 25%.

ALU Gross Profit Margin TTM data by YCharts.

Different products renders cross-sector comparison useless, and sector-specific investing decisions should ultimately have little do to with gross margins. Although they give investors an idea of each corporations' selling "starting point," Alcatel clearly shows that operating margins or net profit margins ultimately provide a clearer picture of a company's trending value proposition.

2. Employee-to-sales ratio

Every day of our lives, we see examples of inefficient labor. From loitering construction workers to extra-long coffee breaks at the office, investors know that people's productivity matters.

But unless a company's profits are nearly exclusively labor-dependent (think massage parlor -- no, not that type of massage parlor), there are better stats to rattle off than how many sales an employee accounted for.

Take SUPERVALU (SVU +0.00%) and Whole Foods Market (WFM +0.00%). Both corporations are consumer-facing retail grocery stores, offering similar products through similar sales models. SUPERVALU has 35,000 full time employees, while Whole Foods employs 74,000 people, more than double that of its competitor. Yet Whole Foods' $11.7 billion in 2012 revenue put sales at $158,108 per head, while SUPERVALU's $17.1 billion equates to $488,571 per employee.

And for the same year, Whole Foods pulled in $466 million in net profit while SUPERVALU reported a not-so-super $1.47 billion loss. That means Whole Foods ended up making $6,297 per worker, while SUPERVALU lost $41,996 per employee.

Many businesses have moved beyond employee-driven models. Herbalife's (HLF 0.14%) sales model allows 2.5 million independent distributors to market its products across 80 countries, but the company has only 6,200 full-time employees on its books. With $4 billion in 2012 revenue, that puts sales per employee at either $1,629 per distributor or $656,827 per full-time worker -- depending on your calculation.

1. Share price

It's not a typo: Share price means absolutely nothing to investors -- by itself. A company's value in the stock market is determined by two key factors -- share price and number of shares – and neither number means anything without the other.

Consider the two most valuable corporations in the world: Apple (AAPL 1.24%) and ExxonMobil. Exxon's $405 billion market cap beats out Apple by $3 billion, but shares of the oil company trade at just $90 compared with Apple's $430. But value evens out when you account for the fact that Exxon investors collectively own 4.45 billion shares, while Apple's allotted just 940 million.

Apple's latest earnings report points to an additional share-price flaw. CEO Tim Cook announced that the company will devote $60 billion to share buybacks, the equivalent of 15% of Apple's current market cap. Shareholders will also enjoy larger dividend distributions, another value add that's disconnected from share price.

All information is not created equal

There's a lot of information out there, and it's up to individual investors to use it wisely. Don't be swayed by skewed statistics, and don't be afraid to fall back on the fundamentals of investing. At the core of every purchase, we should be putting our money behind fairly priced companies with value-adding business models. If you can do that, you'll be well on your way to pulling sizable and sustainable profits for your portfolio.