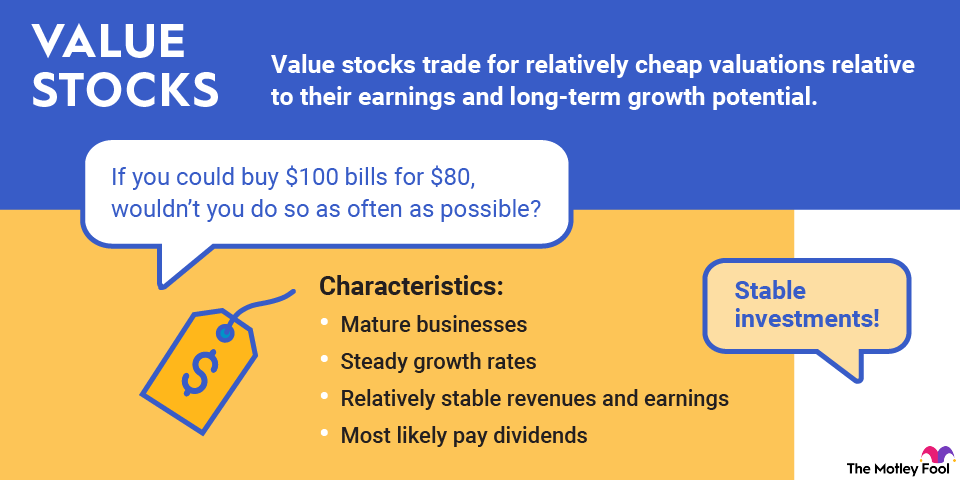

Value investors want to buy stocks for less than they're worth. If you could buy $100 bills for $80, wouldn't you do so as often as possible? Even high-quality companies with strong fundamentals see share prices fall when the overall stock market drops. Plus, value stock companies tend to be well established and less volatile than growth stock companies.

Here's an overview, including some excellent beginner-friendly value stocks and key concepts and metrics that value investors should know.

4 best value stocks for beginners

Value stocks are generally publicly traded companies trading at cheap valuations relative to their earnings and long-term growth potential. Let's look at four excellent value stocks: Berkshire Hathaway (BRK.A +0.71%) (BRK.B +0.72%), Target (TGT +2.56%), General Motors (GM +3.93%), and Signet Jewelers (SIG -1.09%). Then, we'll dive into some metrics that can help you find the best value stock investments.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Berkshire Hathaway (NYSE:BRK.B) | $1.1 trillion | 0.00% | Diversified Financial Services |

| Target (NYSE:TGT) | $48.1 billion | 4.25% | Food and Staples Retailing |

| General Motors (NYSE:GM) | $79.4 billion | 0.67% | Automobiles |

| Signet Jewelers (NYSE:SIG) | $3.7 billion | 1.39% | Specialty Retail |

1. Berkshire Hathaway

Berkshire Hathaway is a unique company on the stock market and has long been a top choice for value investors. That's largely because longtime CEO Warren Buffett, who stepped down at the end of 2025, is the world's most admired value investor, and his investing acumen is the biggest reason for the company's success.

NYSE: BRK.B

Key Data Points

NYSE: TGT

Key Data Points

However, Target has struggled in recent years due to weak consumer discretionary spending, inventory fluctuations, and internal issues such as theft. It's also faced customer backlash due to changes in its diversity, equity, and inclusion (DEI) policies, which may have contributed to weak results in 2025. As a result, the stock traded at a price-to-earnings (P/E) ratio of 12 in January 2026.

That's a great price to pay for a retailer with differentiated positioning and one that's still opening new stores despite its recent struggles. Target is also a Dividend King with a dividend yield of 4.5%, offering a reward to income investors.

Target still has a long-term growth opportunity in retail, both through new stores and e-commerce. This includes its range of same-day fulfillment options, such as curbside pickup, known as Drive Up, and same-day delivery through Shipt.

Target's stock has fallen for a number of reasons, but its challenges are fixable. The company expects to grow sales by a total of 15% over the next five years, and at its current valuation, the stock looks like it should be a winner if it can accomplish that goal.

While its recent results have been disappointing, Target is the kind of value stock that offers value because of its turnaround potential. A change in leadership could also help drive a recovery when Chief Operating Officer Michael Fiddelke becomes CEO in February.

3. General Motors

Valuation is arguably the most important test of a value stock, as a value investor is ultimately looking to buy a stock worth more than its price. As Buffett has said, "Price is what you pay. Value is what you get."

NYSE: GM

Key Data Points

By that yardstick, General Motors (GM) may be one of the best value stocks around. GM has been a leading player in the auto industry for a century and remains one of the world's largest automakers.

Based on its adjusted earnings per share (EPS), GM trades at a P/E ratio of 8.3 as of January 2026. This is a reflection of investors' low growth expectations and uncertainty around tariffs and trade. However, forward expectations have improved due to policy changes under the Trump administration, as well as the company's own moves to scale back on money-losing ventures.

The company has started to benefit from slowing growth in electric vehicles (EVs), though it has a number of them on the market, as the transition will support sales of its combustion vehicles. GM also announced in late 2024 that it would shut down its Cruise autonomous vehicle business, which had cost it an estimated $10 billion. Investors responded positively to the move because it will help GM's cash flow.

Concerns about tariffs have weighed on the stock at times, but it's unclear how the import taxes will affect the business since higher car prices could be good for GM, or at least for its American-made inventory. A recent hike in steel tariffs to 50%, however, is expected to be a hardship for GM and its peers.

The company estimates the gross tariff impact for the year to be $3.5 billion to $4.5 billion. However, the company will benefit from a new government MSRP offset program that lowers the tariff impact, as well as relaxed fuel economy standards.

As a value stock, GM is also able to aggressively repurchase stock to lift its EPS. It has reduced shares outstanding by almost one-third over the last 18 months. That's one way value stocks can grow profits even without growing revenue.

4. Signet Jewelers

Signet Jewelers is the world's largest diamond jewelry retailer. With a market cap of just $3.6 billion, it's much smaller than any of the other stocks on this list, but value stocks come in all sizes.

NYSE: SIG

Key Data Points

Signet operates in a mature industry, and the stock has historically traded at a discount because investors regard it as a low- or no-growth company. There also seems to be some concerns about disruption from lab-grown diamonds.

However, Signet is benefiting from that segment as well since it's driving up average unit retail prices and giving the company new ways of serving a broader range of price points. It's also driving higher demand in the fashion category, which is the non-bridal segment of the business.

The company has made some smart moves, including reducing its real estate footprint, investing in higher-margin service businesses, like repair and warranties, and focusing on driving returns for its largest brands, including Kay, Jared, and Zales.

Based on adjusted EPS, Signet trades at a P/E ratio of just 10, and the company has taken advantage of that discount to buy back stock. Over its last four quarters, it repurchased 8% of shares outstanding after shares fell sharply, and its shares outstanding have fallen by roughly half over the last decade.

What are value stocks?

Most stocks are classified as either value stocks or growth stocks. Generally, a value stock trades for a lower price than its financial performance and fundamentals suggest it's worth. A growth stock is a company expected to deliver above-average growth compared to its industry peers or the overall stock market.

Growth Stock

Don't underestimate the power of value stocks

While they may not be quite as thrilling as their growth stock counterparts, it's important to realize that value stocks can have just as much long-term potential, if not more. After all, a $1,000 investment in Berkshire Hathaway at the beginning of 1965 would be worth more than $28 million today.

Finding companies that trade for less than they are truly worth is a time-tested investment style that can pay off tremendously.