Upstart Holdings (UPST 2.76%) is an artificial intelligence (AI)-powered lending platform. The financial technology company uses machine learning models to recognize true credit risk more accurately. That enables it to approve more applications than traditional credit score-based lending models at a lower annual percentage rate (APR). The company's platform allows more people to borrow money at lower rates while reducing loan default risk for lenders.

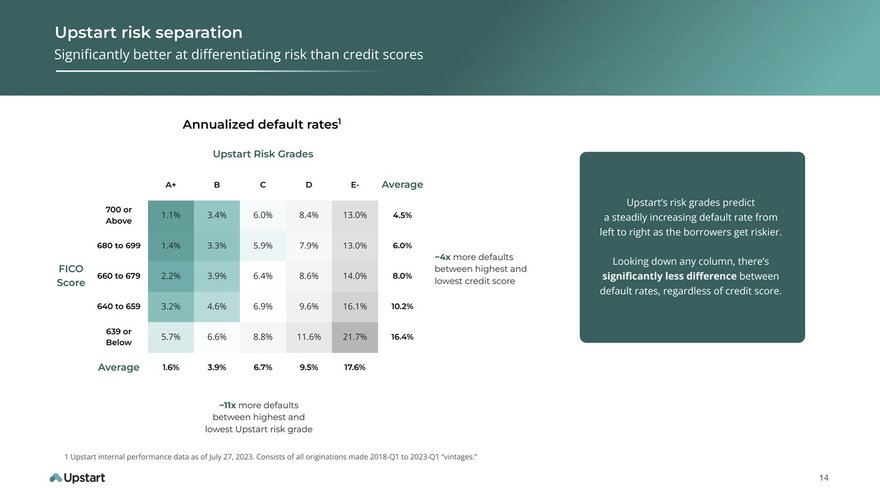

Upstart trains its artificial intelligence model on more than 70 billion cells of performance data, with an average of 88,000 new loan repayments added to its treasure trove of data each business day. That allows it to more accurately predict loan default risk compared to a credit score alone:

Banks and credit unions have been flocking to Upstart's more accurate platform. The company worked with more than 100 lending partners as of mid-2023 (up from 10 since becoming a publicly traded company in 2020). It also works with 61 auto dealerships that offer Upstart-powered loans (up from 39 in the first quarter of 2023). Its platform has helped support more than $34 billion of loan originations to more than 2.7 million customers.

The company has also steadily added new loan types to its platform, growing its total addressable market opportunity. It started in the $170 billion personal loan market. It has since expanded into auto loans ($755 billion opportunity) and home loans ($2.2 trillion). It's also targeting the $895 billion small business loan market.

Upstart enters new markets by beginning pilot loan product programs to gather data and showcase its results to lending partners. For example, it started a home equity line of credit (HELOC) pilot program in Colorado in the second quarter of 2023. It will hold these loans on its balance sheet to test and evaluate the accuracy of its AI models.

Upstart believes it has a long growth runway ahead as more lending partners utilize its platform for more loan products. That could drive robust revenue and earnings growth for years to come.

The AI-powered lending platform's growth potential likely has many investors interested in the possibility of investing in its stock. Here's a step-by-step guide on how to buy shares of the financial technology stock and some factors to consider before adding Upstart to your portfolio.

Loan Default

How to buy

How to buy Upstart stock

You'll need to take a few steps before buying shares in Upstart (or any other stock). Here's a step-by-step guide to adding the AI-powered lending platform to your portfolio.

- Step 1: Open a brokerage account: You need to open and fund a brokerage account before buying shares of any stock. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

- Step 2: Figure out your budget: Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. You don't have to get there on the first day. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

- Step 3: Do your research: It's essential to thoroughly research a company before buying its shares. You should learn about how it makes money, its competitors, its balance sheet, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in Upstart's stock.

- Step 4: Place an order: Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (UPST for Upstart).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Once you complete the order page, click to submit your trade and become an Upstart shareholder.

Credit Score

Should you invest?

Should I invest in Upstart?

Completing your due diligence by fully researching a stock is crucial before making an investment. It could turn you away from the company or confirm your investment thesis. With that in mind, here are some reasons why you might want to consider investing in Upstart:

- You think the company's AI-powered lending platform has an edge over traditional credit score-based lending.

- You believe Upstart will continue adding lending partners to its platform.

- You understand how the company makes money.

- You don't need dividend income from your investment.

- You like to invest in founder-led companies.

- You understand the risks of investing in Upstart, including that its business is more sensitive to the economic cycle.

On the other hand, here are some factors that might cause you to decide against investing in Upstart:

- You're not sure that Upstart's AI-driven approach will displace credit scores.

- You're near or in retirement and need dividend income.

- You're worried about a potential recession and the impact that could have on Upstart's business.

- You're concerned that Upstart holds some loans on its balance sheet that increase its credit risk.

- You're not sure Upstart will turn around and start growing revenue again or return to profitability.

- You're seeking investments with lower volatility.

Is it profitable?

Is Upstart profitable?

Exploring a company's profitability is a crucial part of an investor's stock research process. That's because profit growth typically plays a major role in driving stock price performance over the long term.

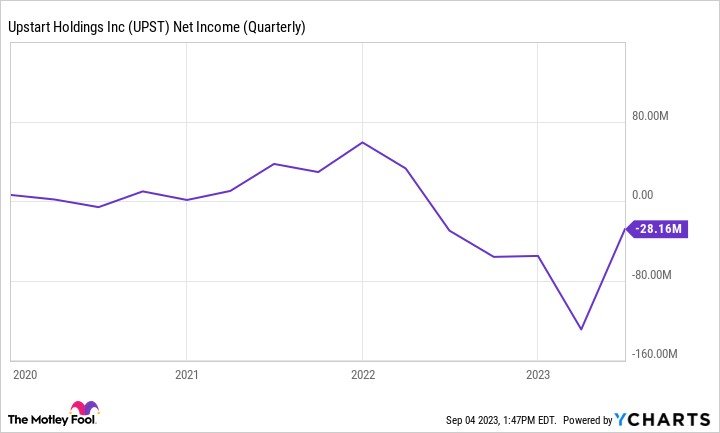

Upstart wasn't consistently profitable as of mid-2023. During the second quarter, Upstart reported a net loss of $28.2 million on $136 million in revenue. Meanwhile, through the first six months of 2023, Upstart reported a net loss of more than $157 million on almost $239 million in revenue.

However, the company has been profitable in the past:

The main factor weighing on Upstart's profitability in 2023 was a significant decline in revenue. Total revenue plunged more than 55% through the first six months of the year due to deteriorating economic conditions. That affected the number of loans banks and credit unions provided using Upstart's technology. Its lending partners originated fewer than 100,000 loans totaling about $1.2 billion across its platform during the second quarter, down 64% from the prior-year period.

The company believes that its partners will start underwriting more loans as the economy normalizes, enabling Upstart to start growing revenue again and return into the black. A return to growth and profitability could help jumpstart Upstart's stock price, which has tumbled as revenue and profits declined over the past several quarters.

Dividends

Does Upstart pay a dividend?

As of mid-2023, Upstart did not make dividend payments to its shareholders. That company also didn't expect to initiate a dividend in the foreseeable future. Upstart intends to retain its earnings to fund its operations and continued expansion.

ETFs

ETFs with exposure to Upstart

An alternative option to investing directly in Upstart stock is to consider passively investing in the company through a fund that holds its shares. One of the most common passive investment vehicles is an exchange-traded fund (ETF).

According to ETF.Com, 52 ETFs held about 6.5 million shares of Upstart as of mid-2023. The iShares Russell 2000 ETF (IWM 0.96%) held the most shares at almost 1.7 million. However, that was a tiny allocation at 0.1% of the fund's holdings, so there are better options for investors seeking passive exposure to Upstart.

The Invesco Dorsey Wright Financial Momentum ETF (NYSEMKT:PFI) had a larger allocation to Upstart stock at about 3% of the fund's holdings. That made it the fund's 11th-largest holding. The ETF is a potentially better option for investors seeking some exposure to Upstart and other leading financial stocks.

Stock splits

Will Upstart stock split?

Upstart did not have an upcoming stock split on the calendar as of mid-2023. The company likely won't split its stock anytime soon. While the share price had risen from its initial public offering (IPO) price of $20 to more than $30 in mid-2023, shares were more than 90% below their all-time high of $390 in late 2021. If shares rally past that prior peak, Upstart could split its stock to make them more accessible to investors.

The bottom line on Upstart

Upstart believes it built a better way to measure the creditworthiness of borrowers than a traditional credit score. Its platform leverages the power of AI to predict the probability that a borrower will default on their loan. The approach enables its lending partners to approve more loan applications at a lower rate, increasing the access to credit to more borrowers while reducing the lender's default risk. The company believes it's still in the early stages of tapping into a massive opportunity.

However, Upstart isn't without risk. The financial technology company's revenue is more sensitive to economic changes since financial institutions pull back on lending when conditions deteriorate. Its revenue and profitability could be lumpy, causing its shares to be very volatile.

Investing in Upstart FAQ

Is Upstart a buy, sell, or hold?

Shares of Upstart have been extremely volatile since the company went public in 2020. The stock zoomed from $20 to almost $400 in the first year before cratering back toward its IPO price as its revenue tumbled and profitability dried up. That volatility will likely keep many investors away from Upstart stock.

However, the company's AI-powered lending platform holds tremendous promise. As more lenders use the platform to approve loans, it could drive Upstart's revenue and profits skyward. That could also give its stock a jumpstart to start rising again. Investors with a high risk tolerance and seeking a high upside opportunity should consider buying Upstart stock.

What is the forecast for Upstart?

Upstart provided the following forecast for the third quarter of 2023. The company expects revenue of about $140 million (up from $136 million in the second quarter). The company also forecast that it would report a net loss of $38 million and a non-GAAP (adjusted) net loss of $2 million. Although that's a wider net loss than the second quarter ($28.2 million), Upstart expects its adjusted net loss to improve from $5.4 million.