Walmart (WMT -0.08%) stock has been a massive winner for investors since its initial public offering in 1970. That's not surprising considering the company's business success. Walmart started out with one store in Rogers, Arkansas, in 1962. Today, it operates close to 10,500 stores and clubs in 19 countries and ranks as the world's largest retailer. In this article, we'll address how to buy Walmart stock, whether or not it's a good investment, and discuss Walmart's profitability, dividend program, and more.

How to buy

How to buy Walmart stock

There are four key steps involved in buying a stock -- and they are as applicable to Walmart as they are to any other stock.

Step 1: Open a brokerage account

You'll first need to open a brokerage account. In the past, brokerages required clients to speak directly with a broker to buy a stock. Now, most brokerages allow easy online trading.

The general capabilities offered by different brokerages are likely to be similar. However, there are a few factors that could make some stand out above others, including:

- Commission structure (several online brokerages have eliminated trading commissions altogether).

- Educational resources.

- Ability to buy fractional shares.

- User-friendliness of the brokerage's platform.

Note that you'll need some information handy when opening a brokerage account. For example, your Social Security number and bank account information for the bank account that you'll use to fund the new brokerage account will be required by all brokerages.

Social Security Number (SSN)

Step 2: Figure out your budget

Speaking of funding the new brokerage account, you'll need to determine how much money you can afford to invest. The best way to do this is to create a budget if you haven't already done so. Identify all of your sources of income and all of your ongoing expenses. It's wise to first fund an emergency fund with at least three to six months of expenses before investing in stocks.

Step 3: Do your research

Whether you're considering investing in Walmart or any other stock, it's important to research the stock before buying. Warren Buffett has stated that he and his longtime business partner, Charlie Munger, "are not stock-pickers; we are business-pickers." That's a great philosophy for any investor to have.

Start with gaining a thorough understanding of the company's business model. With Walmart, for example, you'd want to know about its three business segments:

- Walmart U.S. -- the company's largest segment, which operates retail stores in all 50 U.S. states, Washington, D.C., and Puerto Rico.

- Walmart International -- the second-largest segment, which operates retail stores in 19 countries outside of the U.S.

- Sam's Club – the company's members-only warehouse club, which operates stores in 44 U.S. states and Puerto Rico.

You should research how Walmart's retail stores are performing in the U.S. and in international markets. Check out the company's e-commerce initiatives, especially considering how online shopping has grown tremendously.

With any stock you're considering, investigate the competitive advantages of its business. In Walmart's case, the company views its everyday low pricing as a major competitive advantage. Walmart's supply chain and operational efficiency help it to offer low prices on products sold in its stores and online.

Consider major industry trends, as well as any headwinds. Walmart competes in the discount stores industry. As is the case with the broader retail market, the use of technology is a major factor affecting discount retailers. Walmart has distinguished itself through the years with its early adoption of technology. One key area to watch with the company is how it continues to implement artificial intelligence (AI) in its operations.

There's an old saying in horse racing: "Bet on the jockey, not the horse." This adage is applicable to some extent to investing in stocks as well. Check out the company's management team before buying the stock.

Walmart appears to look solid on this front. Its CEO, Doug McMillon, started working with the company as a teenager and has been with Walmart for more than 30 years. He has served on the senior leadership teams of all three of Walmart's business segments.

A great business doesn't always translate to a great stock to buy, though. The stock's valuation could be higher than the underlying business is really worth. There are several metrics you can use to assess a stock's valuation, including the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio.

Step 4: Place an order

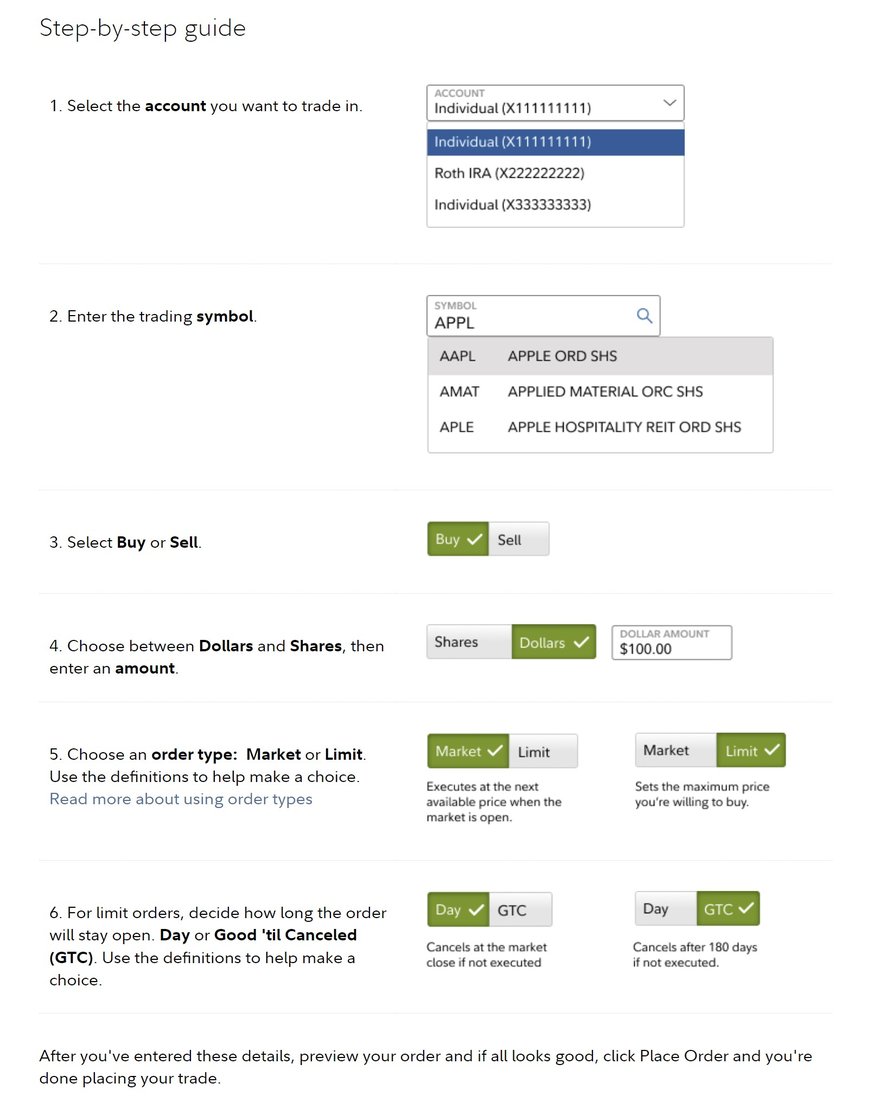

Placing an order on your online brokerage platform to buy a stock is easy. While individual online brokerages will have somewhat different formats, the general process of buying a stock will be the same. The screenshot below explains how to place an order to buy a stock with Fidelity, which is one of the top online brokerages:

Note that the trading symbol (or stock ticker) for Walmart is WMT. Fidelity supports the capability to buy fractional shares. If you're buying a fractional share of Walmart, you'll specify the dollar amount you're investing in step four. Otherwise, you'll enter the number of shares you want to buy.

Step five asks you which order type you want to use -- market order or limit order. Using a market order will allow you to buy the stock immediately at the current market price. A limit order will only be executed if the stock is at or below the share amount specified. The Motley Fool recommends using market orders because they ensure your stock purchase will be executed immediately.

Should you invest?

Should I invest in Walmart?

Perhaps the best way to answer this question is with another question: What type of investor are you? Walmart stock could be a good pick for some investors but not for others.

If you're an aggressive investor focused on growth stocks, Walmart might not be ideal for you. The company's fastest growth is probably in its past.

Value investors might not like Walmart all that much, either. Its shares trade at a relatively high valuation compared to other discount retail stocks.

Income investors, on the other hand, could prize the dependability of Walmart's dividend payments. Conservative investors should also like the resilience of the company's business. For example, Walmart stock tends to perform better than most during economic downturns and is widely viewed as something of a recession-proof stock.

Profitability

Is Walmart profitable?

Yes, Walmart is profitable and has been for a long time. In its fiscal year ending Jan. 31, 2023, the company posted net income of almost $11.7 billion.

However, discount retailers typically have relatively low profit margins. Walmart is no exception, with its net profit margin of a little less than 2% in its most recent fiscal year.

Also, the company's profits have declined in recent years. This is primarily due to the increasing cost of sales, with inflation driving product prices higher.

Dividends

Does Walmart pay a dividend?

Walmart does pay a dividend. The company initiated its dividend program in 1974 and has increased its dividend for 50 consecutive years. That track record makes Walmart a member of the elite group of stocks known as Dividend Kings.

ETF options

ETFs with exposure to Walmart

More than 270 exchange-traded funds (ETFs) own shares of Walmart. That's not surprising considering that the retailer ranks among the biggest companies in the world. Major ETFs that are heavily invested in Walmart include:

- Amplify CWP Enhanced Dividend Income ETF (DIVO 0.25%)

- Consumer Staples Select Sector SPDR Fund (XLP -0.21%)

- Fidelity MSCI Consumer Staples Index ETF (FSTA -0.09%)

- iShares Global Consumer Staples ETF (KXI -0.03%)

- iShares U.S. Consumer Discretionary ETF (IYC 0.68%)

- iShares U.S. Consumer Focused ETF (IEDI 0.88%)

- Pacer BioThreat Strategy ETF (VIRS 0.71%)

- PGIM Jennison Focused Value ETF (NYSEMKT:PJFV)

- VanEck Retail ETF (RTH 1.13%)

- Vanguard Consumer Staples ETF (VDC -0.17%)

Exchange-Traded Fund (ETF)

Because Walmart is a member of the Dow Jones Industrial Average and S&P 500, it is also a holding of all ETFs that track these indexes. They include:

Stock splits

Will Walmart stock split?

Walmart has conducted 11 stock splits in its history. All were 2-for-1 stock splits, with the most recent occurring in March 1999. The company hasn't announced plans for a stock split as of now, but it's possible that Walmart could split its stock again in the future.

Related investing topics

The bottom line on Walmart

Walmart stands out as one of the most successful retail stocks ever. Its stability, competitive advantages, and impressive dividend track record should make it an attractive pick for many investors.

FAQs

Investing in Walmart FAQs

What is the future of Walmart stock?

The future of Walmart stock depends on multiple factors, including overall economic growth and competition in the retail industry. However, Walmart appears to be in a good position to remain successful with the growth of e-commerce and the expansion of middle classes in developing countries.

Is Walmart a long-term investment?

Walmart has definitely been a great long-term investment in the past. Although it’s impossible to know for sure how the stock will perform in the future, the company’s underlying business strength and its market opportunities should make Walmart a good long-term investment for more conservative investors.